| « Back to article | Print this article |

Telecom auction: Flop show or success?

In 2010, nine aggressive telecom operators slugged it out to grab between 15 and 20 MHz of 3G spectrum available in each circle, across the country.

When the dust finally settled on the multiple auction rounds which went on for months, even the government was stunned to see that these telcos had forked out more than a staggering Rs 67,000 crore to buy spectrum.

This was far from anyone's expectations and certainly beyond the government's wildest dreams.

That the price had just shot through the roof was evident in the fact that the base price for the 3G auction for one slot of 5 MHz of spectrum (Rs 1,658 crore) was only 20 per cent of what operators finally paid. Even an optimistic government hadn't expected to net more than Rs 35,000 crore, or about half of what they finally realised.

Click NEXT to read more...

Telecom auction: Flop show or success?

Meanwhile, operators are still to recover the money they spent, especially with subscriber numbers in 3G not materialising.

They complain bitterly that the government, by rationing the amount of spectrum to just three or four slots for nine operators per circle, created an artificial scarcity forcing everyone to overbid to stay in the race.

Flop show

Cut to 2012. The country's second auction in telecom is all set to roll. But, this time, GSM operators make no about saying it will be a monumental disappointment because of the high base price.

Says Rajan Matthews, director general of Cellular Operators Association of India: "It will be a flop auction show. The government's target of getting Rs 40,000 crore is completely misplaced. Except for some circles where Idea, Videocon and Telenor have all bid, in most other areas there will hardly be any competition."

Click NEXT to read more...

Telecom auction: Flop show or success?

On ground, the response has been considerably muted despite the fact that nearly half a dozen operators lost their 2G spectrum after the Supreme Court judgment.

Except for two of them - Telenor and Videocon - the rest have kept away from betting again on the Indian telecom story. So, this time, only six players are in the race for a similar amount of spectrum - some in the 1,800 MHz band the others in the 800 MHz band (for CDMA).

The Department of Telecommunications (DoT), of course, has its own defence and admits that the auction will be short, unlike that of 3G.

The Telecom Regulatory Authority of India (Trai), under former chairman J S Sarma, had assumed that his base price (Rs 18,000 crore for 5MHz) should reflect 80 per cent of the final discovered price.

Click NEXT to read more...

Telecom auction: Flop show or success?

If it is so, today's final base price of Rs 14,000 crore, which was decided by the Cabinet, translates to about 65 per cent of the discovered price.

"The base price has been kept high so that the gap between the discovered and the base price is not too high, as the last time and we save time," says a senior DoT official.

In the interim, however, one change happened - Trai had based its price assumption on the basis of auctioning only 5 MHz of spectrum, yet that was doubled eventually by the government.

So, what happened is that while the base price has been lowered by over 20 per cent (Rs 14,000 crore) by the Cabinet, the supply of spectrum has been virtually doubled. So, the end result will be more spectrum chasing lesser number of buyers even though the base price still remains steep and has not been decreased commensurately.

Click NEXT to read more...

Telecom auction: Flop show or success?

A road map for bidding

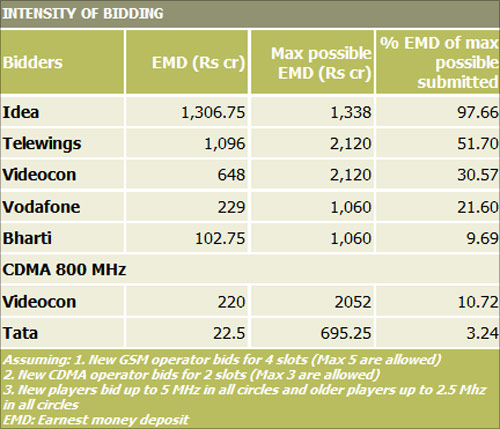

What will the new auction look like? DoT has not divulged what the specific are areas that each operator has bid for. But, based on the earnest money deposits (EMD) made by the various operators which have been announced, some clear trends based on reasonable assumptions are revealed.

For one, it is clear that metros like Delhi and Mumbai and circle A cities will see very low activity, and in most cases there could be surplus spectrum left. In these circles, demand might not exceed eight slots (of 1.25 MHz each) in all the circles where a total of 11 slots are on offer.

Many telcos even allege that the auction has been structured to flop so that the government can go and reduce the spectrum prices which will benefit incumbent players.

Secondly, even for most of the category B and C circles, the demand will be lower - for eight to 10 slots - than the number of slots on offer, which is 11.

Click NEXT to read more...

Telecom auction: Flop show or success?

However, in four circles, the demand might be more than the available slots, and these include Kolkata, West Bengal, Bihar and UP West.

Among the operators, Idea Cellular, for instance, could emerge as a key bidder as it has submitted an EMD of Rs 1,306.75 crore. This gives it the potential to bid for four slots in the nine circles, where it has lost its licence, which is a fair assumption to make, and two slots in almost all the other circles.

Telenor's new company, Telewings, has deposited Rs 1,096 crore of EMD, which is enough for it to bid for all the nine circles which it had publicly said it would concentrate its attention on.

Videocon has submitted Rs 648 crore of EMD which is around 30 per cent of the maximum possible Rs 2,120 crore it would have had to fork out if it had decided to bid for 5 MHz in all the circles.

Hence, it is safe to assume that the company would bid for some category B and C circles to cover maximum territory.

Click NEXT to read more...

Telecom auction: Flop show or success?

Vodafone has deposited Rs 229 crore of EMD. This gives them the potential to bid 1.25 MHz (one block) in 17 circles, excluding Delhi and Mumbai on the basis of revenue potential. Vodafone executives confirmed they had no interest in the two metros.

Bharti has deposited the least EMD, of Rs 102.75 crore. This gives them the potential to bid 1.25 MHz in 10 to 11 category B and C circles.

For the CDMA auction, Videocon has submitted Rs 220 crore as EMD. This gives them the potential to take seven to eight category B and C circles.

Tata has submitted Rs 22.5 crore and this exactly matches the number of points it requires to win the three category C circles which were cancelled by Supreme Court. With just two players, it is reasonable to assume that the auction will end in the first round only.

Click NEXT to read more...

Telecom auction: Flop show or success?

Low-intensity bidding

What is interesting is the low intensity of the bidding by the big boys. For instance, both Vodafone and Bharti could have bid up to 2.5 MHz across the country as incumbents for which they had to fork out Rs 1,060 crore as EMD.

Yet, Bharti has bid at 9.69 per cent of its actual potential while Vodafone has bid at 21.6 per cent of its bidding potential. In CDMA, again Tata has bid for only 3.24 per cent of its bidding potential.

The only notable exception, of course, is Idea Cellular which has bid at over 97 per cent of its bidding potential.

If the government gets more or less closer to what it has defined as the base price, it could end up netting about Rs 28,326 crore from the GSM auction. The calculation shows that government might end up collecting Rs 11,244 crore at the reserve price from the two players in CDMA.

Click NEXT to read more...

Telecom auction: Flop show or success?

Assuming that GSM operators can pay 33 per cent upfront and CDMA ones have to pay 25 per cent of the base price upfront, the government will make Rs 12,158 crore for this financial year from the 2G auction.

The question is whether the auction will end closer to that number or spring a surprise.

The government, which hopes to garner Rs 35,000 crore to Rs 40,000 from the 2G auction, as well as one- time spectrum fee from incumbent operators this financial year, has its fingers crossed.