| « Back to article | Print this article |

How RIM plans to knock out competition in India

The media invite for the launch of Research in Motion's (RIM's) tablet PC, PlayBook, was in the form of a boxing glove.

The message - and we don't pick up signals wrong - was loud and clear: RIM is ready to knock out competition. That's the overriding mood at RIM, better known as the maker of BlackBerry smartphones.

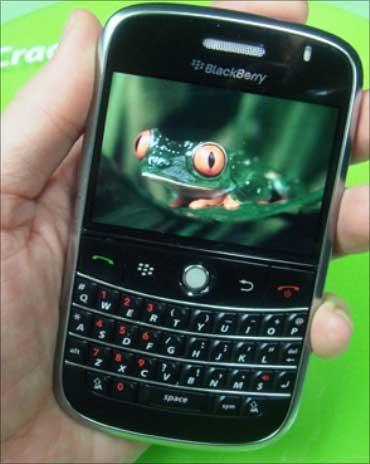

Frenny Bawa, managing director (India), RIM, knows that there are few phones yet that can improvise on BlackBerry's corporate email feature and security functions.

But she's not blind to the growing threat of Google Inc's Android operating system, Apple hardware and affordable handsets from homegrown players in the Indian market.

"There is fierce competition in the industry and we recognise that," Bawa notes. "So, instead of cutting prices and joining the race we chose to focus better on our services, customer data plans, service centres, retail presence and developing the apps' ecosystem."

Click NEXT to read on

How RIM plans to knock out competition in India

But globally it has been hamstrung by delays in product launches and has warned that its profit for the full fiscal year would be well below Wall Street expectations.

In fact, RIM got poor reviews on the April launch of the company's tablet PlayBook and about 1,000 units had to be recalled because of defective software. RIM Co-CEO Jim Balsillie admitted to analysts: "The PlayBook launch did not go as smoothly as we had planned."

After cutting profit forecasts for the year, the company reported a nearly 10 per cent drop in its fiscal first-quarter (ended on May 28) net income.

Click NEXT to read on

How RIM plans to knock out competition in India

As a matter of fact, RIM's sales in the Asia-Pacific region have nearly doubled in the last year, growing to 1.61 million units in the first three months of 2011, from 817,000 units during the same period last year.

But the fight to get a bigger share of India's fast-growing mobile market is getting fierce by the day.

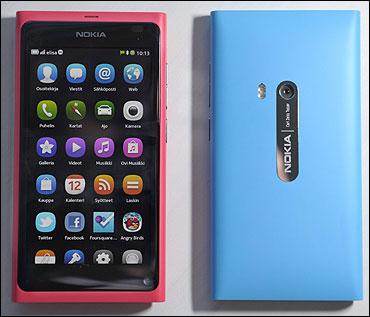

With smartphone platforms like Google's Android and Apple's iOS upending the market, players like Nokia and RIM are forced to entirely rethink how they interact with their customers.

Click NEXT to read on

How RIM plans to knock out competition in India

RIM is hoping that QNX-based "superphones" and a tablet, also running on open-platform QNX OS, would help it not only retain its share in the enterprise segment, but will garner a bigger share of the consumer market. Look at the direction in which the market is headed.

CyberMedia Research (CMR) expects the India telecom services and mobile handsets market to grow at 16.7 per cent in 2012 (over 2011) to touch revenues of Rs 288,832 crore.

Click NEXT to read on

How RIM plans to knock out competition in India

Voice & Data 100, an annual survey of the Indian equipment industries and telecom services, has reported that BlackBerry is among the top five mobile phone brands in India with revenues of Rs 1,950 in 2010-11, up 61.2 per cent from 2009-10.

The survey claims that its entry level smartphone saw more sales in the fourth quarter than the other three quarters put together and helped the company take its market share to 5.9 per cent.

Click NEXT to read on

How RIM plans to knock out competition in India

There's a bigger worry for RIM, more so in India. Analysts at equity research firm William Blair note, "Although RIM does maintain a strong position among enterprise users, we believe new consumer smartphone buyers have dried up, as consumers strongly prefer Android and iOS and sales representatives position RIM as a business-centric platform." Having seen its base expand quickly among the youth in the last two years, especially for its services like BlackBerry Messenger (BBM), the Canadian company will go the distance to correct that perception.

Click NEXT to read on

How RIM plans to knock out competition in India

To be fair, RIM has spent the last two years wooing the individual customers in India.

Beginning with pre-paid BlackBerry data plans to give Indian users the flexibility they sought, RIM has negotiated affordable data plans (starting as low as Rs 150) from mobile operators. Affordable smartphones, at prices below Rs 10,000, got RIM a big chunk of the youth market that saw sense in investing in the free BBM service. "Social networking has been a leg up for individual users and we realised that as we saw a sharp uptake in BBM subscribers," Bawa states. "So we sat down with operators and talked through what kind of flexi plans we could offer the younger customer base."Click NEXT to read on

How RIM plans to knock out competition in India

Apple, which wowed customers with bleeding-edge apps on the iPhone, has shown what innovative content can do to smartphone sales.

