| « Back to article | Print this article |

Is GenNext at Infosys ready for the challenge?

Infosys Technologies appears to have set out on a journey of generational change which will unravel over the next few years.

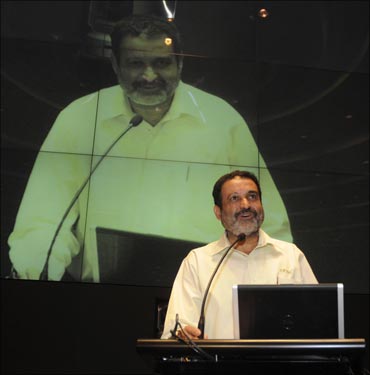

While the retirement of N R Narayana Murthy, the foremost among the founders of India's most iconic software firm, as chairman later this year has been pre-announced, the big surprise is Mohandas Pai, director for human resources and number three in the executive hierarchy, deciding to hang up his gloves.

With, both, CEO Kris Gopalakrishnan and COO S D Shibulal having around three years to go, Pai at 52 could have looked forward to a reasonable term at the top till he turned 60.

This, going by what he has said, would have been his for the asking. But he has chosen to step down, saying it is time the next generation took over -- there is enormous depth of talent in the organisation -- because the business has changed from what the founders have known and been good at.

Click NEXT to read on . . .

Is GenNext at Infosys ready for the challenge?

Software firms have to now offer enterprise solutions custom-made to drive transformational change in clients so they can survive in the tough post-financial-crisis global atmosphere.

Several industry leaders have gone through a change of guard, starting with Tata Consultancy Services and spreading to Wipro and most recently MindTree.

An industry which in a quarter century has grown from scratch to global pre-eminence, now urgently needs to reinvent itself in order to meet the challenge posed by new low-cost geographies like Vietnam in software and the Philippines in BPO.

Click NEXT to read on . . .

Is GenNext at Infosys ready for the challenge?

Part of this transformation that Indian vendors have started to undergo has taken them down the road to becoming more global.

The USP of Indian software cannot remain the cost advantage derived from offshoring work to India. If Indian leaders have to challenge the global top dogs like IBM, Accenture and Capgemini they also have to become truly international.

This can only happen by locating delivery centres around the globe and acquiring an international management team.

Click NEXT to read on . . .

Is GenNext at Infosys ready for the challenge?

The shareholders of Infosys, interestingly, may at some point start pushing for this as right now arithmetically non-Indians, foreign institutional shareholders and ADR holders, account for over half the shareholding and foreign institutions own more, twice the Indian promoters.

Such shareholder activism can come once performance begins to slacken, as seems to be happening right now, compared to the earlier stellar record.

Infosys still leads in pricing -- top and bottom lines growing despite fall in volume -- but the distance between it and TCS on this score has been narrowing.

Click NEXT to read on . . .

Is GenNext at Infosys ready for the challenge?

One reason why Pai may have decided to call it a day is the clash between his immense energy and the conservative groove in which Infosys seems to have settled.

He does not want to wait for three years to be able to do bold things and the ability to do so even then may be limited as in the foreseeable future the firm is likely to be run in a collegial way which does not make for vigorous innovation and aggression.

Infosys is still a great company but it needs to prove that the young blood, for whom Pai has made way, are best capable of doing so.