| « Back to article | Print this article |

Move over MNCs, Made in India mobiles are here

'Made in India' mobile telecom brands are expected to give a tough fight to global handset makers with the rollout of third-generation (3G) services in the country.

Global handset makers such as Nokia, Samsung, LG and Motorola will have to face 50-odd Indian brands, ready with cheaper 3G-compatible models.

According to industry sources, most of the Indian brands like Karbonn, Micromax, Maxx Mobile, Intex, Spice Mobiles and Lava, which entered the market with low-cost dual and triple SIM card phones, have started offering 3G-enabled phones with a starting price of about Rs 4,000.

Click on NEXT to read more...

Move over MNCs, Made in India mobiles are here

Handsets compatible with 3G technology have been around for quite a while, though the service rollout is happening only now.

"We are ready with three new models of 3G-enabled phones and are planning to launch it next quarter. We see traction for these phones from the urban and semi-urban markets," said Ramesh A Vaswani, executive vice-chairman, Intex Technologies Ltd.

Intex, which sells around 200,000 handsets per month, is planning to scale up to 400,000 phones.

It expects 3G-enabled phones to contribute five to 15 per cent of total sales.

Click on NEXT to read more...

Move over MNCs, Made in India mobiles are here

Similarly, Spice Mobiles expects to raise its 3G share to 17 per cent from the present five per cent in a couple of years.

Growing share

According to market research firm IDC, the sales of mobile devices in India are likely to reach 156 million in 2010 and are expected to grow at 12 per cent, to reach 174 million in 2011.

Another study by Gartner says that in India, the 3G device's sales alone should account for 16.7 per cent of mobile handset sales in 2010, up 9.2 per cent in 2009.

Click on NEXT to read more...

Move over MNCs, Made in India mobiles are here

Though the market potential is huge, some Indian mobile companies are taking a cautious approach to the launch of 3G products.

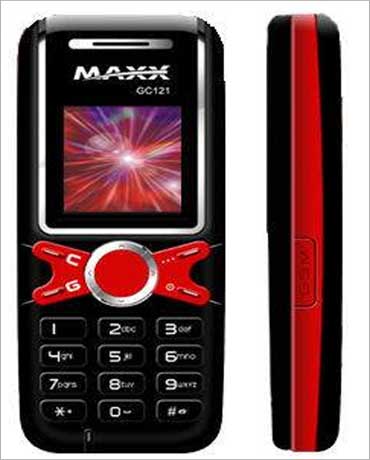

For instance, Maxx Mobile, which sells 350,000 phones per month, is ready with the phone and is closely watching the scene.

Ajay Agarwal, chairman and managing director, said: "We are ready to offer a 3G phone in the range of Rs 5,000-7,000.

We are waiting for the pan-India rollout of 3G, because the adoption of the service is primarily based on the rates for 3G service."

Click on NEXT to read more...

Move over MNCs, Made in India mobiles are here

India accounts for approximately 10 per cent of worldwide handset sales.

The entry and growth of Indian domestic players had affected the marketshare of global giants.

The intense competition in this market has prompted Finnish and Korean majors such as Nokia and Samsung to rethink their pricing strategy for India.

Nokia, Samsung and LG have already launched 3G-enabled handsets in India, starting at as low as Rs 5,000.

Click on NEXT to read more...

Move over MNCs, Made in India mobiles are here

Kishan Bhat, manager-consulting at Zinnov Management Consulting, said: "Indian consumers are cost-conscious and they expect value for the money they spend.

As there is a buzz for 3G and Indian customers prefer affordable handsets, the global majors have come out with customised phones for India at a low price.

The rates for the 3G services are also a major quotient for the adoption."

Click on NEXT to read more...

Move over MNCs, Made in India mobiles are here

Indian companies have already spent a significant amount on roping in celebrities, sponsoring various events and cricket tournaments as part of their brand building initiatives.

They plan to spend more on these efforts.

Intex, which has a major customer base in the northern and western parts of the country, has planned to invest Rs 8-10 crore (Rs 80-100 million) for advertising.

Likewise, Maxx Mobile is planning to spend Rs 100 crore (Rs 1 billion) during 2011-12.

The companies are also in discussions with service providers for their bundled offers to take the 3G experience to the masses.

Click on NEXT to read more...