August was a month of agony for investors as they lost more than Rs 1 crore (Rs 10 million) in every second of trade, on an average, taking the total losses for the market to over Rs 5.5 lakh crore.

It was also the worst month for investors since January 2011, when the average loss per second of trade was about Rs 1.5 crore (Rs 15 million).

The benchmark index lost over 1,500 points in the entire month, while the investor wealth plummeted by Rs 555,650 crore (Rs 5,556.50 billion) -- the biggest monthly loss since January 2011 when the market had lost little over Rs 700,000 crore (Rs 7,000 billion).

Amid slowing growth and global uncertainties, here are the top recommendations of leading research houses -- Edelweiss Research, ENAM Securities, Macquarie Research and Motilal Oswal Securities.

All FY12 & FY13 figures are estimates.

Click on NEXT for more...

20 stocks you can gain from

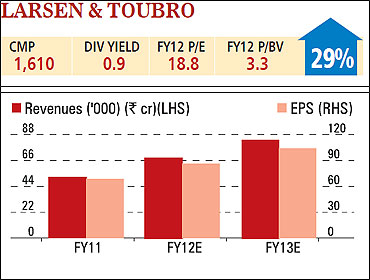

Positives

Strong revenue growth guidance of 25% for FY12

Order inflow growth guidance of 15%

Potential write-back of provisions created for Delhi airport in FY11 to limit margin fall

Downside risk to earnings limited

Key risks

Macro economic uncertainties may cap orders

Higher raw input costs could hurt margins

To get the stock price, CLICK on the company name.

Click on NEXT for more...

20 stocks you can gain from

Positives

Market leader in the demand-inelastic cigarettes business

High pricing power, hence less impacted by input cost inflation

FMCG business closing in towards breakeven

Other businesses viz, agri, paperboard & packaging and hotels growing strong

Key risks

Trading at higher end of historical valuations

A mid-year excise duty hike could hurt volumes

To get the stock price, CLICK on the company name.

Click on NEXT for more...

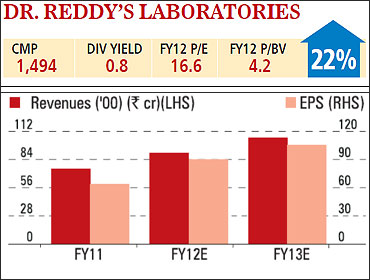

20 stocks you can gain from

Positives

Strong pipeline in the US business; 76 ANDAs pending with US FDA for approval

Robust growth in Russia continues on the back of strong traction in the OTC business

Ten product launches in FY12

Strong growth in API business

Key risks

Muted India sales in some products

Difficult pricing scenario hits revenue growth in Germany

To get the stock price, CLICK on the company name.

Click on NEXT for more...

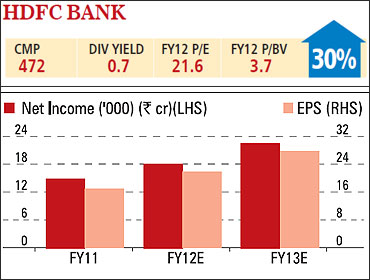

20 stocks you can gain from

Positives

Consistent track record of strong earnings

High asset quality, including lowest risk on asset quality due to small exposure to stress sectors

Robust borrowing mix with high CASA of 49% to support margins

High provision coverage ratio of 83% (including floating provision it is at over 125 %)

Key risks

Moderating loan growth and NIMs in a high interest rate scenario Benign retail asset quality

To get the stock price, CLICK on the company name.

Click on NEXT for more...

20 stocks you can gain from

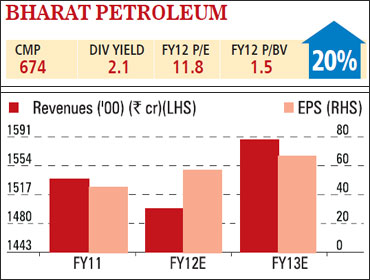

Positives

Likely to derive significant value from its exploration activities in Brazil over the next two years

Ramp, up in Bina refinery to boost GRMs

Key beneficiary of cooling crude oil prices as well as fuel price deregulation

Trading at attractive valuations

Key risk

Uncertainty regarding subsidy burden a major overhang on the stock

To get the stock price, CLICK on the company name.

Click on NEXT for more...

20 stocks you can gain from

Positives

Key beneficiary of the structural coal deficit in India

Washed coal volumes will surge to 150 million tonnes (25% of total) by FY17 spurring margins

Average realisation for CIL is still 50% lower than import parity price of coal

Largest coal reserves in the world of 22 bln tonnes

Key risks

Plan of 26% profit sharing for local development

Inability to get environmental clearances or land

To get the stock price, CLICK on the company name.

Click on NEXT for more...

