Image: RBI Governor D Subbarao with Finance Minister Pranab Mukherjee.

Photographs: Reuters. Parnika Sokhi & Malvika Joshi in Mumbai

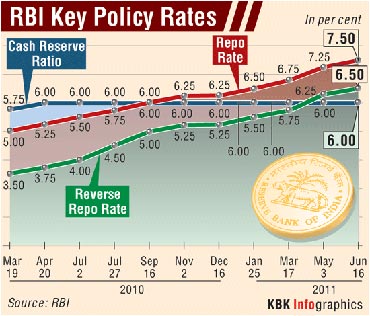

Bankers and other stakeholders are now almost certain that the Reserve Bank of India (RBI) will increase the key policy rate, or the repo rate, by 25 basis points (bps) on Tuesday. But if they are still keenly awaiting the first quarter review of the monetary policy, it's because of growing expectations that Governor D Subbarao will finally signal an end to the prolonged rate increase season, with core inflation showing signs of stabilising.

Photographs: Reuters. Parnika Sokhi & Malvika Joshi in Mumbai

Bankers and other stakeholders are now almost certain that the Reserve Bank of India (RBI) will increase the key policy rate, or the repo rate, by 25 basis points (bps) on Tuesday. But if they are still keenly awaiting the first quarter review of the monetary policy, it's because of growing expectations that Governor D Subbarao will finally signal an end to the prolonged rate increase season, with core inflation showing signs of stabilising.

Reserve Bank set to hike rates again

Image: Reserve Bank of India.

The central bank has increased rates 10 times in the last 15 months to arrest the rise in prices. If it does so on Tuesday, it will be the third time in as many months. In May, the policy rate was increased by 50 bps, while in June the quantum was 25 bps.

Reserve Bank set to hike rates again

Image: RBI key policy rates.

Economists and market watchers said though the wholesale price index (WPI)-based inflation was still much above the central bank's comfort zone, non-food manufacturing-based inflation, or the core inflation, was steady in June, with food prices easing.

Reserve Bank set to hike rates again

Image: Loans to be costlier.

"We expect RBI to increase rates by 25 bps. There could be a pause after that in case core inflation shows signs of cooling off in the coming months," said Siddhartha Sanyal, chief India economist, Barclays Capital.

Reserve Bank set to hike rates again

Image: Inflation rises.

In June, WPI inflation was 9.4 per cent and core inflation was 7.3 per cent, marginally up from the May figure of 7.2 per cent. Food inflation eased. It came down to 7.58 per cent as on July 9 compared to 8.31 per cent a week ago.

Reserve Bank set to hike rates again

Image: A rickshaw puller transports onions at a wholesale market in Agartala.Photographs: Jayanta Dey/Reuters.

Economists say inflation is not likely to increase significantly in the coming months unless global commodity prices, particularly of oil, oilseeds, edible oil, sugar and metals, harden, or the monsoon is a big disappointment.

Reserve Bank set to hike rates again

Image: Reuters."The flat month-on-month core inflation, after an average rise of 1 per cent month-on-month during January-May, is encouraging, as it suggests some easing of price pressure this month, in line with the recent data signalling weakening consumption," said Nomura Securities in a report.

Reserve Bank set to hike rates again

Image: Industrial growth appears to have moderated.

The brokerage firm, which expects a 25 bps increase on Tuesday, is of the view that lower commodity prices and slowing demand will moderate inflation after August.

"A case for ending the rising interest rate cycle seems to be building up somewhat more rapidly than we had expected earlier. Industrial growth appears to have moderated, as April and May Index of Industrial Production numbers showed," said economists at HDFC Bank.

Reserve Bank set to hike rates again

Image: Reuters.

Moderation in credit demand is visible with bank credit registering a modest 3.75 per cent growth in the first quarter over March. Bankers said the reasons were high interest rates and an uncertain economic environment. Following RBI's signal, banks have increased base rates by 50-100 bps since April.

Reserve Bank set to hike rates again

Image: RBI set for a rate hike.

According to P Sitaram, chief financial officer of IDBI Bank, banks' decision to pass on the policy rate increase to customers will depend on the liquidity conditions. "Although liquidity is getting better, it is still not very comfortable. IDBI will take liquidity into account before revising the base rate," he said. Liquidity conditions have improved in July as compared to the previous month, as indicated by the drop in banks' borrowings from the liquidity adjustment facility of RBI.

article