| « Back to article | Print this article |

Why Premji's dual CEO model for Wipro failed

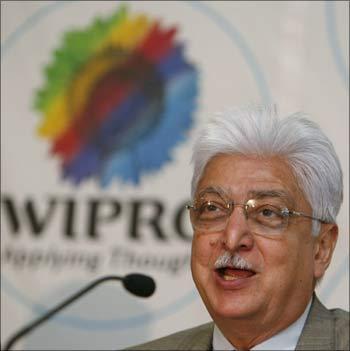

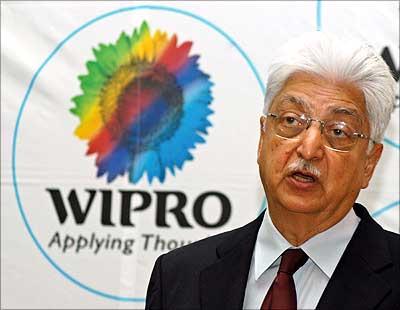

"A joint CEO structure is the best way forward to leverage the depth of our leadership and maximise the opportunities ahead of us." This was one of the comments made by Wipro Chairman Azim Premji, when he announced a dual CEO management structure at India's third-largest IT services company in April, 2008.

Premji's decision to have Girish Paranjpe and Suresh Vaswani jointly run the IT business had at the time taken many by surprise.

But just as baffling was Premji's abrupt announcement last month that he was dismantling the dual management structure and was appointing a single CEO -- T K Kurien -- to head the business.

Industry watchers believe it was Wipro's performance over the last four to five quarters that prompted the rejig at the top, after a three-year experiment with the dual CEO structure.

Click NEXT to read on . . .

Why Premji's dual CEO model for Wipro failed

"Wipro did not take an aggressive enough market-facing approach during the downturn," says Viju George at J P Morgan.

While Premji mentioned the company's performance vis-a-vis some of its peers, the real threat to Wipro comes from Nasdaq-listed Cognizant, which is a few steps behind.

While a section of analysts feels that Cognizant will overtake Wipro in terms of revenue growth in the fourth quarter of this fiscal, there are indications that it would have already done so in the October-December quarter.

What is interesting is that the change in the management at both Cognizant and Wipro took place within a gap of around 15 months.

Click NEXT to read on . . .

Why Premji's dual CEO model for Wipro failed

Franciso D'Souza took the helm at Cognizant in January 2007, while Wipro introduced its dual CEO model in April 2008.

At the end of June 2008, the quarterly revenue difference between Cognizant and Wipro was around $380 million. Compare this with the quarter ended September 2010, which saw that gap narrowed to $63 million.

So, what went wrong at Wipro, considering both Paranjpe and Vaswani are veterans of the industry?

"Wipro has not broken new ground in creating a distinctive offering with promising market potential or adopting a differentiated client engagement approach," says George.

Click NEXT to read on . . .

Why Premji's dual CEO model for Wipro failed

"Wipro's sales and marketing expenses in IT services declined in FY10 versus FY09. In essence, Wipro has tended to look relatively inward in the quest to improve profitability," adds George.

Many also point out that Wipro's business model just did not allow it to make the best of the recovery. The banking, financial & insurance sector accounted for 50-55 per cent of Cognizant's revenues and in excess of 35 per cent at Infosys and TCS.

"So, they have got the advantage of extremely high turbocharged growth, which has happened in the financial services sector -- an advantage we did not get," Premji has noted.

Another reason why Wipro could not leverage the turnaround was its supply-side constraints. During the slowdown, Wipro froze new hiring in a few quarters; it also net lost people in a few quarters.

Click NEXT to read on . . .

Why Premji's dual CEO model for Wipro failed

This resulted in higher churn among employees when the market situation improved. Attrition at Wipro was at 21.7 per cent for the third quarter, whereas at TCS it was 14.4 per cent.

However, many feel that Premji's original decision to have a dual CEO structure itself was faulty. Globally, management gurus agree that the model can work at best as a stop-gap arrangement to gauge two candidates for the top job.

"Perhaps this model works best only at an entrepreneurial level, where a team of people are working together. But it is difficult to work when a company is in a stable to growth stage," says Dhruv Prakash, managing director, leadership & talent consulting, Korn-Ferry International.

According to Prakash, the failure of the dual CEO model is not attributed to individual capability. "It's more about lack of communication. These are two people and will work in different ways.

Click NEXT to read on . . .

Why Premji's dual CEO model for Wipro failed

Dual CEOs also means a lengthy decision-making process and contradictory viewpoints. It also means a lack of nimbleness in an organisation," he adds.

Some global examples were the joint CEO model has been brought to an unceremonious end include John Reed and Traveler's Sandy Weill at Citicorp.

Unilever is another example. Within the IT industry, there have been such experiments, but hardly any have been successful. Sapient was one such instance.

Human resource experts also opine that creating strategic business unit heads is much more efficient.

Click NEXT to read on . . .

Why Premji's dual CEO model for Wipro failed

"When you create an SBU, you give an individual responsibility for its growth and failure. But when you have a cross vertical system, you end up with a metric style of working, which consumes time," says an HR executive.

In the case of Wipro, many feel perhaps this was a stop-gap arrangement for Rishad Premji to make his mark on the business.

"He is very involved in all the important decisions. I will not be surprised if in the next few years he takes over as CEO," says a senior executive of a leading company, on condition of anonymity.

A top management shuffle is not new at Wipro. Some of the senior managers who have left Wipro in the recent past include Vivek Paul, Ashok Soota, Arun Thiagarajan and Ashok Narsimhan exited the company at a time when they were at the height of their careers.

Click NEXT to read on . . .

Why Premji's dual CEO model for Wipro failed

There were others like Sudip Banerjee (L&T Infotech), P R Chandrasekar (Hexaware), Sudip Nandi (Aricent) who left, dissatisfied as they were sidelined.

As for T K Kurien, he has his role cut out. He might have helped the Spectramind BPO grow in 2005, but how successful he will be in tackling the speeding Cognizant and other IT firms is yet to be seen.

As a long-term strategy, he has already said that improving Wipro's strength in the banking and financial segment is important.

"We have to position ourselves in markets that are growing and geographies that are growing, and that is where the bulk of investments will go in the future. It will be foolish to ignore the financial services, healthcare and energy (and utility) business," he has said.