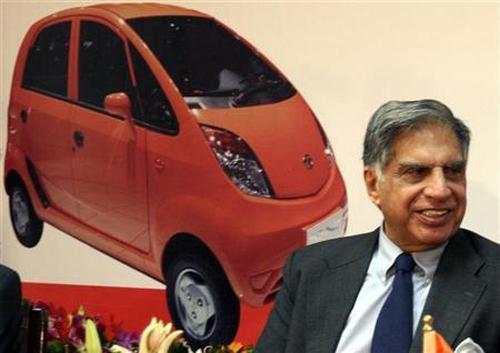

Photographs: Amit Dave/Reuters Krishna Kant and Swaraj Baggonkar in Mumbai

Ratan Tata became the chairman of Tata Motors in 1988, a full three years before he took the leadership mantle of Tata Sons. Since then, the company has been a canvas for Tata to give expression to his aspirations.

Be it India's first indigenous car (Tata Indica), first sports utility vehicle (Safari), first micro truck (Ace) or a Rs 100,000 car for the common citizen (Nano), Tata Motors has many firsts to its credit.

The acquisition of Jaguar Land Rover in 2008 catapulted Tata Motors to one of the world's top car makers. It has also been an unqualified financial success.

JLR accounts for nearly two-thirds of revenue and 90 per cent of consolidated profit. It also helped the company de-risk its finances from the vagaries of the commercial vehicle business.

The JLR success, however, masks Tata Motors' failure to connect with Indian car buyers, increasingly shifting to its rivals. Fixing this will be top priority for Cyrus Mistry, the new chief, given the amount of financial and strategic capital invested by Tata Sons in the company over the years.

According to the Society of Indian Automobile Manufacturers (Siam), Tata Motors' market share in the passenger vehicle segment fell to 12.7 per cent during April-November 2012 from 16.4 per cent in 2006-07. It is India's fourth largest passenger car brand, after Maruti Suzuki, Mahindra & Mahindra and Hyundai.

...

JLR's success masks Tata Motors' failure

Image: Tata Motors chairman Ratan Tata gestures as he stands next to a Jaguar XF during a launch of Jaguar and Land Rover in IndiaPhotographs: Punit Paranjpe/Reuters

The slowing in its domestic business is a financial drag. During the 12 months ending September, the domestic business earned just 5.1 per cent operating profit against 12.5 per cent for its consolidated operations. The financial ratios of the domestic business are even worse, with a return on capital employed (RoCE) of just 3.3 per cent in FY12.

Analysts, however, are not losing sleep over Tata's apparent failure in the passenger car market. "At best, it accounts for 5 per cent of the company's consolidated profit and its financial performance is linked to JLR, followed by its commercial vehicle business in India," says the automobile analyst at a leading brokerage company.

However, he adds, success in the home market matters in the longer term, as India is set to become one of the world's top car markets in 10-15 years.

Complacency

Experts say the company failed to build on initial successes. "Tata Motors is an engineering powerhouse and most of its products have been segment builders. Indica was India's diesel hatchback, Sumo started the MPV (multipurpose vehicle) segment, while Safari pioneered SUVs in India but the company failed to carry it forward," says Pradeep Saxena, executive director, TNS India.

He finds a paradox here. "Brand Tata has certain inherent values embodied in it, such as trust, fairness and integrity. The issue is whether these are good enough for the car category or a buyer cares for another set of values such as modernity, innovation and style," he says.

...

JLR's success masks Tata Motors' failure

Image: Engineers work on a car body at Tata Motors Ltd.'s in PunePhotographs: Punit Paranjpe/Reuters

The poor show in the domestic car market is recognised by the company, up to Ratan Tata himself. "Success in the domestic passenger car market is non-negotiable for us. The goal is to become a strong number two in the near term, and eventually target for the market leadership," says the company's spokesperson.

To achieve this, it will first need to fix Tata Motors' brand image and then flood the market with new products. "A product is a brand in the auto industry and Tata Motors' product line-up is neither exciting enough or come about as sophisticated and stylish. The company's portfolio hasn't changed much in 10 years, except routine product refreshments," says an analyst.

Others put the blame on the Nano failure; the vehicle consumed resources and management bandwidth for years. "If the Nano had ...

JLR's success masks Tata Motors' failure

Image: A worker cleans a Tata Motors logo outside its showroomPhotographs: Krishnendu Halder/Reuters

The pace of new launches has considerably slowed since and in the past 10 years, it launched just four new products - Indica Vista, Indigo Manza, Nano and Aria, besides refreshments of older models. This is not acceptable to car buyers today, now that every global auto major is wooing them.

Action needed

"When the Indica was first launched in 1998, it was competing against the Maruti Zen and Hyundai Santro. The new generation Indica Vista is up against a dozen or more compact cars. The company needs a breakthrough product and not incremental model changes as it has been doing all through," says Pradeep of TNS India.

The company seems to agree. "There has certainly been a quiet period of late (in terms of new product launches). However, there are new products and offerings in the pipeline," it says.

Experts said it might take time but the company had the means and resources to make a strong comeback. "JLR's acquisition distracted the top management for a while but the domestic market will be its top priority now. JLR's success gives Tata Motors the financial muscle and the engineering prowess to adopt an aggressive posture in India," says the auto analyst at a brokerage house here.

If the company succeeds, this will be the best retirement gift from Cyrus Mistry and the company's top management to Ratan Tata.

article