Swati Garg

Arguably Finnish mobile handset maker Nokia, the Euro42 billion (2010) multinational company, did as much to usher the telecom revolution in India, as did the Bharti or the Ambani dream.

Despite the vision the Helsinki headquartered company has found itself cornered in the Indian market, its market share visibly reduced and its devices dumped for cheaper, Indian and Chinese counterparts over the past two years.

Now, Nokia has chalked out its fight-back strategy.

. . .

How Nokia plans to make it big in India

The vision to drive this next leg, say company executives, is nothing new but an extension of Nokia's stated purpose -- that of 'Connecting People'.

"The new strategy, as announced by the CEO, looks to 'Connect the Next Billion'. This is an extension of our long standing announced vision of allowing people the right to connect using the latest in technology," says Viral Oza, director, marketing, Nokia India.

According to Oza, the strategy now is to ensure that the product suite that the company has on offer evolves with the evolution of technology and is made available at a lower price band -- that is, at the sub-Rs 6,000 segment as well.

The next billion, he says, will come not just from the pipe connect that a handset provides, but from providing the user with the ecosystem to connect using data, and this data usage will not be confined to those carrying costly handsets.

. . .

How Nokia plans to make it big in India

Image: A woman talks on a mobile phone.Photographs: Reuters

"The basic premise of mobile technology has to be to make it available to everyone.

"This has been the mainstay of the Nokia brand, which has traditionally had a presence from the Rs 2,000 to the Rs 20,000 range.

"The change one will see now is the need of the future," Oza explained.

The idea itself has roots in Nokia global CEO Steven Elop's words: "The battle of devices has now become a war of ecosystems."

That Nokia had to work toward the development of a favourable ecosystem is not a new premise in the larger Nokia strategy.

Conventionally, the term ecosystem was used to refer to a group of partners that Nokia would bundle with in the creation of the device.

These would include the contributions from silicon providers, software component developers, integrators and operators besides Nokia, the majority partner.

. . .

How Nokia plans to make it big in India

In the new scheme of things, this ecosystem also refers to telecom service providers like Bharti Airtel and Vodafone.

In other words, the idea has now been expanded to include third party software and services, while the underlining philosophy of building around the device remains intact.

"The idea of access is linked to affordability.

"So we have tied up with service providers like Airtel where we will provide free internet surfing for the first six months on the purchase of a handset," Oza said, detailing the new strategy.

The direction in which the market is moving is unmistakable. According to a recently released report by the Federation of Indian Chambers of Commerce and Industry and Ernst & Young, in 2010, handset volumes in India reached 150 million.

. . .

How Nokia plans to make it big in India

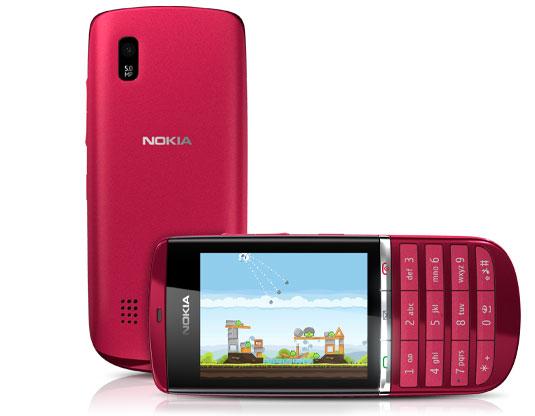

Image: Nokia Asha.Their volumes are expected to grow at a compounded annual growth rate of 10 per cent during 2010-13 to reach 200 million.

Also important is the number of active mobile connections.

Consider this: According to data released by the Telecom Regulatory Authority of India, in August 2011, the country had about 866 million, with additions of about 6-7 million a month. India is the world's second largest mobile telephone market, second only to China.

The numbers have plateaued out, however, with 70 per cent of the population now having access to mobile telephony.

The report also states that in dollar terms, the Indian handset market value was pegged at $7.5 billion in 2010.

. . .

How Nokia plans to make it big in India

For the period 2010-13, the market value is expected to grow at a CAGR of 13.5 per cent to reach $10.1 billion by 2013, and $20.7 billion by 2020.

These numbers have important cues for handset makers.

"In the next five years, or by 2015, smartphones are expected to go up -- from having 3 per cent of the overall handset pie in India to 30 per cent of the larger pie," said Deepak Kumar, research director at the International Data Council India, the global provider of market intelligence, advisory services and events for the information technology, telecommunications and consumer technology markets.

The new smartphone

According to market analysts, India is at that juncture where the smartphone segment will see exponential growth, driven largely by the need of the consumer to access data on the mobile phone.

