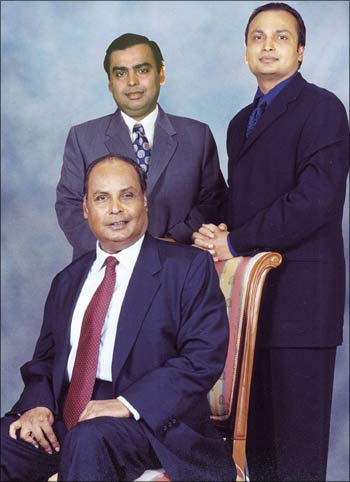

While there is a lot of buzz on peace between brothers -- Mukesh and Anil Ambani -- synergies in the telecom businesses of the two are possible only in limited areas.

Mukesh Ambani, unlike his younger brother, is banking on high speed data and not voice to change the rules of the telecom game.

Experts widely believe that Mukesh will drive a hard bargain in case he decides to use any of Anil's business assets, towers or optic fibres, to drive his 4G telecom strategy.

In case the brothers decide to synergise the telecom businesses, Anil's presence in 2G and 3G, and Mukesh's 4G business, can help them take on competition.

. . .

But again, since their focuses are different, the jury is out on whether a synergy of telecoms will happen.

We take a look at the areas where the brothers, warming up to each other in Chorwad, can co-operate.

Infrastructure -- towers

There are areas in telecom infrastructure where Mukesh can strike a deal with his younger brother.

Anil's RCom has over 50,000 towers across the country, as much as 277,000 km of optical fibre network and as many as one million telecom retail outlets (including company owned, franchisee and distributors) who sell their products.

. . .

Mukesh's Infotel Broadband, which has a pan-India licence and spectrum for broadband wireless access or 4G, which offers multiple times higher speeds than 3G, according to tower companies, is looking for a similar number of towers to launch a pan-Indian network.

Those who are closely watching him say the company would also require a lot of fibre optic capacity to link more than 100 cities across the country in the initial stages of the roll-out.

These cities would then have their own intra city network where the last mile provider could be your cable operator or the company through a wireless access connection to your home.

Mukesh, though, is in a market where there is a glut of tower as well as optic fibre capacity. So he can push prices down.

. . .

Mukesh's Reliance Industries did not reply to queries for the story.

There are five tower companies (including Anil Ambani's), which have 350,000 towers on offer, and each of them can handle three telcos as their tenants.

Due to the failure of half a dozen new operators to kick off subscribers numbers and the slow roll out of 3G services, nearly half the tower capacity is untilised, creating a glut in the market.

"We have enough capacity for the next five years in rural India and, at least, for the next two years in urban markets," admits a CEO of a US-based tower company.

. . .

Tower companies admit that instead of the Rs 30,000, a-month rental, telcos pay half.

Of course, instead of paying tower rental, Mukesh can pick up a stake in a tower company at an attractive price.

His younger brother is looking for such an investor and is already in talks with private equity funds to sell stake in his tower company.

Experts ask, if Mukesh invests in a business when he can get the same service cheaply by outsourcing, he would rather invest in rolling out the network quickly.

. . .

He is expected to spend Rs 15,000 crore (Rs 150 billion) for the 4G roll out, which does not include what he paid for the spectrum.

Those in the know say if his brother offers him the best tenancy deal, there is no reason for the elder Ambani not to grab that offer.

Most telcos generally pick up towers from multiple operators to hedge their bets.

Also, since Mukesh's strategy is to look at broadband wireless deployment initially at homes and offices, his requirement for towers will be low.

. . .

Fibre optics

In the fibre optic space, Mukesh has a number of players to choose from -- Railtel, as well as power companies and competing telcos.

Telcos say there is over 700,000-800,000 km of optic fibre capacity available in the country and it has become a commodity business where there is a lot of capacity.

So, the rules of the game here will not be very different from towers.

Many argue the telecom businesses of the two brothers complement each other. RCom has over 150 million subscribers straddling the 2G and 3G space (in some circles) but does not have a presence in the 4G space where it has not bid for spectrum.

. . .

Mukesh, on the other hand, has spectrum to operate in the 4G space and can get a readymade subscriber base from RCom, which wants to upgrade or take 4G high speed services.

Taking on Sunil Mittal

Synergising the two businesses will help them take on their largest rival, Bharti Airtel.

The Sunil Mittal company plans to provide customers seamless services across 2G, 3G as well as 4G on the same device and mobile phone which can be a very potent offering.

Mukesh cannot do it alone unless he buys a 2G voice operator to offer a similar service.

. . .

Anil's RCom cannot offer the speeds of 4G until it again bids for spectrum when it is on offer.

While this looks perfect on paper, the indications from Mukesh's Infotel Broadband is that the company is banking solely on data and not voice.

It, of course, can offer voice over the Internet in case the Government changes the policy and allows net telephony between mobile and fixed networks.

The key question is whether it is worthwhile for Infotel to synergise with a 2G operator so that it can offer voice also?

. . .

Experts say that the answer is a big no, especially as voice has become a commodity business and margins can be made only in data.

3G roaming

It's not only on the business front that synergy between the two faces challenges. Telecom watchers also say the interests of the two on many regulatory issues do not merge-for instance, on the issue of allowing roaming agreements in 3G services.

Last month, when Anil Ambani, Bharti Group chairman Sunil Mittal, Vittorio Colao, CEO of Vodafone Plc and Kumara Mangalam Birla, who runs Idea Cellular, called on the prime minister, they pushed for permitting roaming agreements to offer 3G services.

That's because India's three leading telcos, Vodafone, Airtel and Idea Cellular, have a roaming pact through which it was possible for them to offer their customers 3G services on a pan-India basis despite the fact that they did not have 3G spectrum in many circles.

. . .

While the TDSAT has given a stay against a DOT order to stop all such services a few days ago because they consider it illegal, the final decision on the legality on this issue will decide the rules for the next big battle -4G.

Infotel is the only pan-India player in 4G space.

But others like Airtel (which have spectrum in four circles in BWA and Vodafone, which is in no circle with BWA) could become pan-India or large players in the 4G space, too, without having to pay for spectrum by getting into roaming agreement with a second player in each circle.

Anil's RCom has not got into any roaming agreement yet, but will surely be waiting for the final judgment eagerly-as it could also do the same too.