Photographs: Abhijit Mhamunkar/Rediff Ujjval Jauhari

Nervousness ahead of the election outcome on May 16 may keep markets volatile, but experts say investors can pick up stocks across sectors.

The high probability of a stable and pro-growth government after the elections has seen the broad indices run up sharply.

Experts, however, remain cautious, considering the rally and the valuations which, a little above the long-term average, aren’t cheap anymore.

Nevertheless, they believe there are pockets of opportunities investors can consider, as some companies will do well after the elections.

...

Stocks that will give you high returns during poll season

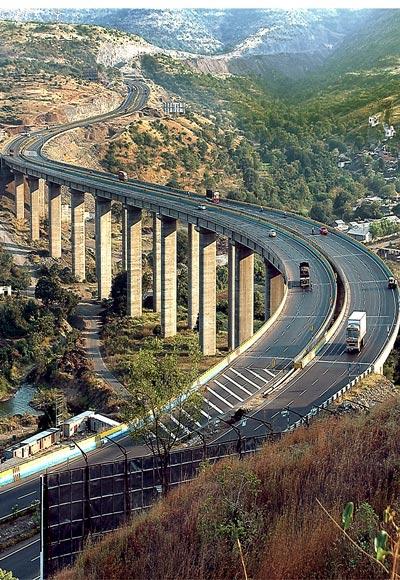

Photographs: Courtesy, NHAI

Recently, research house Nomura recommended its cherry picks from the financials, infrastructure and oil and gas sectors, on the assumption of a stable and reform-focused government at the Centre.

The research house feels a focus on infrastructure and reforms in sectors such as power will be positive for the medium-term outlook on asset quality and inflation expectations.

...

Stocks that will give you high returns during poll season

Image: Axis Bank stock is one of the top picks during poll season.Photographs: Reuters

Rate cyclicals, especially high-beta banks, will be the key beneficiaries of a positive outcome of the elections.

Therefore, it feels despite the recent run-up, the valuations of many banks are still inexpensive, with stocks trading below their five-year mean one-year forward price/adjusted book values.

Their picks include ICICI Bank, Axis Bank, YES Bank and State Bank of India.

...

Stocks that will give you high returns during poll season

Photographs: Uttam Ghosh/Rediff

Others, too, are positive on the banking sector. Dhananjay Sinha, head (research) and strategist at Emkay Global, maintains a cautious view on the markets, as valuations look stretched, with the indices rising to record highs. While he expects some correction, he feels there are investment opportunities in many sectors and companies with strong growth prospects can be considered.

Among private banks, ICICI Bank remains his top pick; in the public sector banking space, he prefers Bank of Baroda.

...

Stocks that will give you high returns during poll season

Photographs: Reuters

Kunj Bansal, executive director and chief investment officer at Centrum Wealth Management, says though all eyes are set on what happens on 16th May (when the election results will be announced), quality cyclicals will continue to do well, irrespective of the outcome.

Bansal says as is indicated by macro numbers, good bets in the banking, infrastructure, power and capital goods segments should continue doing well.

He is bullish on ICICI Bank, Union Bank of India, Punjab National Bank and Bank of India.

He adds though some volatility may be associated with the March quarter results posted by Union Bank, it remains a good bet.

...

Stocks that will give you high returns during poll season

Image: An oil rigPhotographs: Atef Hassan/Reuters

For the oil & gas sector, gas prices and fuel subsidies are the two key issues that can potentially be addressed by a strong and stable government, feels the research team at Nomura.

“An early decision to raise gas prices will markedly change the E&P (exploration and production) investment climate. Also, steps to reduce fuel subsidies will augur well for the sector,” says the research house. Its picks include Reliance Industries, BPCL and GAIL.

...

Stocks that will give you high returns during poll season

Image: Reliance Industries' KG-D6 basin off east coast of India.Photographs: Reuters

Sinha, too, is optimistic about the prospects of the oil and gas sector due to a number of policy decisions that could be taken.

Owing to the likely rise in gas prices soon, he is positive on Reliance Industries.

But some aren’t too enthused by the oil sector. Bansal feels the prospects of companies are much too dependant on government decisions.

And, as there are opportunities in other sectors, he believes investors should look at those options rather than wait for policy decisions.

...

Stocks that will give you high returns during poll season

Photographs: Reuters

Companies in the pharmaceuticals, consumers and information technology (IT) segments are favoured, as experts believe these will continue to grow at a healthy pace, given election results don’t play a key role in driving their fortunes.

Bansal feels IT and pharmaceuticals segments are safe bets, while Sinha says pharmaceutical companies are associated with growth; he prefers Dr Reddy’s and IPCA.

Further, after a correction in IT stocks, partly due to rupee’s appreciation, there are many opportunities, says Sinha. Companies as Infosys and Wipro offer good opportunities, while NIIT Tech is among the top picks in the mid-cap space.

...

Stocks that will give you high returns during poll season

Image: Mundra PortPhotographs: Adani Enterprise

Nomura feels a stable, investment-focused government is likely to lead to faster decision-making, addressing key bottlenecks in infrastructure projects.

Over the medium term, they expect a pick-up in order inflows and award of infrastructure development projects, under public-private partnerships.

Also, a recovery in economic growth should bode well for ports, transport operators and independent private partnership projects.

However, given the strong run-up in the stocks through the past six months, they remain selective at current levels, only cherry-picking companies with good visibility and/or very high delta from accelerated reforms.

Their picks include Coal India, Concor, Adani Port and Voltas.

...

Stocks that will give you high returns during poll season

Image: L&T has managed to maintain good margins in its core businessesPhotographs: Courtesy, Metro Rail

Kunj cites Larsen & Toubro, Thermax and ILFS Transportation Networks (roads) as fundamentally good bets, along with Bharat Forge. Among consumer goods companies, ITC, Emami and Bata are his top picks.

Sinha says volume recovery is likely to boost Hero MotoCorp’s prospects.

In the entertainment and media space, he is bullish on Zee Entertainment and DB Corp, while in the fast-moving consumer goods space, he is betting on Colgate.

article