| « Back to article | Print this article |

Realty slump? Bah! Property worth crores sold in Mumbai

South Mumbai, which houses the city's rich and famous, is seeing a sudden spurt in high value property deals, at a time when home sales here are down - June saw one of the sharpest falls in registration.

In the past couple of weeks, a handful of such deals worth Rs 1,200 crore (Rs 12 billion) have been inked or are set to be signed by the who's who of the corporate world such as the Mahindras, Jindals, Piramals and Runwals.

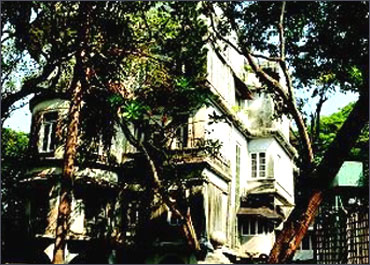

While these firms have made headlines by buying companies or plants world over in the past, this time their targets were the colonial style bungalows in the southern tip of the country's financial capital.

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

Early this month, Sajjan Jindal, vice chairman and managing director of JSW Steel, bought a three-storey bungalow on South Mumbai's Napean Sea Road for Rs 400 crore (Rs 4 billion), making it the country's costliest house.

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

In the same locality, the Mahindra group is set to acquire a three-storey bungalow for Rs 270 crore (Rs 2.7 billion).

Called 'Gulistan', it is meant for Anand Mahindra, vice-chairman and managing director.

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

In June, the Runwal group of property developers bought the Napean Grange bungalow on Napean Sea Road from the Kapadia family for Rs 350 crore (Rs 3.5 billion).

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

Ashok Piramal group company Peninsula Land has signed an informal agreement with veteran actor Dilip Kumar for developing the latter's bungalow in the Pali Hill area of Bandra.

The property is valued at around Rs 150 crore (Rs 1.5 billion).

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

Willing payers

Though the prices look exorbitant, the buyers are willing to pay to get the marquee properties, considering that a home in south Mumbai is considered a status symbol.

"South Mumbai is the address for the rich people and you do not get large properties in these areas. Once they come up for sale, they will see a lot of traction," says Sandeep Runwal, director, Runwal group.

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

Adds Sanjay Dutt, chief executive of global property consultant Jones Lang LaSalle (JLL) India: "If you look at the profiles of the people, they have arrived in life and their net worth run into billions.

They can pay premium for these locations and for them, these prices do not mean much."

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

According to Ramesh Jogani, managing director of Indiareit Fund Advisors, a unit of the Ajay Piramal group, buyers are willing to pay a premium of 30 to 40 per cent if they get properties of the right size and at the right locations.

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

And, sluggishness in the property market is also helping buyers of high value properties, consultants say.

According to JLL's Dutt, during 2010, when the office property market was down, around seven million sq ft of office space was bought by the likes of ICICI Bank, Mahindra, Kotak and others.

"The same trend is continuing now. For the common man, homes may be going out of bounds but when it comes to the rich and famous, they are not bothered by the increase in home loan rates, as they need not borrow.

When markets are down and developers or owners want to sell, you can expect more deals," he says.

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

Supporting his contention, global banking majors Standard Chartered and Hong Kong and Shanghai Banking Corporation have put their plush residential building, Bishops Gate in the Breach Candy area, on the block. It has a market value of around Rs 300 crore (Rs 3 billion).

Similarly, fast moving consumer goods major Hindustan Unilever has put its seven-storey Gulita building in Worli and its Churchgate property on the block.

While Gulita is said to be worth Rs 300 crore, the latter is valued around Rs 500 crore (Rs 5 billion).

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

JJ Bhabha Mansion, belonging the family of Homi J Bhabha, the father of India's nuclear programme, is also on the block. The property is expected to be worth around Rs 300 crore (Rs 3 billion).

Click on NEXT for more...

Realty slump? Bah! Property worth crores sold in Mumbai

Are such deals recession-proof? Runwal does not think so.

"Nothing is recession-proof but some locations sell better and HNIs (high net worth individuals) are less affected. So stock would sell at these locations but at lower prices during slowdown," he says.