| « Back to article | Print this article |

Flipkart beefs up to take on Amazon

The $200-million investment signals the return of faith in e-tailing, especially in emerging markets like India, though profitability is still a distant dream When e-commerce major Flipkart decided to hold a press conference last week to announce its biggest fund-raising, the event added an additional air of mystery around the company.

Co-founders Sachin Bansal and Binny Bansal were for the first time addressing the media ever since the online retailer, best known for selling discounted books, went live in 2007. What’s the deal, people tracking the sector asked.

Some even tried to guess if the announcement had any links with the entry of American online retailer Amazon into India recently.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

After all, talk of Amazon buying into Flipkart has been doing the rounds for long, although the two Bansals have denied it many times before.

The $200-million fund-raising announcement may have lacked the glamour of a big-ticket deal, but it made the market watchers sit up at a time when critics had given up on private equity and venture capital firms betting on e-commerce.

More so on Flipkart, which has been through bad times and is yet to get out of the woods. So, how did the company, which is believed to have long been in the market for funds, make the cut, with its estimated valuation rising $1.2 to $1.5 billion from around $900 million last year?

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

While the management claims it was the trust in the brand that prompted its existing investors -- Naspers, Accel Partners, Tiger Global and Iconiq Capital -- to put in more money, many analysts and rivals argue there was hardly any choice.

To be able to exit at a good value later, current investors decided to fund some more in Flipkart, says an executive from a rival e-commerce company.

Last year, the company had raised $150 million from the same set of investors.

As for the Amazon connect, analysts argue the entry of the American biggie has made it all the more necessary for Flipkart to scale up, and, therefore, it is raising more funds.

Amazon and Flipkart are similar in their outlook in ignoring profits in favour of growth, experts say, explaining why the Indian daddy of e-commerce is treated seriously by the investing community.

Amazon took more than a decade to turn profitable.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

Growth factor

Binny Bansal, COO and co-founder of Flipkart, says: “They have invested in us before and an additional round is an emphasis on the fact that we are all aligned to grow the company and retain our market leadership at all times.”

The company is focusing on an ‘eventual IPO at some point’.

Earlier at the conference, Sachin Bansal, CEO, had admitted the company was not profitable, but explained that it was because of the ‘massive investments it was still making’.

He had added, “We can be profitable if we stop investing, but we are thinking long term.”

Even as Indian pure-play online retailers, quite like their counterparts globally, are losing money, investors realise that the future of shopping surely rests on e-commerce, with the pie split among the top few players.

E-tailing (excluding travel related transactions) in India is projected to grow over hundred-fold by 2021 to touch $76 billion, from $0.6 billion in 2012, according to a Technopak White Paper.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

The recent shut-down of international retail chains across Europe and the US has also sparked global investors’ interest in parking their funds once again in e-commerce companies, including in India, as more and more people opt to buy online.

Five retail chains with a turnover of $900 million are reported to have collapsed in the past two months in Britain alone, among other notables like American bookstore Borders, Virgin Megastores of France and Tower Records of the US.

While stating that demand in e-commerce is intact, Pankaj Karna, founder & managing director, Maple Capital Advisors, says most investors who put in money in this sector have not had a great experience.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

The recent shut-down of international retail chains across Europe and the US has also sparked global investors’ interest in parking their funds once again in e-commerce companies, including in India, as more and more people opt to buy online.

Five retail chains with a turnover of $900 million are reported to have collapsed in the past two months in Britain alone, among other notables like American bookstore Borders, Virgin Megastores of France and Tower Records of the US.

While stating that demand in e-commerce is intact, Pankaj Karna, founder & managing director, Maple Capital Advisors, says most investors who put in money in this sector have not had a great experience.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

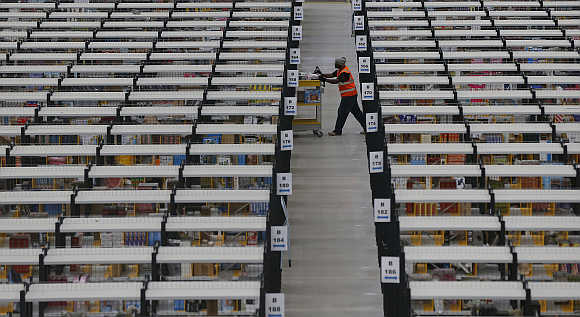

“Many of them are worried about their money as business models of companies are still not clear. . . companies need to keep their balance sheets light, pushing inventory and have a good grip on their supply chain.”

Although foreign direct investment is not permitted in Indian e-commerce, companies are switching to models like marketplace, which is about hosting online brands and stores without owning any inventory in order to attract foreign money.

Unlike in pure-play online retail or the inventory-led model, there’s no bar on FDI in marketplace.

Flipkart, too, had recently announced that it was shifting to a marketplace model.

Business of scale

Commenting on Flipkart’s fund-raising, Pinaki Ranjan Mishra, partner and national leader (retail) at EY (earlier Ernst & Young), says, “E-commerce players will succeed only if they have scale.”

Pointing out the significance of scaleability, Mishra says eventually only one or two companies will be successful.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

According to another industry watcher, “Nobody will put good money behind bad money.”

He argues that investors knew what they were doing while putting in more money into Flipkart.

It does not matter whether it is an existing investor or an external one that is putting in money, points out Arvind Singhal, founder and chairman of Technopak Advisors, a retail consultancy.

“In fact, an existing investor knows better than anybody else, and the fact that it is putting in money again shows its belief in the management,” he adds.

In terms of profitability, even most of the major brick and mortar retail firms in India took over four to five years to produce good numbers, Singhal says.

“More than profitability, traction of a retail chain is important. Also, it is good to remember that e-commerce is the medium of the future.”

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

According to an industry expert, online retail players, including Flipkart, are switching to newer models as they are trying to figure out what will click.

Globally, too, the pattern is quite the same.

Books-to-electronics player Amazon’s expansion of food and grocery services beyond its home turf in Seattle is being seen as a case in point.

E-commerce, in general, and more specifically in India due to the lack of infrastructure, is a capital-intensive business, where companies burn more cash than they are generating, and they will continue to do so in the foreseeable future, according to Arjun Basu, CFO and co-founder, Mydala, a leading couponing and loyalty platform enabling e-commerce.

“This (Flipkart’s) fund raising outlines the confidence that certain investors are making on market leaders to replicate successes in demographically similar countries such as China,” Basu says.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

Again, the real test comes in a bearish market. If investors support the company, then chances of survival are greater, points out an analyst.

“Whether or not your investors back you at such times can define the company’s future.”

The chief of an e-commerce company which competes with Flipkart says, “Though this latest funding exercise has created the right noise and maybe dimmed the chances of funding for other players, Flipkart’s burn rate is very high and it may again need fresh funding after two years.”

Flipkart’s fund raising should not be seen as one-size-fits-all, as it may not signal a turnaround for the entire online retail industry.

It may, however, step up investor confidence in the medium term.

Click NEXT to read further. . .

Flipkart beefs up to take on Amazon

As Basu of Mydala puts it, “Funds are available for the right opportunities, niche and horizontal market players who are leading in their respective categories.”

And then, it has lots to do with who the investors are.

Firms like Tiger or Accel have the appetite to take long-term bets on market leaders, says an executive from a PE firm.

“This strategy has worked for them in other countries like the US and China, where they have pumped in a lot of money into companies with potential and they have turned out to be profitable.

"So, they are hoping that the same will happen in India as well.”