Photographs: Kind Courtesy, www.stockguruvictims.com N Sundaresha Subramanian in Mumbai

In the recent Hollywood hit Looper, there is a sequence where the lead actor, Joseph Gordon Levitt, ages and morphs into Bruce Willis.

The only feature that tells us the two very different looking men represent the same character is the hairstyle - long, straightened hair flowing by the sides, with a few strands pulled back to reveal the face.

When he was arrested on Monday, Ulhas Prabhakar Khaire, 33, sported the same look. He probably added a little goatee as a personal touch.

While Khaire might have looked for inspiration for his many different looks in Hollywood, an account of his exploits over the past couple of years would give any Hollywood scriptwriter a run for his money.

Khaire and his wife of seven years, Raksha Urs, have been on a seven-year nationwide tour tricking unsuspecting investors, patients, credit card companies and banks.

To cover their tracks, they managed to take new identities in each new place to suit the local culture. Thus, they became the Zaveris in Gujarat, the Khatris in Uttar Pradesh and the Maheshwaris in Dehradun. Even Khaire's mother was not spared.

To avoid being declared a proclaimed offender, Khaire sent a photograph of his "dead body" to his mother and tricked her into believing he was dead.

...

Stock Guru story can put caper films to shame

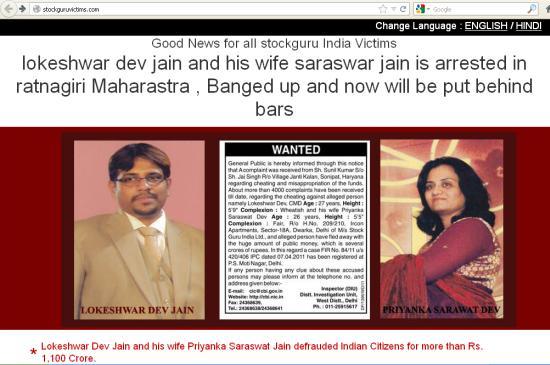

Photographs: Facebook page of Stock Guru India Victims

Their modus operandi ranged from going on a spending spree on multiple credit cards to running a fake psychotherapy clinic in Dehradun. But, it was with the story of the technical analyst who could give "jackpot calls" on stocks that they hit jackpot.

For this stock market venture, the couple took suitably Marwari-sounding names: Lokeshwar Dev Jain and Priyanka Saraswat Dev Jain.

Stock Guru India started in the National Capital Territory around 2009. It took deposits of Rs 10,000 or more, promising returns of 20 per cent per month and return of principal in the seventh month. Effectively, it doubled your money in seven months.

How did the investors buy the idea? Sunil Kumar, a senior official with a state-run insurance company, says, "An acquaintance brought this scheme to me talking about the fantastic returns. Ek-do bar humne mana kiya (I refused a couple of times). But, somehow, this person put pressure on us and got us to invest."

Kumar, among the first to file a police complaint in April 2011, adds, "I have seen the couple in a few sessions conducted at the star hotels of Delhi. He looked stylish and sounded very convincing. He told us he was a technical analyst and was capable of generating 30-35 per cent returns in the stock market, of which he would give us 20 per cent." Kumar and his family members invested a total of Rs 15 lakh (Rs 1.5 million), according to an FIR with the Motinagar police station.

...

Stock Guru story can put caper films to shame

Image: Ulhas Prabhakar Khaire, the owner of Stock Guru IndiaKhaire had issued demand drafts to initial investors, which helped in building confidence and spreading the word about the scheme. He even asked people to open accounts with State Bank of India where the promised returns could be deposited.

Investors were also given a login id, where they could see their 'monthly income' credited.

"We could see the sum credited online in the Stock Guru account. But, there was nothing in the bank account. Whenever we tried to log into the bank account, some data error occurred. We were told that a lot of Stock Guru customers were accessing the site, leading to network congestion," Kumar says.

Though the arrest has given some hope to investors like Kumar, doubts linger as the Khaires seem to have already spent a significant sum on organising lavish events at five-star hotels and holidaying abroad.

Of the Rs 593 crore (Rs 5.93 billion) the duo allegedly collected, only about Rs 100 crore (Rs 1 billion) has been traced and frozen in 94 bank accounts across the country.

Khaire grew up in Nagpur, where he ran a small construction business before falling off with his partner. He met Raksha, a Mysore girl, while working in a financial firm in Bangalore around 2005.

Police accounts say the Khaires barely finished high school. For a couple who had never been to college, they were doing well with a villa in Goa, flats in Delhi, a fleet of cars and a couple of new businesses in Ratnagiri. And, then, the cops came calling.

article