20 stocks you can gain from

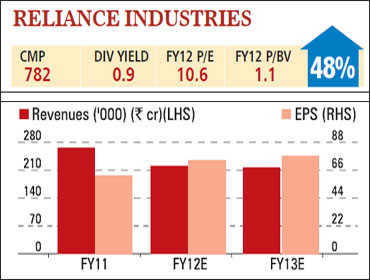

Positives

Company will be net cash positive in FY12, led by huge operating cash flow and proceeds from BP

E&P business not fullly reflecting in valuations

Doubling of petchem capacity in the next 2-3 years will boost its earnings significantly

Key risks

Higher cash allocation to unrelated areas

Slowdown in global petrochemicals and refining businesses

To get the stock price, CLICK on the company name.

Click on NEXT for more...

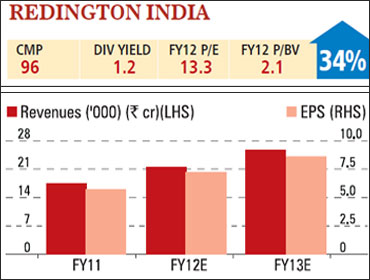

20 stocks you can gain from

Positives

India, which is 61% of PBIT, continues to grow at a fast pace

High growth and potential in the smart phone and iPad segments

Strategic initiative to improve the working capital cycle

Value unlocking from business such as NBFC and benefits from GST implementation

Key risks

Further interest rate hikes

Currency fluctuation

To get the stock price, CLICK on the company name.

Click on NEXT for more...

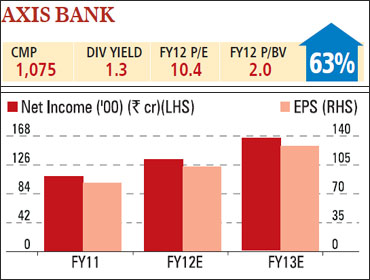

20 stocks you can gain from

Positives

The bank's loan book is expected to grow at a brisk pace of 25% plus in FY11-13

Stable margins and healthy asset quality

Growing franchise, new products will further drive retail fee income

As it delivers consistent earnings, valuation discount of 40% with HDFC Bank will narrow

Key risks

Deterioration of macro environment can result in higher slippages and slow down in business

To get the stock price, CLICK on the company name.

Click on NEXT for more...

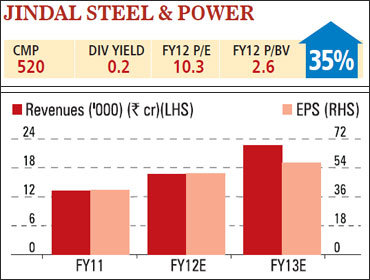

20 stocks you can gain from

Positives

Current valuations only reflect the operational power and steel assets

Power expansion by 4,400 Mw, foreign coal and iron ore assets not fully reflected in valuations

Cost of power & steel production among lowest

Earnings to grow at about 22% annually, backed by volume expansion

Key risks

Final outcome of draft mining bill

Decline in global commodity prices

To get the stock price, CLICK on the company name.

Click on NEXT for more...

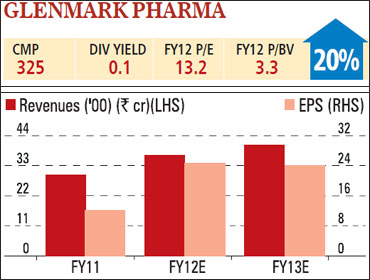

20 stocks you can gain from

Positives

Niche product launch to drive growth in the US market by 16 % during FY11-13

With an increase in market share, domestic business to grow at 16% during FY11-13

Valuations are lower compared to peers

Upside from other products in the pipeline

Key risk

Lost Abbott and Sanofi cases, liable to pay $16 million, though it will appeal in higher court

To get the stock price, CLICK on the company name.

Click on NEXT for more...

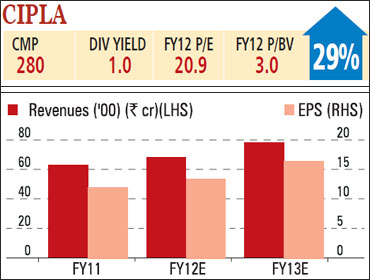

20 stocks you can gain from

Positives

Company is the best play on emerging markets

Supply agreements with 22 US players for 118 products to drive growth in the medium term

Commencement of exports of CFC-free inhalers to Europe will be a key positive.

Potential MNC contracts are likely to improve earnings for FY12/13.

Key risks

New pharma policy creates uncertainty over pricing

NPPA liability of Rs 1,200 crore (if it materialises)

To get the stock price, CLICK on the company name.

Click on NEXT for more...

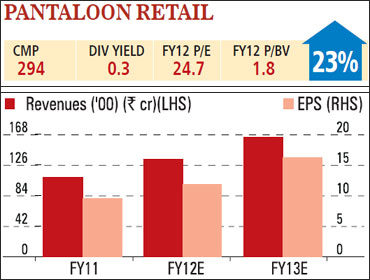

20 stocks you can gain from

Positives

Growing trend among consumers to allocate more income to consumption, lifestyle products

Allowing FDI in multi-brand retailing

The company plans to monetise its non-retail assets over next 12-18 months and reduce debt

Valuation of investment in subsidiaries is worth Rs 3,000-4,000 crore

Key risks

Higher inventory days remain

Slow revenue growth due to rollout delays

To get the stock price, CLICK on the company name.

