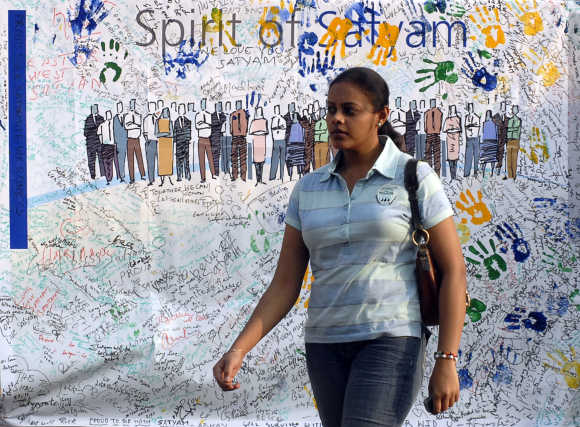

Photographs: Vivek Prakash/Reuters Sheetal Agarwal in Mumbai

Steady performance of Mahindra Satyam and increasing traction in non-BT revenues are key positives for Tech Mahindra. However, Mahindra Satyam bagging larger deals is crucial to boost growth, believe analysts.

Three years after acquiring trouble-laden Satyam Computer (now, Mahindra Satyam), Tech Mahindra has managed a successful turnaround of the firm.

It has cleared up most of the mess and has been focussing on core business growth. In fact, Mahindra Satyam's performance has been improving for the past four-six quarters, while that of Tech Mahindra has also been good.

However, Mahindra Satyam has been unable to get back into the big league (over $100 million deals) and is only executing deals of up to $50 million.

...

Mahindra Satyam needs to bag big deals, say analysts

Image: Anand Mahindra.Photographs: Danish Siddiqui/Reuters

While analysts remain bullish on both companies given their strong deal pipelines and multiple margin levers at their disposal, they believe Mahindra Satyam's future growth hinges on its ability to bag bigger deals.

Going ahead, both managements remain watchful of the overall demand environment consequent to elongated decision making cycles by some clients.

For Mahindra Satyam, growth will be driven by traction from existing clients, while non-British Telecom business will continue to drive growth for Tech Mahindra. Further, the strategy of just in time lateral hiring and higher recruiting from off-campus sources should rub off positively on their margins.

...

Mahindra Satyam needs to bag big deals, say analysts

Image: File photo of Satyam.Photographs: Krishnendu Halder/Reuters

Post-June quarter results last week, most analysts have revised upwards their FY13 proforma earnings estimates for the Tech Mahindra-Mahindra Satyam combined entity by 8-10 per cent, driven by the strong margin expansion by both companies.

While Tech Mahindra has already benefited from merger synergies, management believes some efforts are yet to bear fruit.

Ankita Somani, IT analyst at Angel Broking, says: "Taking into account the new share count of 230.8 million (post-merger of Tech Mahindra and Mahindra Satyam), the consolidated earnings per share (EPS) comes in at Rs 84 which values Tech Mahindra at 10 times FY2013 estimated EPS".

...

Mahindra Satyam needs to bag big deals, say analysts

Image: Mahindra Satyam has resolved most issues regarding clients/employee retention.Photographs: Vivek Prakash/Reuters

The key risks surrounding Tech Mahindra are slower than expected growth in non-BT business and higher contingent liabilities than the estimated Rs 4,500 crore (Rs 45 billion).

Most analysts remain bullish on both stocks and expect them to deliver over 15 per cent growth from current levels. Post its takeover by Tech Mahindra, Mahindra Satyam has resolved most issues regarding clients/employee retention and has witnessed margin expansion.

Barring a few blips, it has also delivered decent revenue and earnings growth in the last four-five quarters. The management has also streamlined its sales and account management functions over the past two years and made continuous investments in the same.

...

Mahindra Satyam needs to bag big deals, say analysts

Image: A view of a call centre.Photographs: Vivek Prakash/Reuters

However, it has been unable to bag large deals of over $100 million. Though the number of invites to participate in large deal proposal process has gone up in Europe and Asia Pacific, these continue to be low in the US.

While partly attributing the poor response in the US to the American depository receipt delisting, analysts say winning large size deals is key to Mahindra Satyam's next growth phase.

This is considering the growing size of the company (revenues up 28 per cent to Rs 6,372 crore in trailing 12 months to June 2012). Notably, things are looking up.

...

Mahindra Satyam needs to bag big deals, say analysts

Image: Key issue around Tech Mahindra - shrinking revenues from top client BT - seems to be nearing a bottom. A file photo.Photographs: Vivek Prakash/Reuters

Sandeep Muthangi of IIFL say: "Large deal wins are imminent for Mahindra Satyam as the traction has been improving even in the US over the past few months as the company's investments in sales force and analyst/advisory relationships are paying off."

The management also says it has been selectively looking at large deals (over $50 million) in the US and hopes to win a few. The key issue around Tech Mahindra - shrinking revenues from top client BT - seems to be nearing a bottom.

BT business has remained stable for two quarters in a row now. Also, commentary from the BT management indicates a large part of its cost rationalisation process is done away with.

...

Mahindra Satyam needs to bag big deals, say analysts

Image: Management remains fairly confident of holding on to its BT market share. A file photo.Photographs: Krishnendu Halder/Reuters

The Tech Mahindra management, too, remains fairly confident of holding on to its BT market share. Notably, the company has expanded its non-BT business over the past few quarters and continues to be positive on the same, going forward.

The company also won a three-year large deal worth $50 million from its non-BT clients in the June quarter.

"BT today contributes 36 per cent to TechM's overall revenues as against more than 50 per cent of its overall revenues about 10 quarters back. Though it is partly because BT revenues declined six per cent in FY12, it is equally driven by the fact that non-BT revenues grew 20 per cent in FY12," says Kuldeep Koul of ICICI Securities.

...

Mahindra Satyam needs to bag big deals, say analysts

Image: Anand Mahindra with Vineet Nayyar.Photographs: Arko Datta/Reuters

Overall, Tech Mahindra's dollar revenues are expected to post a four per cent compounded growth rate over FY12-14.

Continuous reduction of Tech Mahindra's debt will also improve its profitability. Notably, its debt/equity ratio is expected to fall from 0.3 times in FY11 to 0.1 times in FY13 and is likely to be paid off fully by FY14.

article