RIM was quick on the uptake - the company has roped in 17,000 developers who are working on apps for BlackBerry's global audience. Then it has quite a distance to cover - Apple with over 400,000 apps or Android with over 200,000 apps would still be a bigger draw for the astute smartphone or tablet PC consumer. Nobody at RIM would admit this but the company, which had till date focused just on smartphones, is in a hurry to build categories like tablet PCs, a consumer fan base and apps -exactly where its competition had moved in a couple of years ago.Click NEXT to read on

How RIM plans to knock out competition in India

But if tablet PC is a new business vertical for RIM, it has no intention to be just a follower.

"PlayBook is a tablet PC that runs BlackBerry OS and does everything that competition cannot. It runs Adobe AIR, Flash and has BBM built in for current BlackBerry users," Bawa says drawing attention to what the company is touting as the PlayBook's unique selling proposition. Priced at Rs 32,900, the PlayBook has to fight for shelf space primarily with the Samsung Galaxy Tab and Apple iPad in India, where both of them have had a good head start.Click NEXT to read on

How RIM plans to knock out competition in India

Vishal Tripathi, principal research analyst, Gartner points, "While many different OS-based tablets have been launched in India, none of them have been able to penetrate the enterprise market. Though RIM has substantial following in smartphones, its tablet still needs to prove its worth to RIM followers."

While enterprise customers are warming up to the idea of a tablet, Tripathi adds, adoption is not happening fast enough. The point to remember is that the enterprise segment prefers 10-inch tablets - in contrast to the 7-inch PlayBook - for their ability to support two-hand typing and larger viewing areas for apps.Click NEXT to read on

How RIM plans to knock out competition in India

Then some missing features. Experts point out that the Personal Information Management (PIM) function is not accessible unless you pair the device with a BlackBerry handset - so if you don't have one, buy one.

And even in this case you have to use your handset's cellular data connection to work with your email and contact lists. PIM is undeniably one of the most important features of a tablet device, making the PlayBook, in its current state, somewhat unappealing to users not on the BlackBerry owners list. <B>Watching competition</B><BR>Apple with a market capitalisation of $307.19 billion has become the biggest technology company in the world, followed by Nokia with a market cap of $30.89 billion; RIM occupies the third slot with a market cap of $22.5 billion.

How RIM plans to knock out competition in India

That perhaps is no deterrent for the company, which has invested heavily in tablet PCs, the QNX operating system, and software services that it can provide its enterprise and individual consumers.

In fact, services are proving to be BlackBerry's backbone in both the enterprise and consumer segments. Mind you, while the software business makes up only 1 per cent of RIM's total revenue, it has much higher margins than the hardware business.Click NEXT to read on

How RIM plans to knock out competition in India

Original equipment manufacturers such as HTC and Samsung have moved in rapidly with Android handsets in the mid- and premium-segments of the market.

As Android gains share, consumers are exposed to open cross-ecosystem messaging platforms such as WhatsApp.

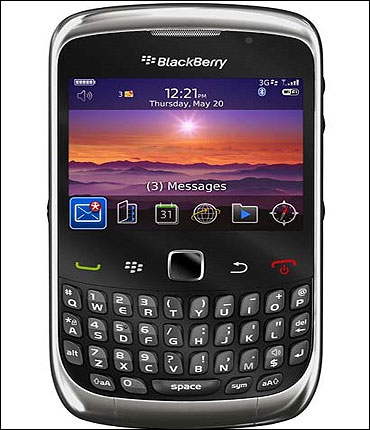

Canaccord's checks in emerging markets indicate that sales of BlackBerry Curve 8520 have slowed in recent months as Nokia has aggressively priced its C-Series smartphones, and low- and mid-tier Android models have started gaining share in several key markets.

Click NEXT to read on

How RIM plans to knock out competition in India

These phones are a slimmer version of the familiar BlackBerry. "Of the upcoming BlackBerry devices, we believe RIM will continue to lose market share given that it will not aggressively price its new products to avoid further share losses in these emerging markets," writes Canaccord in its latest report on the global smartphone market.

As far as RIM's tablet PC offering is concerned, analysts are recommending a wait-and-watch approach.

Click NEXT to read on

How RIM plans to knock out competition in India

Enterprise support for the PlayBook is based on BlackBerry Bridge, a system where secure information remains on the BlackBerry, but is displayed on the PlayBook through a Bluetooth connection.

"RIM's security model has not yet been ported to QNX, thus the need to bridge to the BlackBerry. It also does not have 3G or other carrier-based mode of internet access, for which the user have to be in a Wi-Fi environment which is a challenge to real mobility," underlines Gartner's Tripathi.

Keeping its hold on the enterprise sector is going to be key to RIM's future in India, and the Canadian company knows it.

Click NEXT to read on

How RIM plans to knock out competition in India

"We are multiplying reach so that now Ingram will distribute the full portfolio of BlackBerry enterprise solutions in India, including smartphones, accessories, software and technical support services," points Sunil Lalwani, director (enterprise sales), RIM India.

RIM is now readying a new enterprise technology that it acquired from Munich-based Ubitexx, that brings a single web-based console for CIOs to add and securely manage both BlackBerry and non-BlackBerry devices.

Click NEXT to read on

How RIM plans to knock out competition in India

RIM, which started as a pager company, is banking on the enterprise customer to be its pivot in the smartphone market.

Bawa and her 60-member team in India are hoping that satisfied enterprise customers will translate into greater individual patronage for the company.