The crime takes many forms. Identity thieves may rent an apartment, obtain a credit card, or establish a telephone account in the victim's name. The victim may not find out about the theft until they review their credit report or a credit card statement and notice charges they didn't make - or until they are contacted by a debt collector.

...

Identity theft: How not to become a victim

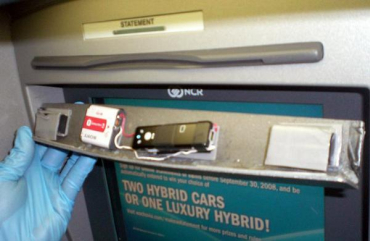

Image: Skimming is a common tactic.Criminals steal credit/debit card numbers by using a special storage device when processing credit/debit card.

...

Identity theft: How not to become a victim

Image: Spam is another popular tool to get personal information.Criminals pretend to be financial institutions or companies and send spam or pop-up messages to get you to reveal your personal information.

...

Identity theft: How not to become a victim

Image: Some criminals change billing address.Criminals divert billing statements to another location by completing a change of address form.

...

Identity theft: How not to become a victim

Image: Stealing wallets the old way is another trick.Criminals steal wallets and purses; mail, including bank and credit card statements; pre-approved credit offers; and new cheques or tax information.

They steal personnel records, or bribe employees who have access.

...

Identity theft: How not to become a victim

Image: Information is obtained through false pretenses.Criminals use false pretenses to obtain personal information from financial institutions, telephone companies and other sources.

...

Identity theft: How not to become a victim

Image: Criminals steal information from garbage.They rummage through trash looking for bills or other paper with personal information on it.

...

Identity theft: How not to become a victim

Image: There are variety of ways to commit fraud.Once they have personal information, identity thieves use it in a variety of ways.

Credit card fraud

They may open new credit card accounts in your name. When they use the cards and don't pay the bills, the delinquent accounts appear on your credit report.

They may change the billing address on your credit card so that you no longer receive bills, and then run up charges on your account.

Because your bills are now sent to a different address, it may be some time before you realize there's a problem.

Phone or utilities fraud

They may open a new phone or wireless account in your name, or run up charges on your existing account.

They may use your name to get utility services like electricity, heating, or cable TV.

Bank/finance fraud

They may create counterfeit cheques using your name or account number.

They may open a bank account in your name and write bad cheques.

They may clone your ATM or debit card and make electronic withdrawals your name, draining your accounts.

They may take out a loan in your name.

Government documents fraud

They may get a driver's licence or official ID card issued in your name but with their picture.

...

Identity theft: How not to become a victim

Image: A victim should take immediate action.Filing a police report, checking your credit reports, notifying creditors and disputing any unauthorized transactions are some of the steps you must take immediately to restore your name.

...

Identity theft: How not to become a victim

Image: Stay alert for signs of identity theft.How long can the effects of identity theft last?

It's difficult to predict how long the effects of identity theft may linger. That's because it depends on many factors including the type of theft, whether the thief sold or passed your information on to other thieves, whether the thief is caught, and problems related to correcting your credit report.

Victims of identity theft should monitor financial records for several months after they discover the crime.

Victims should review their credit reports once every three months in the first year of the theft, and once a year thereafter.

Stay alert for other signs of identity theft.

article