According to forecasts by the IDC, by 2015, while the mobile handset units shipped in India is expected to dock 328 million, at a CAGR of 14.5 per cent, the smartphone segment is forecast to dock a CAGR of 68.4 per cent to achieve a shipment of 81.5 million in the same period.

. . .

How Nokia plans to make it big in India

Image: Smart phones."The smartphone segment in India is growing at a remarkable pace and should continue to do so for the next few years, driven by cheaper models and the evolution of consumer habits, requiring most of them to access the internet on the move," says Pankaj Mohindroo, president, Indian Cellular Association.

However, detractors argue that the reason for the spike in smartphone sales has to do with the fact that it is a new category, and while the segment is sure to grow, it will not overtake the feature phone growth, which will continue to dominate.

"The smartphone segment will contribute to realisation, but the bulk of the numbers will continue to come from the budget feature phone segment," says Prashant Singhal, partner, E&Y.

. . .

How Nokia plans to make it big in India

Photographs: Reuters

"The smartphones will increase their share in the overall pie because of their low base. This does not necessarily amount to them taking over the mobile market in India."

This is precisely the view that seems to be defining the strategy at Nokia.

The company says the very features that defined the smartphone device have themselves undergone a radical change.

"Till two years ago, the definition of a smartphone would encompass something with a Qwerty keypad, a touch-screen or a good processor.

"Today, the smartphone, in the Indian context, is anything that allows the consumer to access data in a smart way," says Jasmeet Gandhi, head, service, Nokia India.

. . .

How Nokia plans to make it big in India

According to Gandhi, while the company has had in the past and will continue to have its focus across the budget, mid and premium segments, the strategy has kept in mind the fact that the next push in mobile handset sales will come from the sub-Rs 6,000 category.

"In India, the next phase of growth will come first from those that are looking to get more features and data connectivity apps at a lower price, and second from a market which will be largely replacement-based," Gandhi explains.

Gandhi's assumption is backed by some data put forward by the Ficci-E&Y report. According to the report, the share of communication related services in the average household consumption was estimated to increase from 1 per cent in 1995 to 6 per cent in 2025.

. . .

How Nokia plans to make it big in India

"Things we are able to add on top, free data plan, apps that are localised, business models that work for the country will aid sales.

"So for most phones, Nokia allows free downloads from its music catalogue consisting of 6 million songs.

"The differentiation has to come at every price point not, just at the high end," explains Gandhi.

"The winners will be ones who are able to innovate largely in the sub-Rs 6,000 category. This is aided by two factors: First, the size of the market, which is huge, and second, by the challenge, which is to pack in more and more features at the restricted price point, and then adding more layers of services," Gandhi adds.

The sub-Rs 6,000 segment, according to Gandhi, is growing at 5-6 per cent per annum, and the big push here is expected to come from smaller cities and non-urban areas.

Gandhi's optimism is understandable given that at present, 72 per cent of the Indian population lives in rural areas, and that in 2010, 65 per cent of the overall handset sales came from semi-urban and rural markets.

Then, as Oza points out, the country has a burgeoning young population, 'eager to get online'.

"The consumer has become experimental. It does not matter at what price the phone comes, the buyer expects the same features at Rs 6,000 that he would get at Rs 20,000.

It therefore becomes essential that the company is able to address this challenge to ensure growth," Oza says.

. . .

How Nokia plans to make it big in India

The New Nokia

According to officials at Nokia, the strategy is bound to succeed given the kind of product differentiation and value-added services that Nokia brings to the table. "It is a multitude of things.

Both price and brand play a role.

However, things like post purchase service, where Nokia scores, and the ability to localise applications to suit the taste of the country are factors that will determine the success in the new play," Gandhi says while elaborating on the advantages Nokia enjoys.

The value additions that Gandhi is referring to include things like a fast browser, its ability to cache, and the number of . . .

How Nokia plans to make it big in India

"The past success and the Nokia brand will help us make a success of these partnerships. If one looks at the local players, the market is fragmented and therefore it is not clear which brand is which.

"There is no long-term commitment and bonding with the brand, which they will have to build, and which we have already built, making this our advantage," Gandhi says.

Analysts tend to agree. According to Kumar of IDC, Nokia, in spite of competition, will continue to retain its top spot in both the feature and smartphone categories.

Interestingly, even as Nokia is gearing up to enter the lower end of the price band, local players like Lava, Spice and Karbonn, which have so far determined the growth of the mass market, are looking to increase their average price points, signaling the need for consolidation in the market.

From an average of Rs 2,500, these manufacturers are looking to take the average price point to Rs 4,000.

"Most local players are already well established.

"The rankings of the top seven to eight players will remain the same.

"It is right below this segment that one will see some sort of consolidation, even elimination of some of the players," says Singhal of E&Y.

article