Click on NEXT for more...

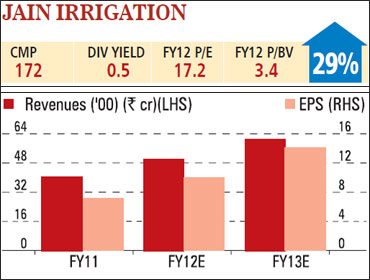

20 stocks you can gain from

Positives

MIS business, which is 50% of sales, will grow

30% annually over the next five years

Growth is backed by expansion in new states, higher farm income and government initiatives

Improvement in capital efficiency

Stock trading at 6-year median level at EV/Ebitda

Key risk

Capital allocation to non-MIS business

To get the stock price, CLICK on the company name.

Click on NEXT for more...

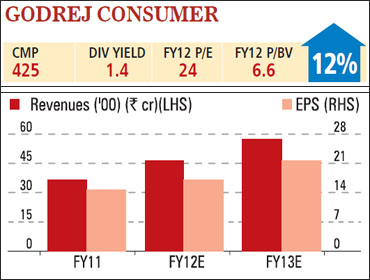

20 stocks you can gain from

Positives

Firm growth in all its major categories

Soft commodity prices and product price hike to add to margins

Earnings surprise could come from Darling acquisition

Earnings growth of 21 per cent over the next two years

Key risks

Rising competition in key segments

Sharp rise in prices of inputs

To get the stock price, CLICK on the company name.

Click on NEXT for more...

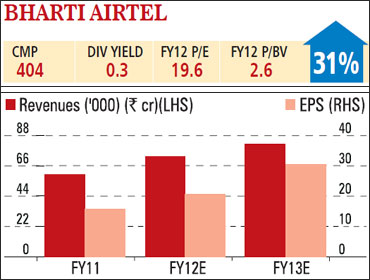

20 stocks you can gain from

Positives

Turning point for Indian telecom industry led by improvement in rates

Rate hikes should lead to gradual improvement in voice revenue per minute (RPM) and margins

3G services will also add 3-5% to RPM by FY13

Its African business and improving cash flows augur well and will boost earnings in coming years

Key risks

Any move to reverse rate hike will hit profits

Trai recommendations on spectrum

To get the stock price, CLICK on the company name.

Click on NEXT for more...

20 stocks you can gain from

Positives

Growth visibility supported by strong volumes

Better return ratios, good dividend payout and attractive valuations

Better revenue mix will help sustain margins

b>Focus on leading brands, drive to grow exports and ramp up capacity

Key risks

Increasing competition

Rise in commodity prices could hurt margins

To get the stock price, CLICK on the company name.

Click on NEXT for more...

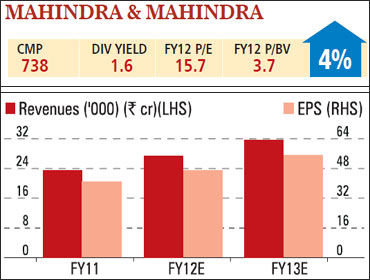

20 stocks you can gain from

Positives

M&M dominates the domestic tractors market enabling it to capture rising rural demand

Enjoys good pricing power in tractors & UVs

The launch of its sub-tonne Maxximo and Gio to lead incremental volume growth

Long-term gains from Ssangyong Motors buy

Key risks

Higher duties on diesel vehicles would impact

M&M, as its entire portfolio is diesel-based

Higher interest rates may also impact demand

To get the stock price, CLICK on the company name.

Click on NEXT for more...

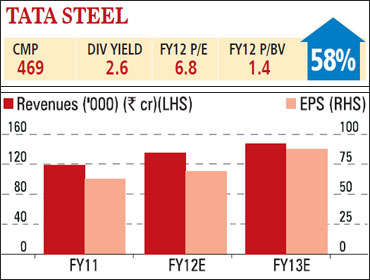

20 stocks you can gain from

Positives

Strong business model and attractive valuations

Cash flows are expected to grow, driven by volume growth and better margins

Projects in Jamshedpur to expand capacity from 6.8 million tonnes to 10 million tonnes moving fast

Tata Steel Europe (TSE) to come out stronger after its recent restructuring at Scunthrope

Room for TSE to improve productivity

Key risks

Demand scenario in Europe

Lower steel prices could impact earnings

To get the stock price, CLICK on the company name.

Click on NEXT for more...

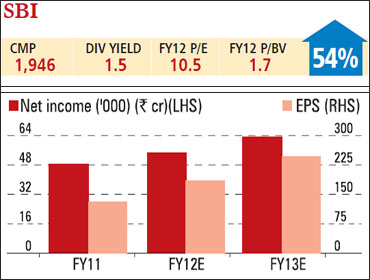

20 stocks you can gain from

Positives

With interest rates expected to ease, SBI should do well with better loan growth

It has been able to protect its margins well

Even if there are concerns over asset quality, provisioning coverage is near mandated levels

Market leader trading at attractive valuations

Key risks

Higher interest rates

Tightness in the G-sec yields

To get the stock price, CLICK on the company name.

article