| « Back to article | Print this article |

Reliance calls govt move on KG-D6 cost-recovery illegal

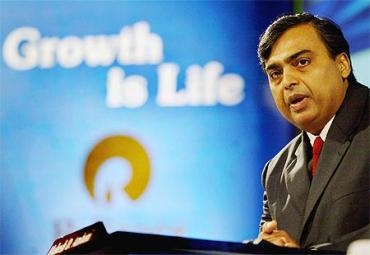

As the Oil Ministry readies to take action against Reliance Industries for the fall in output from the KG-D6 gas fields, the Mukesh Ambani-led firm has warned that any attempt to limit cost-recovery is illegal and will be challenged in court.

The ministry and its technical arm, the Directorate General of Hydrocarbons, are upset with RIL because production from the Dhirubhai-1 and 3 (D1 and D3) gas fields in the prolific KG-D6 block has fallen from 61 million cubic metres per day in March, 2010, to about 37 mmcmd, instead of rising to 61.88 mmcmd, as projected by the company when it got its $8.8 billion capital expenditure plan for development of the field approved in 2006.

Click NEXT to read further. . .

Reliance calls govt move on KG-D6 cost-recovery illegal

The ministry has attributed the fall in output to non-fulfilment of RIL's commitment to drill 22 wells in the field.

RIL has so far spent $5.694 billion on the two fields and has recovered $5.258 billion from the sale of gas produced.

However, the ministry wants to limit cost recovery in the block in proportion to the slippage in output vis-a-vis the stipulated timeline, reducing RIL's entitlement to $3.405 billion.

The firm however feels such a move would be ultra vires, or beyond the ministry's powers, as the production sharing contract does not have any such provision and the $1.85 billion already recovered by RIL cannot be reversed.

Click NEXT to read further. . .

Reliance calls govt move on KG-D6 cost-recovery illegal

"If the PSC were indeed to be re-written to link cost recovery to levels of production, it would also have to include provisions for allowing the contractor to recover costs in excess of his investment in case he were to achieve a rate of production higher than that estimated at the time of capex approval," RIL senior vice-president (commercial) B Ganguly wrote to the ministry on September 16.

RIL said production below the original estimates meant the company loses its right to recover its investment within the originally estimated timeframe, causing huge losses in terms of sunk capital.

Besides, RIL has already suffered huge erosion of market cap due to news of the fall in production.

Click NEXT to read further. . .

Reliance calls govt move on KG-D6 cost-recovery illegal

RIL said as per the PSC, all costs and production numbers provided in the field development plan (like the one approved for KG-D6 in 2006) are only estimates based on the understanding of the reservoir and the market prices at any given point of time and 'such estimates cannot be construed as constituting a commitment under the PSC.'

KG-D6 wells did not perform as per the FDP, as a severe drop in reservoir pressure and acute water ingress has already forced closure of two out of the 18 well drilled so far.

The oil ministry's views have been backed by Solicitor General of India that said RIL should not be allowed to recover the cost of facilities that remain underutilised due to lower than anticipated output at its KG-D6 gas field.

Click NEXT to read further. . .

Reliance calls govt move on KG-D6 cost-recovery illegal

SGI Rohinton F Nariman on August 17 opined that 'the cost expenditure incurred in constructing production/processing facilities and pipelines that are currently underutilised/have excess capacity cannot be recovered'.

"There is no provision under the Production Sharing Contract that can limit cost-recovery to either production levels achieved by a contractor or to the extent that facilities are utilised under a development plan at any given point of time," RIL wrote.

"To even suggest that the contractor should, over and above this loss, forego his basic investment by foregoing cost recovery would be contrary to the fundamental notion of the PSC," it said.

Click NEXT to read further. . .

Reliance calls govt move on KG-D6 cost-recovery illegal

"Any such attempt being contrary to the letter as well as spirit of the PSC would only trigger unnecessary disputes between the contractor and the government leading to needless arbitration proceedings," it added.

The Initial Field Development Plan for the D1 and D3 gas fields in the KG-DWN-98/3 block (KG-D6) envisaged a capex of $2.47 billion at a peak production rate of 40 mmcmd from 14 wells.

Subsequently, RIL submitted an addendum saying the size of the gas reserves was twice the estimate of 5.32 tcf in the initial plan, at 11.3 trillion cubic feet.

Click NEXT to read further. . .

Reliance calls govt move on KG-D6 cost-recovery illegal

It proposed a $8.835 billion capex over two phases and envisaged a peak output of 80 mmcmd from 31 producing wells by April, 2012.

Commercial gas production from the D1 & D3 fields commenced from April 1, 2009. RIL in December, 2009, tested its field production facilities at their full rated capacity of 80 mmcmd, during which time an average gas rate of 77-80 mmcmd was maintained for a brief period of three days.

Subsequently, the gas production rate was maintained at 57-61 mmcmd for a four-month period (January, 2010, to April, 2010).

Subsequently, the gas production rate has gradually declined and the current rate is about 37 mmcmd, as against the approved FDP rate of 61.88 mmcmd for the year 2011-12.

Click NEXT to read further. . .

Reliance calls govt move on KG-D6 cost-recovery illegal

RIL says the gas production rate will remain in the range of 40-38 mmcmd, as against the projected peak of 80 mmcmd, till mid-2013 and also that no new well will hooked up to production facilities till mid-2013/14.

The ministry claims that the DGH has repeatedly asked RIL to comply with the approved FDP work programme by drilling two more wells and connecting two other wells to its production system by the first quarter of 2011-12 fiscal.

It asked RIL to drill another nine wells by March 31, 2012.

However, RIL has failed to comply with the directive and to penalise the firm, the Oil Ministry has now threatened to restrict cost-recovery on a pro rata basis at the current production rate of 37 mmcmd, reducing RIL's entitlement to $3.405 billion.