| « Back to article | Print this article |

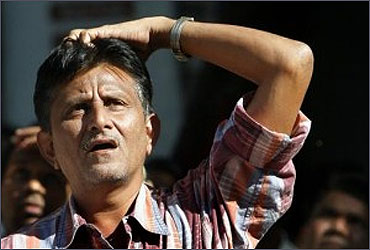

Markets sink on global meltdown

The Sensex nose-dived 364 points in opening trades and continued to remain under pressure due to heavy selling in index heavyweights -Infosys, Reliance Industries and ICICI Bank.

The BSE benchmark index touched a low of 16,990 in noon trades. Recovery in ONGC and Larsen & Tourbo in late trades helped the index trim losses.

The Sensex finally ended at 17,306, down 387 points the Nifty closed at 5,211, down 120 points. Both the benchmark indices were down 5% for the week.

Click on NEXT for more...

Markets sink on global meltdown

Recession jitters inflated investors anxiety after series of weak economic data raised global growth concerns.

On Thursday the European Central Banks held policy rates at 1.5% and resumed the purchase of government bonds after a hiatus of four months.

The ECB also announced longer term funding for banks facing cash crunch.

US markets clocked their biggest percentage drop since 2008 on global growth concerns.

Markets in Asia were also hammered badly, Hang Seng Index declined 4.3%, the Shanghai Composite index plunged almost 2% and Japan's Nikkei Stock Average also tumbled 3.7%.

Click on NEXT for more...

Markets sink on global meltdown

While the selling in commodities might help the Indian markets, by mitigating concerns on inflation and interest rates front, a sustained weakness in the global economy might impact the exports.

Dipen Shah, Senior Vice President (Private Client Group Research) from Kotak Securities said, "the overall GDP growth could also moderate in case exports are hit badly.

However, exports form only about 18% - 20% of the overall GDP and hence, the impact, if any, should be muted."

Worries of the hike in interest rates slowing down corporate earnings growth further also weighed on investor sentiments.

Click on NEXT for more...

Markets sink on global meltdown

Interest rate and export sensitive, blue-chip stocks tumbled in trade.

BSE IT index slumped 4% on worries that if US slows down, clients might cut their spending over there. HCL Technologies fell 4.8%, Infosys and TCS were down almost 4% each.

BSE Realty index fell over 3%. Godrej Properties and HDIL declined 4.3%, and Anant Raj Industries slipped 3.8%.

From the broader markets, midcap and smallcap indices were down 2% and 3% each.

Click on NEXT for more...

Markets sink on global meltdown

Among individual stock, India's most valuable stock, in terms of marketcap, Reliance Industries slipped 2.5% to Rs 791 after output from the KG-D6 fields fell 27% to around 47 million standard cubic meters per day in June.

Larsen & Tourbo touched a low of Rs 1,574, but recovered sharply from the day's low and closed at Rs 1,647.

Top losers on the Sensex were Infosys, down 4.5%, ICICI Bank declined 2.7% and TCS slipped 3.7%.

Only three components on the Sensex ended in the green, ONGC and Hindalco advanced over 1% and Cipla added 0.7%.

Market breadth was negative 2,365 stocks declined for 556 advancing stocks on the BSE.