| « Back to article | Print this article |

What to expect from the telecom sector in 2014

With reduced uncertainty and clarity on the spectrum-pricing and sharing front, industry set to see positive growth and stability in the new year.

For the telecom sector, 2013 was a year of key regulatory changes. The government decided to allow 100 per cent foreign direct investment (FDI) in the sector and cleared the much-awaited policy on mergers and acquisitions (M&As). It also allowed trading and sharing of spectrum.

With the adoption of the new unified licensing regime, spectrum has been de-linked from licences. However, ambiguity over spectrum usage charge remains a concern.

Early next year, a huge quantity of 2G spectrum will be up for auction at a new reserve price, about 25 per cent lower than that in the March 2013 auctions, which failed to attract bidders.

Also on the cards is the much-awaited roll out of fourth generation (4G), or long-term evolution (LTE), services by Reliance Jio Infocomm, expected to initiate another price war.

Click NEXT to read more...

What to expect from the telecom sector in 2014

This year, the industry saw an unusual move. To reduce costs, two bitter adversaries, Reliance Jio Infocomm chief Mukesh Ambani and Bharti Airtel’s Sunil Mittal, joined hands to share telecom infrastructure.

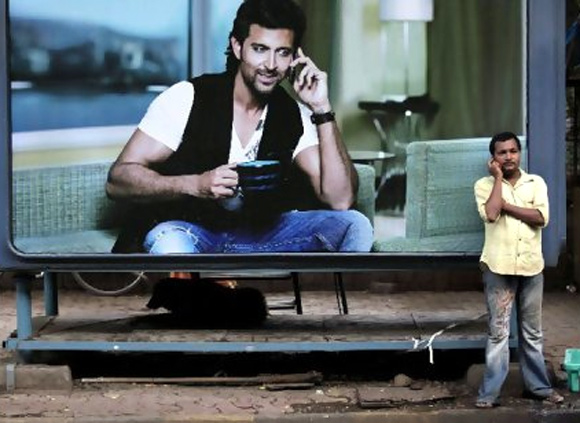

A few rounds of cuts in 3G and 4G base rates reduced 3G rates to 2G levels and 4G rates to 3G data costs. New customer information norms were introduced, and average revenue per user and realisation per customer rose.

For consumers, it was a year of convenience - more service offerings at affordable costs. In April, Bharti Airtel started offering video content for just Rs 1, making it affordable to all, especially mobile users in rural and semi-urban markets.

Aided by this, the company added four million first-time mobile internet users in the quarter ended June, taking its video store customer base to 12 million.

Other operators also replicated the sachet model.

Click NEXT to read more...

What to expect from the telecom sector in 2014

“The telecom industry saw promising signs in 2013, with rationalisation of realised rates, sharp growth of data revenue, control on acquisition costs and churn and, finally, some clarity on the regulatory front, with auctions announced for January 2014. However, the industry has a long way to go to be financially robust and, therefore, 2014 would have to see continued improvement in realised rates and proliferation of 3G deep into the country to maintain high data growth,” said Akhil Gupta, deputy group chief executive officer and managing director, Bharti Enterprises.

Following the government’s decision to allow 100 per cent FDI in telecom, British telecom operator Vodafone Plc has submitted a proposal to increase its stake in Vodafone India to 100 per cent, while SingTel has already received approval to increase stake in SingTel Global (India) Private Ltd, in which Bharti Enterprises has a 9.9 per cent stake.

Click NEXT to read more...

What to expect from the telecom sector in 2014

Fresh start

Operators such as Uninor, run by Norway-based Telenor, and Russia’s Sistema-owned Sistema Shyam Teleservices, which runs the MTS brand, have made fresh starts through the past 12 months.

This was after their licences were terminated by the February 2012 Supreme Court order that quashed 122 telecom licences for alleged irregularities in licence allocation. Both companies have trimmed their operations, adopting a pick-and-choose-circle strategy, instead of pan-India presence.

While Telenor started a new entity, Telewings, and decided to restrict itself to six zones with its sabse sasta pricing, covering about half of India’s population, Sistema Shyam Teleservices chose to operate in nine circles, covering about 60 per cent of India’s data pie.

Sigve Brekke, head of Telenor Group’s Asia operations and acting chief executive of Uninor, said, “As we move towards the end of 2013, we conclude uncertainty has been reduced in the industry. 2014 will likely be a year of consolidation and strengthening of business by most operators. With the government progressing effectively towards finalising M&A guidelines and clarifying spectrum-pricing and sharing, the industry is set to see positive growth and stability, to the benefit of all mobile users in India.”

Click NEXT to read more...

What to expect from the telecom sector in 2014

Syed Safawi, chief executive of Viom Networks, believes 2014 will see the beginning of the second phase of telecom growth in India.

“From a slightly uncertain and, therefore, pause mode last year to renewed vigour this year - that’s the current sentiment of India’s telecom industry,” he said.

Rajan Mathews, director-general of the Cellular Operators Association of India, said next year, telecom operators would shift focus to data, as the voice market matured.

“While the government’s security interests are paramount, the costs of such initiatives and programmes should not ride on the fragile financial shoulders of service providers,” he said.

What to expect from the telecom sector in 2014

An Aircel spokesperson agreed, saying the company would focus on data and value-added services.

Mohammad Chowdhury, telecom industry leader and member of the global executive team, PricewaterhouseCoopers, says data consumption will grow across 2G, 3G and 4G, while Wi-Fi roll-out by operators might facilitate growth, adding 2014, especially its second half, will see restoration of vitality in the sector.

“We may even see LTE trials in the liberalised 1,800-MHz band. While we may not expect any more entrants, additional clarity may bring new investments and action into the sector. This industry has an appetite for three-five national players and a small number of regional players. We may see initial action in this space after the general elections,” he said.

Equipment vendors and infrastructure are likely to gain from the coming refarming of 900-MHz spectrum, as there won’t be any reservation and operators will need to invest more in infrastructure to ensure quality service. Sameer Rawal, director (marketing), Huawei India, has estimated the opportunity in this space at about $10 billion through the next few years.

Click NEXT to read more...

What to expect from the telecom sector in 2014

Key features of 2013

- Govt allows 100 per cent FDI in telecom

- Empowered group of ministers clears M&A policy

- Govt decides to allow trading and sharing of spectrum

- Spectrum de-linked from licences; unified licensing adopted

- Rates across 2G, 3G and 4G reduced drastically; more convenient options across services

- Two rivals, Bharti Airtel and Reliance Jio Infocomm, join hands to share infrastructure

- Telcos clean up subscribers, after strict customer information norms are imposed; increase in average revenue per user and net realisation

Expectations from 2014

- Launch of 4G LTE services by Reliance Jio Infocomm

- Consolidation and, therefore, lower national-, circle- or region-specific focus

- Fresh investments due to clarity in regulatory issues; though new players unlikely

- Data consumption to grow across 2G, 3G and 4G, but localised content may remain an issue

- Operators likely to integrate services closely with social platforms and start introducing advanced analytics

- Focus on enterprise business to grow

- Nationwide mobile number portability on cards; free roaming unlikely