| « Back to article | Print this article |

What led to the huge Sensex fall

Global turbulence came to fore on Tuesday as the Korean neighbours exchanged firing. With world markets already weighing under the euro debt crisis and fears of China rate hike, tension between North-South Korea added salt to its wound. Asian markets in particular took a severe beating.

According to media reports, North Korea today fired dozens of artillery shells at a South Korean island, setting buildings on fire and prompting a return fire by the South.

Further, the South Korean military is said to be on its highest non-wartime alert.

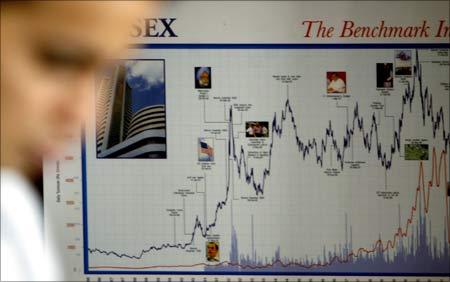

The BSE benchmark index, the Sensex, after a weak start in line with its Asian peers took a sharp dip in mid-noon trades following reports of Korean turmoil.

The Sensex tumbled to a low of 19,343 -- down 615 points, however, bounced back partially and settled with a loss of 266 points at 19,692.

The Nifty too shed 84 points to end below the 6000-mark at 5925. The broader markets too recovered partially towards the close.

The smallcap and the midcap indexes closed down 1% each in sync with the benchmark index.

Click NEXT to read further. . .

What led to the huge Sensex fall

The Asian markets after opening in the red continued its subdued trading.

At the close, Hang Seng shed over 2.5%, Shanghai Composite dropped nearly 2% while Straits Times closed down 1.8%.

Globally too the sentiment remained quite weak, as despite Ireland's aid request, global markets fear that the risk may probably spread to Portugal or Spain.

Meanwhile, European markets started in red and US futures too hold no promise. The CAC and DAX were down 0.6% each around 1530 hrs (IST) while FTSE is trading 0.8% lower.

Back home, all the BSE sectoral indices also ended in the red. Realty was the major loser, down more than 3%. The BSE PSU, Metal and Oil & Gas indices were the other major losers.

However, auto and Healthcare indices led the late recovery.

Maruti Suzuki (Rs 1438) and Hindustan Unilever (Rs 300), up 1% and 0.3% respectively were the only gainers in the Sensex- 30 stocks.

Click NEXT to read further. . .

What led to the huge Sensex fall

In the losers list, Tata Power (Rs 1301) and SBI (Rs 2952)shedding 3% each were the major losers. Bharti Airtel (Rs 329), Reliance Communications (Rs 146), Sterlite (Rs 171), Hindalco (Rs 210) and ACC (Rs 1004) losing 2% each were the other noteable losers.

In the reality space which took the maximum beating,DB Realty was the top loser, down 9.6%, followed by HDIL, down 5.6% and Indiabulls Real Estate, down 5.4%

From the PSU space, HMT shed 4.7%, followed by Indian Oil Corporation, down 4% and Hindustan Corporation, dipped 3.8%

From the Auto space which managed to hold most of its gains, Bajaj Auto added 2.8%, followed by Maruti Suzuki, up 1.5% and Cummins India, gaining 1%

The market breadth was very negative. Of teh total 3070 stocks traded, 2151 stocks had declined while 801 had advanced on the BSE.