| « Back to article | Print this article |

Flipkart: From a revenue-guzzler to an asset-light e-tailer

The CEO of a rival e-commerce firm argues Flipkart’s ‘high-burn strategy’ could be seen both as a great opportunity and a big risk, notes Nivedita Mookerji.

Six-year-old Flipkart, country’s most prominent e-commerce player was started as an online bookstore in 2007.

It has often come under scrutiny for being dismissive about ‘profitability’ and unmindful of the high cost of running an inventory-led business, aided by deep discounts and free shipping.

Much of that seems to be changing now, a shift already yielding results.

“Profitability isn’t a short-term goal. We view it as a long-term investment.

While we are not operationally profitable today, that is simply a function of the investments we are making,” says Sachin Bansal, co-founder & chief executive.

He, however, quickly adds Flipkart “wants to be profitable at a much larger level”.

That assertion seems important.

Click NEXT to read further. . .

Flipkart: From a revenue-guzzler to an asset-light e-tailer

Opportunity or risk?

The CEO of a rival e-commerce firm argues Flipkart’s “high-burn strategy” could be seen both as a great opportunity and a big risk.

“Profitability is not on its horizon.”

If the market does not grow as expected, Flipkart’s strategy could backfire, says the executive.

But on the ground, Flipkart’s transition from a revenue-guzzler inventory-led business to an asset-light marketplace model recently got a thumbs up from investors.

It raised $200 million from existing investors -- Naspers, Accel Partners, Tiger Global and Iconiq Capital. In a slow economy, this took the sector by surprise.

With that, its estimated valuation is believed to have risen to $1.5 billion from around $900 million last year.

While the management claimed it was trust in the brand that prompted existing investors to put in big bucks, many analysts and rivals argued there was hardly any choice.

To be able to exit at good value later, current investors decided to fund some more in Flipkart, they said. Last year, the company had raised $150 million from the same set of investors.

Click NEXT to read further. . .

Flipkart: From a revenue-guzzler to an asset-light e-tailer

Shift to a new format

Sameer Gandhi, partner at venture fund Accel Partners, recently told Business Standard it was a conscious decision to invest aggressively in Flipkart and its new marketplace model.

The marketplace is about connecting a large number of buyers and sellers on a site without being a retailer.

This model, followed by many, including the world’s largest online retailer, Amazon, in the Indian market, means losing control over the things sold on the site.

But since there’s no foreign investment restriction in the marketplace format, unlike in the pureplay e-commerce model, online chains are swiftly changing their business strategy, even if that means sacrificing their essential DNA, an analyst says.

Click NEXT to read further. . .

Flipkart: From a revenue-guzzler to an asset-light e-tailer

Investigations by the Enforcement Directorate into foreign investment in Flipkart through a complex corporate structure is believed to be the primary reason for the company and some others to shift to marketplace.

Bansal’s reason, however, is a single e-commerce player can scale only to a certain extent.

“But the range of products and prices one can offer a consumer through the marketplace is, by itself, an argument in its favour.”

Without revealing the exact income, the Flipkart CEO says the company has crossed the halfway mark of its $1-billion gross-merchandise-volume goal for 2015.

Click NEXT to read further. . .

Flipkart: From a revenue-guzzler to an asset-light e-tailer

So, how close is an exit?

There’s been much speculation around that possibility, including talk of Amazon picking up stake in Flipkart.

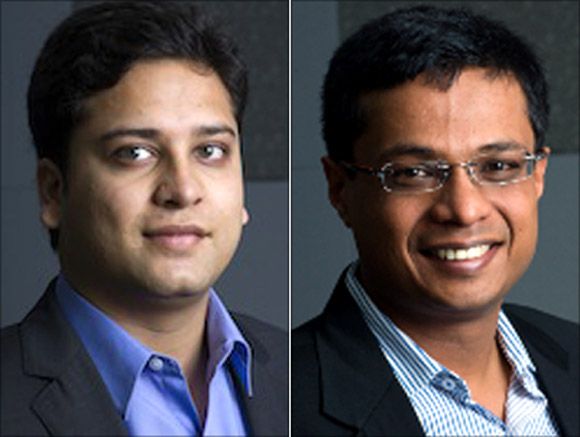

After all, founders Sachin Bansal and Binny Bansal (not related to each other) had begun their careers at Amazon, which, like Flipkart, didn’t make profits for years.

“We have no plans of selling the company. We hope to be one of the largest companies from India on the global map,” says Bansal.

Flipkart has 10 million registered users; about a million visit the site every day.

Its marketplace platform is already used by about 500 sellers.

At its peak, Flipkart sold 130,000 items -- that’s 4,000 items every hour! Bansal lists the online payments sector and uniform GST (Goods and Services Tax) as areas that need attention for e-commerce to grow.

Click NEXT to read further. . .

Flipkart: From a revenue-guzzler to an asset-light e-tailer

Innovation

The roadblocks haven’t prevented the company from innovating.

Cash-on-delivery and card-on-delivery are among its most popular ones. eBooks were another first on its platform; so was the launch of PayZippy, an online payments solution for merchants and customers.

Pinaki Ranjan Mishra, partner and national leader (retail) at EY (earlier Ernst & Young), says: “E-commerce players will succeed only if they have scale.”

Arvind Singhal, founder and chairman of retail consultancy Technopak Advisors, says, “An existing investor knows better than anybody else, and the fact that it is putting in money again shows its belief in the management.”

Most major brick-and-mortar retail firms in India took four-five years to produce good numbers, Singhal said, adding, “More than profitability, the traction of a retail chain is important.

“Also, it’s good to remember e-commerce is the medium for the future.”

Now on a high, Flipkart aims to be the largest shopping destination for Indians -- across online and offline platforms.

But hear the warning note -- its fund-raising should not be seen as a trend; it might not signal a turnaround for the entire online retail sector.