| « Back to article | Print this article |

Swiss banks info-sharing to be effective in Sept: FM

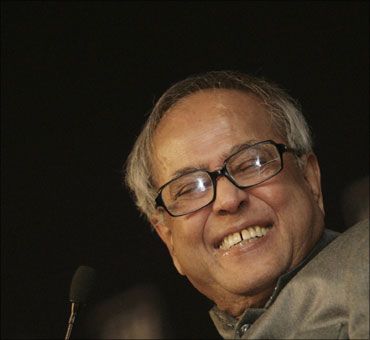

Finance Minister Pranab Mukherjee on Friday said the agreement signed with Switzerland for sharing banking information on demand is likely to come into force by September.

He said during Question Hour in the Lok Sabha that he had signed the agreement with Switzerland for sharing banking information of Indians having accounts there during his earlier tenure as Finance Minister in UPA-I government.

He said the Swiss Parliament had ratified the agreement but as per rules of direct democracy prevalent in that country all cantons (states) have to ratify it.

"This process will be completed by September. Information will be shared from April 1, 2011, prospectively not retrospectively. No country has agreed to share information retrospectively," Mukherjee said, adding once it comes into force, banking information will be exchanged between the two countries on demand.

Mukherjee said India's Tax Information Exchange Agreement (TIEA) with four sovereign entities, namely Bahamas, Bermuda, British Virgin Islands and Isle of Man was already in force.

Click NEXT to read on . .

Swiss banks info-sharing to be effective in Sept: FM

These are famous tax havens where black money of individuals from several countries has been parked.

India has also signed TIEA with Cayman Islands but it is yet to come into force.

The Finance Minister said India's Double Taxation Avoidance Agreement with 80 countries was already in force while DTAA with Columbia, Ethiopia, Lithuania, Taiwan and Tanzania has been signed but is yet to come into force.

India has re-negotiated DTAA with Italy, Norway, Singapore and Switzerland.

"In last two years, India has negotiated 16 TIEAs, 18 new DTAAs and has also renegotiated 21 existing DTAAs. TIEA with Bahamas has been signed and has also entered into force. TIEA with Monaco has been negotiated. DTAAs with Republic of Columbia and Taiwan have been signed and are waiting to be entered into force," Mukherjee said.

Click NEXT to read on . .

Swiss banks info-sharing to be effective in Sept: FM

The finance minister claimed DTAAs help in the flow of investment and technology as it seeks to avoid double taxation.

"DTAAs and TIEAs help in countering the menace of tax evasion and black money stashed in foreign banks by helping in collection of information regarding tax evasion and foreign bank accounts. DTAAs also sometimes help in collection of taxes from assets located abroad. 27 out of 80 DTAAs contain such a provision for assistance in collection of taxes," he said.

Mukherjee said TIEA is a concept created to deal with tax havens where banks are established which do not share information and act as "sovereign entities".

He informed the House that after 2008, and during the London and Pittsburgh summits, all countries including Switzerland -- which were not cooperating earlier in sharing banking information were asked to cooperate.

Mukherjee said every country had its own detailed and elaborate procedure of entering into and ratifying international agreements.