Photographs: Pawan Kumar/Reuters N Sundaresha Subramanian in New Delhi

In an emotional note following the Supreme Court order last year, the group put up a brave face saying, “We at Sahara, we are not escapists. We shall fight against the system and grow in our beloved country for the growth of our country”.

On October 2, the birthday of Mahatma Gandhi, Subrata Roy Sahara was in Skojpe, the capital city of Macedonia.

He was presiding over a grand peace festival featuring Indian dance groups and a firework display. The festivities that took place on Skopje’s main square were attended by the Macedonian Prime Minister, Nikola Gruevski, and his cabinet colleagues.

“I was searching for a country without corruption to stage the first festival [of peace] and decided to choose Macedonia,” local media quoted Roy as saying in front of thousands of spectators.

The group patriarch had also announced plans to build a recreational complex on the shores of Lake Ohrid, in the middle of a Unesco-protected heritage zone. Roy also announced a euro 211-million investment in a cattle farm in central Macedonia, which would produce some 300,000 litres of milk a day.

...

How the glitzy Sahara Parivar slipped into deep crisis

Image: Subrata Roy.Photographs: Pawan Kumar/Reuters

Macedonians might have been surprised. But, such opulent display of glitz and grand announcements have been hallmarks of the Lucknow-based Sahara India Parivar and its patriarch for the best part of the past three decades.

Thursday’s Supreme Court order, the harshest the group has faced over the years, threatens to derail this Macedonian expedition and a few others.

While Roy will not be able to fly to Skojpe or any other international destination where he has business interests, his group cannot easily raise money for future investments as the court has banned the group from parting with any asset until it submits original title deeds worth Rs 20,000 crore (Rs 200 billion) to Sebi.

The order also puts a question mark over recently reported plans of the group to sell its iconic hospitality assets such as the Park Plaza in New York and the Grosvenor House in London at huge valuations.

...

How the glitzy Sahara Parivar slipped into deep crisis

Image: A Sahara Star hotel in Mumbai.Photographs: Danish Siddiqui/Reuters

Financial wizardry

The Sahara India Parivar has over the years developed interests in real estate, media, cricket, entertainment and hospitality.

It even briefly ran an airline before selling it off to Jet Airways. But at the core of this empire was its Residual Non-Banking Company (RNBC) Sahara India Financial Corporation.

Sahara had built up a huge customer base in rural north India, especially in the states of Uttar Pradesh and Bihar, serviced by a million-strong agent network.

According to the group, these agents went about collecting small-ticket deposits from the unbanked population which included street vendors, daily-wage labourers and other such small investors.

...

How the glitzy Sahara Parivar slipped into deep crisis

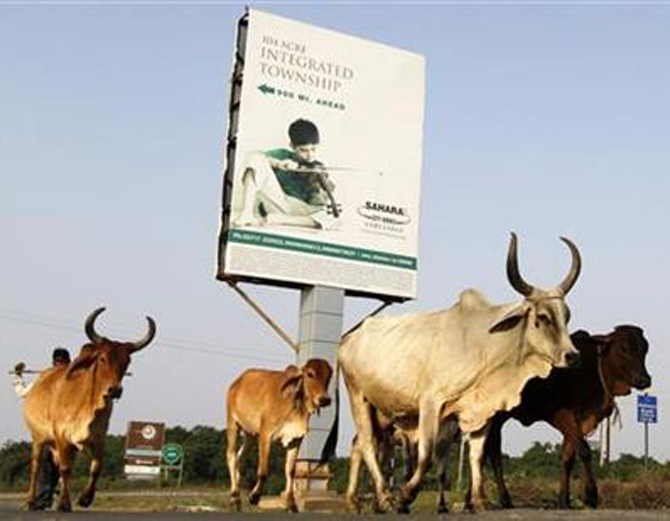

Image: A Sahara advertisement board installed at a township under construction, owned by Sahara group on the outskirts of Ahmedabad.Photographs: Amit Dave/Reuters

In 2008, the Reserve Bank of India (RBI) found several discrepancies in the functioning of the group and its books and ordered it to wind down RNBC operations and stop raising fresh money.

Sahara moved the Supreme Court. On directions of the Supreme Court, RBI reconsidered its directive and gave a staggered timeline to bring down the liabilities to zero.

Even as it set about winding down RNBC operations, a group company Sahara India Real Estate Corp decided to raise money for real estate projects through what it termed “housing bonds”.

