Photographs: Reuters

They spend, they invest, they save and they share. It's just that it is a whole lot more extravagant than most individuals. They are: ultra high net worth individuals (UHNIs).

In short, these individuals are people with large personal financial holdings.

Conventionally the term used was millionaire, but in recent years the term high net worth individual has become the preferred way to define these individuals.

HNIs are the creme de la creme of society, in all respects be it in terms of money, power, status and lifestyle.

In India, over the past few years, the economic boom has driven many existing-rich people, and a few other first-time entrepreneurs and technocrats have joined this exclusive club.

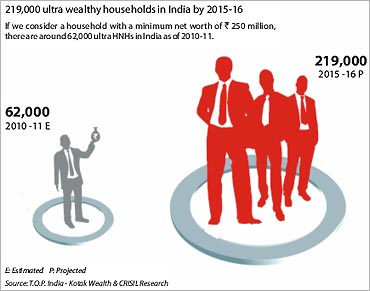

According to a study released by Kotak Wealth and Crisil Research, ultra high net worth households are those with a minimum net worth of Rs 25 crore, or $5 million, as the benchmark for qualifying into the UHNI segment.

. . .

A sneak peek into the lives of the high networth individuals

Photographs: Reuters

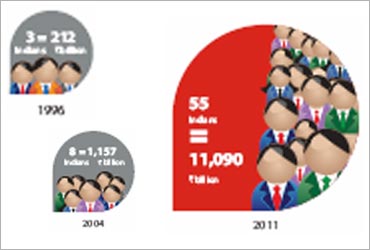

Reports have indicated that number of billionaires is increasing in India. And these billionaires come from diverse backgrounds.

To simplify, this study concludes that ultra HNIs fall into two broad categories:

Old money: This is essentially inherited money and comprises people who have inherited wealth or businesses.

New money: This includes the newly rich who come from all walks of life and those who have made money through mega salaries, bonuses and stock options, and those who have started their businesses on their own and made their fortunes.

Thus, based on the results of the survey, HNIs are classified into three groups:

1. Self-made: are first generation entrepreneurs, whose success in business brings them wealth and power.

2. Professionals: are qualified, highly skilled professionals who gained wealth through high salaries, Esops, bonus, and so on.

3. Inheritors: are born with a silver spoon, and have inherited high net worth.

If the way in which they made their money is interesting, even more noteworthy is the finding that these three types of ultra HNIs differ in their spending and investment patterns.

...

A sneak peek into the lives of the high networth individuals

At present, India has 62,000 ultra-high net worth households, with an average net worth of Rs 75 crore (Rs 750 million).

In five years, the number of such households will more than treble to 219,000, each with a net worth of about Rs 100 crore (Rs 1 billion).

According to this study, the fast growth in their ranks notwithstanding, the number of ultra wealthy households remains a mere 0.03 per cent of the total households in the country.

. . .

A sneak peek into the lives of the high networth individuals

The total net worth of Indian ultra HNIs is expected to reach Rs 235 trillion in 2015-16 from an estimated Rs 45 trillion in 2010-11.

Presently, 90 per cent of the UHNIs wealth resides in the top ten cities of the country. However, going ahead, the growth will come more from smaller towns which constitute a minority now.

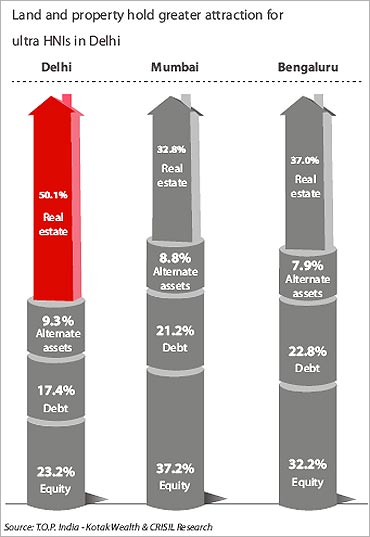

The report is based on analysis of government data and interviews of luxury brand managers and existing UNHIs says a majority (37.2 per cent) of the investible surplus is deployed in the real estate sector followed by equities (33.1 per cent), 20.4 per cent in debt and 9.2 per cent in alternate assets.

...

A sneak peek into the lives of the high networth individuals

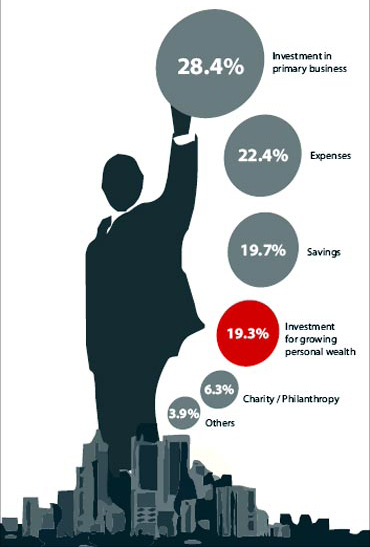

Further, ultra HNIs invest one-fifth of their income for growing their wealth. But they put a large proportion back into their business to fuel the engine of wealth creation.

