| « Back to article | Print this article |

Sensex to zoom if BJP wins elections: Poll

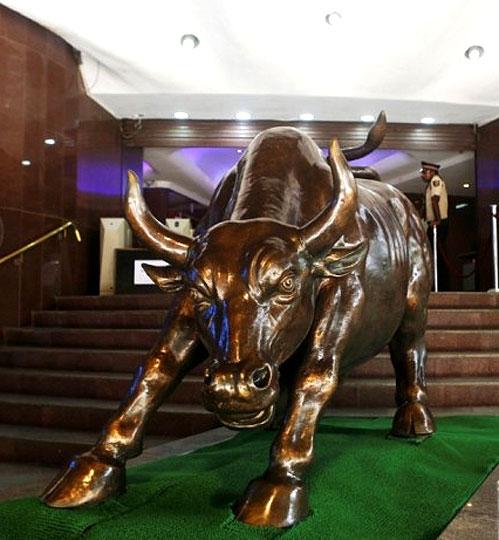

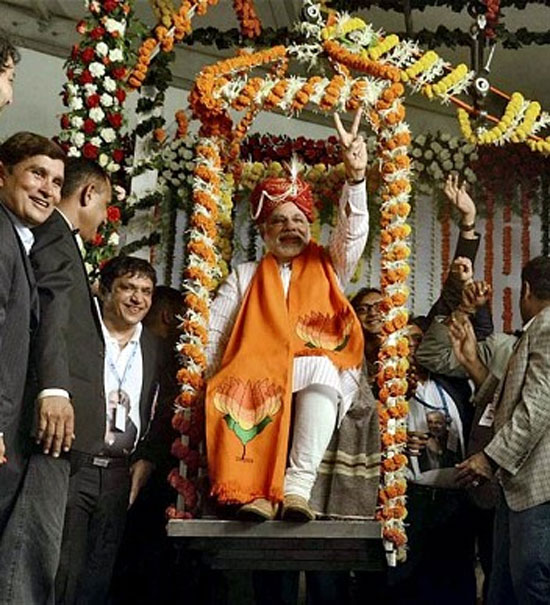

Indian shares are forecast to continue setting new record highs this year as foreign capital is lured into the market, especially if general elections return the business-friendly opposition Bharatiya Janata Party to power, a Reuters poll found on Thursday.

The BSE Sensex hit a life-time high of 22,040.72 on Tuesday but the poll of 23 equity analysts, taken in the past week, forecast the index to rise further to 23,000 by the end of June.

It is then expected to hit 24,500 by the end of 2014, a 12 percent gain from Wednesday's close of 21,832.86.

Click NEXT to read more…

Sensex to zoom if BJP wins elections: Poll

India's top share index has risen 3 percent this year, with foreign investors pouring in nearly $2 billion after ploughing in more than $18 billion last year.

Analysts expect overseas investors to continue buying Indian shares in the run-up to the world's largest democracy going to the polls in April and May.

Click NEXT to read more…

Sensex to zoom if BJP wins elections: Poll

"The market will keep going up until the (election) results are announced and the euphoria will last for a month or two after, until the budget is announced where people expect big bang reforms," said Madan Sabnavis, chief economist at CARE Ratings in Mumbai.

All but one of the 19 strategists polled expected the Sensex to rally in anticipation of reforms and draw further overseas funds if, as is widely expected, the opposition Bharatiya Janata Party (BJP) wins the election.

Click NEXT to read more…

Sensex to zoom if BJP wins elections: Poll

However, 13 of the 19 strategists expect the index to change little or fall if the ruling Congress Party gains a majority. Only 6 said the index will rise in such a scenario.

"Since the market is fairly valued, a badly fractured election verdict will result in a sell off and a market crash," said V.K. Vijayakumar, investment strategist at Geojit BNP Paribas, adding that a coalition led by the BJP would likely extend the recent rally.

Click NEXT to read more…

Sensex to zoom if BJP wins elections: Poll

However, 13 of the 19 strategists expect the index to change little or fall if the ruling Congress Party gains a majority. Only 6 said the index will rise in such a scenario.

"Since the market is fairly valued, a badly fractured election verdict will result in a sell off and a market crash," said V.K. Vijayakumar, investment strategist at Geojit BNP Paribas, adding that a coalition led by the BJP would likely extend the recent rally.

Click NEXT to read more…

Sensex to zoom if BJP wins elections: Poll

On Tuesday, Goldman Sachs upgraded its rating on Indian shares to "overweight" from "marketweight" as external vulnerabilities have reduced and noted a potential for further gains ahead of elections.

Most emerging market stocks took a hit in May when the United States Federal Reserve first hinted at tapering its monthly bond purchases but have consolidated since then, despite the Fed rolling back its stimulus from January.

Click NEXT to read more…

Sensex to zoom if BJP wins elections: Poll

"We believe emerging markets look attractive as compared to developed markets in terms of valuations," said Deven Choksey, chief executive of broking firm K.R. Choksey in Mumbai.

"Within emerging markets, countries which are reliant on exports to the U.S. look very attractive considering the improvement in U.S. macro data."

(Polling by Shaloo Shrivastava, analysis by Hari Kishan and Swati Chaturvedi; Editing by Shri Navaratnam)

© Copyright 2025 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.