Photographs: Reuters Raghavendra Kamath

Jones Lang LaSalle India says growth was skewed towards suburban and emerging locations as opposed to city sub-markets in 2013.

Real estate professionals are unanimous in one prediction: Things will start looking up for the sector only in the second half of 2014, after the general elections, when clarity on the new government will emerge and businesses start investing.

2013 was clearly a dull year for real estate, when all asset classes - residential, office and retail properties - barring some cities such as Bangalore saw a steady decline in absorption.

...

Will the New Year bring cheer for the realty sector?

Photographs: Reuters

Residential

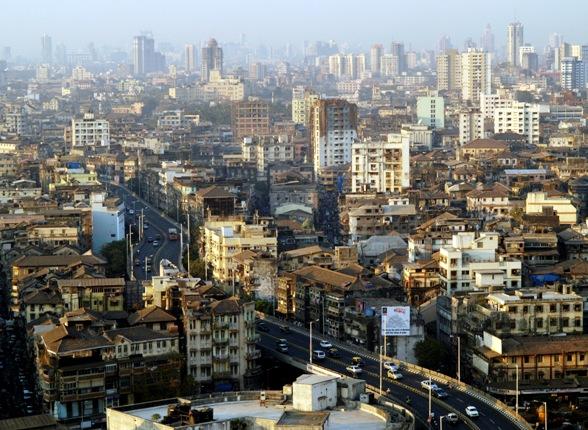

Absorption of residential units in most cities such as Mumbai, Delhi-NCR and Pune went down in the first three quarters of 2013.

“The year 2013 was a drag for the Indian economy, with poor macroeconomic conditions. Slowing income growth, sustained weakness in the rupee, sky-rocketing inflation and high borrowing rates combined to make consumers vary of spending,” said Anuj Puri, chairman and country head of realty consultant Jones Lang LaSalle India (JLL).

According to JLL, weighted average prices of homes across the country rose 10 per cent year-on- year during the first three quarters of 2013. But growth was skewed towards suburban and emerging locations, as opposed to city sub-markets. Rental values rose eight per cent during the period.

...

Will the New Year bring cheer for the realty sector?

Photographs: Reuters

Consumer confidence is expected to remain subdued in first two quarters of 2014 due to uncertainties surrounding general elections and macro-conditions.

“However, after the elections, fence-sitting investors are likely to become active. The increase in absorption of residential units will help reduce the currently large inventory holdings of developers,” Puri said, adding residential prices are expected to raise 10-12 per cent during 2014.

According to a recently released report by UK-based Knight Frank, about 45 per cent of Mumbai’s under- construction properties are unsold, indicating stress in the realty market.

Says Sunil Rohokale, managing director of ASK group, an investment manager: “In 2014, interest rates will be high in the first half and will go down in the second half. When rates go down, sales will happen and absorption will improve.”

“We expect residential to experience traction in terms of sales volume and launches at the start of the second half of 2014 and there would be an upward pressure on prices. The office segment is driven more by economic rationale and as a result, the uptick is likely to take place with a quarter lag,” said Shishir Baijal, chairman and managing director, Knight Frank India.

...

Will the New Year bring cheer for the realty sector?

Photographs: Reuters

Office

The office realty segment was the most-hit segment in 2013 as occupiers deferred leasing activity due to overall slowdown and uncertainty.

According to a recent report, India Office Market View Q3 2013, by US-based CBRE, office space absorption in the top seven cities of the country declined by approximately 14 per cent

q-o-q — registering six million sq ft in Q3 of 2013, as compared to seven million sq ft in the previous quarter.

“Commercial real estate is dependent on individual and corporate earnings and for this to pick up, these parameters have to pick up,” says Rajeev Talwar, executive director at DLF, the country’s largest developer.

...

Will the New Year bring cheer for the realty sector?

Photographs: Reuters

“The pick up in office properties is also dependent on how many banks you allow to open. If you become more and more socialist, the growth rate will come down,” Talwar said.

According to JLL, vacancy rates in office properties are to go up from 18.2 per cent in 2013 to 19.2 per cent in 2014 due to growth in supply, though absorption is expected to get moderated.

If government allows tax breaks for real estate investment trusts, traction in commercial properties will increase, consultants say.

...

Will the New Year bring cheer for the realty sector?

Retail

2014 is expected to see a lot of action on the retail front due to the possible entry of multi-brand retailers.

2013 saw a 39 per cent jump in addition of mall spaces over the last year despite 18 malls being deferred by developers, said a study by global consultant Cushman & Wakefield (C&W).

The good news for developers is that overall vacancy in malls has reduced by two per cent on account of increased leasing activities in the freshly-launched malls, most of which started with a high percentage of occupancy, C&W said. The fresh mall spaces that have started operations in 2013, have witnessed an average occupancy of over 94 per cent.

PAST AND PRESENT

Things that happened in 2013

- Cabinet approves land acquisition bill

- Sebi releases draft Real estate investment trust (REITs) guidelines

- RBI bans buying property abroad

- Lodha buys Rs 3000 crore property in London

Things to watch out for in 2014

- Developers, owners may get to launch REITs

- Government may announce realty regulator

- Residential sales may improve, prices may rise

- Vacancy rates in office properties to rise

article