However, this is slowly changing. More ultra HNIs are also now investing in vehicles that are generally considered to be risky, such as hedge funds, private equity, structured products and derivatives.

Of the three, inheritors indicated that they distribute their investments across asset classes, with a greater emphasis on real estate - about 40 per cent - and equity - about 30 per cent.

While, the self-made organise the lowest proportion of their income on investments to grow their wealth, and the professionals deploy around 22 per cent.

In terms of being involved in planning their investments, the self-made are also likely to be the most involved, among the three types, in planning their investments, followed by the professionals and then the inheritors.

...

A sneak peek into the lives of the high networth individuals

Further in terms of investments, regional biases were clearly observed.

Wealthy investors in Delhi and Bengaluru are more focused on building portfolios in property (Delhi - 50 per cent of ultra HNI investment is in real estate followed by Bengaluru at 37 per cent) as indicated by their current investment pattern.

However, the ultra HNIs in Mumbai are far more likely to put money in equity (37.2 per cent of ultra HNI investment in equity).

...

A sneak peek into the lives of the high networth individuals

Likewise, the way HNIs spend also depends on the way they approach money. According to the survey, ultra HNIs who are active or very active in their businesses spend nearly a fifth of their income on regular or occasional expenses, and reinvest almost 30 per cent of their earnings in their primary business.

If we break into the categories inheritors, self-made and professionals professionals put away a reasonable percentage of their income as savings and they also show greater propensity to spend on luxurious items. But even here, caution rules: the motto is "value for money".

Also, professionals are conscious of the environment they come from and are far more inclined towards charity than the others. They give nearly 10 per cent of their income towards charity. This is higher than 6 per cent for inheritors and around 4 per cent for the self-made.

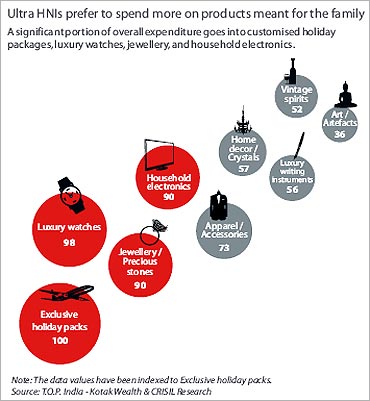

But, in terms of spending pattern it is observed that overall, HNIs spend on domestic and international branded apparel high-end cameras, and luxury leather products. Ultra HNIs as a class spend a significant portion of their overall expenditure on customised holiday packages, luxury watches, jewellery, diamonds and precious stones, and household electronics....

A sneak peek into the lives of the high networth individuals

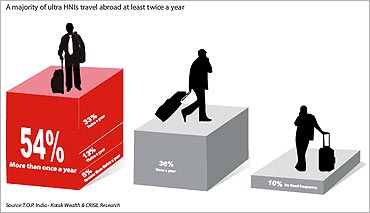

It is also observed that travel and holidays play a major part in the overall spending pattern of ultra HNIs.

Nearly 67 per cent of the professionals said that their biggest weakness was exclusive luxury holidays, as compared to 65 per cent and 54 per cent respectively, for both the inheritors and the self-made.

A majority of the ultra HNIs travel at least twice a year, while about 15-20 per cent of the inheritors and the self-made travel thrice or more annually.

For the inheritors and the self-made, the most common reasons for travel abroad are family functions, business purposes, or leisure.

...

A sneak peek into the lives of the high networth individuals

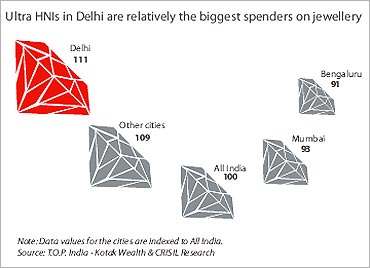

Just like most Indians, ultra HNIs are also spend a fare amount on jewellery. Here, the inheritors and the self-made spend more on jewellery than the professionals.

As a result of which, the top end of the luxury jewellery market is dominated by leading family jewellers and independent jewellery designers. Also, major global brands such as Cartier, Chopard, and Tiffany are trying to capture the Indian market.

The demand for luxury jewellery in the country is virtually insatiable, and unlike other luxury products, this market is more or less evenly distributed.

...

A sneak peek into the lives of the high networth individuals

Going forward, the phenomenal growth in the number of the super rich is expected to rise further, and will encompass a large number from other Tier II and III cities as well.

One indicator of this is the growing number of Indians who are featured in the Forbes Billionaires list, which is released every year.

This has resulted in the expansion of the wealth management industry in India, along with the rise in luxury brands that cater exclusively to the tastes of the ultra high net worth individuals (UHNIs).

It is also interesting to note that despite unforeseen circumstances, there is no turning back of the clock on the spectacular India growth story.

article