Soon, another group firm Sahara Housing Invest Corp joined the bond issue. Technically, these bonds were known as optionally fully convertible debentures (OFCDs).

...

How the glitzy Sahara Parivar slipped into deep crisis

Image: Rickshaw pullers wait for customers outside the Sahara Mall, a shopping centre built by Sahara group, in Gurgaon.Photographs: Mansi Thapliyal/Reuters

How did things get so bad?

The lid on the alleged wrongdoing was blown off on January 4, 2010, when Roshan Lal, a resident of Indore, sent a note written in Hindi to the National Housing Bank, requesting it to look into housing bonds issued by the two companies.

Being a chartered accountant, Lal wrote in the note that he found that the bonds, bought by a large number of investors, were not issued according to the rules.

The National Housing Bank did not have the wherewithal to investigate the allegation, so it forwarded the letter to Sebi, the capital markets regulator.

That note set in motion a chain of events that resulted in the Supreme Court ordering the two companies on August 31, 2012 to return the money they had raised through the bonds - Rs 24,029 crore - to 29.6 million investors, along with interest (15 per cent per annum).

...

How the glitzy Sahara Parivar slipped into deep crisis

Image: Commuters walk past a billboard advertising the Sahara News Network, along a road in Noida on the outskirts of New Delhi.Photographs: Mansi Thapliyal/Reuters

The latest Supreme Court order came because the two companies have not complied with this Supreme Court directive. Sebi had moved a contempt petition and the matter has dragged on for 15 months, frustrating the regulator and baffling legal experts.

But the Sahara group always has its own way of looking at things. It paid Rs 5,120 crore to Sebi and claimed it had already refunded most of the money to investors.

Its top lawyers have argued that it was not the intention of the court to pay investors twice and that the regulator has to first check several truckloads of documents pertaining to the millions of investors before coming to ask for the balance.

In an emotional note following the Supreme Court order last year, the group put up a brave face saying, “We at Sahara, we are not escapists. We shall fight against the system and grow in our beloved country for the growth of our country”.

To continue fighting and growing, it has to first deposit cash of Rs 20,000 crore or title deeds of properties of similar worth in the next few days.

...

How the glitzy Sahara Parivar slipped into deep crisis

Image: Subrata Roy accompanied by his security leaves the SEBI headquarters in Mumbai.Photographs: Danish Siddiqui/Reuters

‘That lady’ in Sebi and other nemeses

Belling the BIG cat

In an interview earlier this year, Subrata Roy talked about a “lady sitting on the Sebi board” who acted with vengeance.

Roy was probably referring to former Reserve Bank of India deputy governor Usha Thorat, who was a nominee member on the Sebi board.

According to Roy, Thorat got Sebi to act against Sahara to avenge the humiliation of the central bank in the Supreme Court. Observers say the very purpose of having an RBI person in Sebi is to enable coordination between the two bodies.

There were other ‘ladies’, too. Usha Narayanan, executive director of Sebi, was heading the department that vetted initial public offering documents. In September 2009, Sahara Prime City filed an offer document for an IPO.

Narayanan’s department got a letter from one Roshan Lal raising questions about housing bonds floated by Sahara. This letter triggered inquiries and subsequent investigations.

When Sahara was trying to pitch the matter as a turf battle between the ministry of corporate affairs (MCA) and Sebi, it was Renuka Kumar, joint secretary, MCA, who helped the department take the correct view.

...

How the glitzy Sahara Parivar slipped into deep crisis

Image: A metro train moves past Sahara Mall, a shopping centre built by Sahara group, in GurgaonPhotographs: Danish Siddiqui/Reuters

K M Abraham, whole-time member of Sebi, passed one of the most comprehensive, well-argued and technically sound orders, directing the two Sahara companies to refund the amount raised through OFCDs. Legal experts point out that the beauty of Abraham’s order was its precision.

“Had he over-reached his powers, the courts could have stuck it down. If he erred on the side of caution, the companies would have got away setting a very wrong precedent,” said a lawyer who was part of the case.

NUMBER CASTLES

Number of workers (agents)

1 million

Number of offices

4,500+

Net outstanding liabilities

Rs 54,364 crore

Land, inventory and work In progress

Rs 35,358 crore

Fixed Assets

Rs 9,475 crore

Cash/bank

Rs 10,263 crore

Land bank

36,631acres

Source: Financial statement as of September 2012

article