But there is a mixed story behind this overall bottomline. The fall in oil and gas output, which has clouded sentiment on India's foremost private company, has pulled down the overall profitability of operations (profits before depreciation, interest and tax) by 340 basis points to 13.1 per cent.

Profits (before interest and tax) for the segment itself are down 23 per cent. It is the refining business that has carried the can, with profits going up by as much as 57 per cent.

...

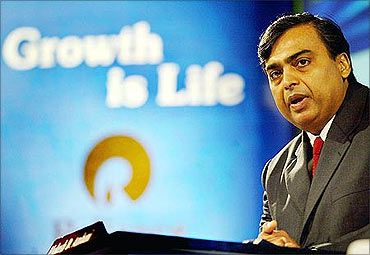

Reliance Industries: Mixed bag of results

Image: Volumes have let Reliance down in the quarter.Even now it stays ahead of regional (Singapore) gross refining margins. The third segment, petrochemicals, one of Reliance's oldest, has more or less marked time with profits going up by eight per cent.

But volumes have let Reliance down in the quarter. While refining and petrochemical revenues were driven by price and not volume, the severe volume shortfall brought about a commensurate fall in oil and gas revenues.

What partially saved the day were investment operations, other income accounting for a good 43 per cent of the overall incremental profit.

...

Reliance Industries: Mixed bag of results

Image: Outlook for Reliance in near term will remain subdued.Although the collaboration with BP has been approved by the government, it cannot be predicted when the infusion of technology will result in higher output.

Greater longer-term uncertainty centres around the global energy outlook.

The world economy has reconciled itself to living with high energy prices but it is the spurt in overall commodity prices, as soon as clear signs of economic recovery were sighted, that has caused energy prices to shoot up again.

This has made inflation rear its head in emerging economies, the current global engine of growth, and brought on monetary tightening, which has cast a shadow over global recovery.

...

Reliance Industries: Mixed bag of results

Image: It is a rough road ahead for energy players.So it is a rough road ahead for energy players for now with volatile prices and no sign of sustained recovery.

But Reliance faces additional uncertainty from as many as three directions. It has decided to get into, and remain in a big way in, the retail business, which will require huge investments and see intense competition with foreign players being allowed in, going by current indications.

And retailing is a math that Reliance has yet to crack. It also intends to get into telecommunications, which will consume resources in a big way and be intensely competitive.

On top of all this is the regulatory uncertainty created by the Comptroller and Auditor General of India.

So Reliance's cup of challenges is not just full, it is overflowing.

article