Photographs: Reuters

Hinting at yet another hike in key interest rates in its quarterly review on Tuesday, the Reserve Bank of India on Monday said that containing inflation would be the top priority as high rate of price rise could hurt the economic growth.

". . . containing inflation will have to be the predominant objective of monetary policy in the near term," the Reserve Bank said in its macroeconomic review released a day before the third quarterly review of the policy.

Faced with high food inflation, the Reserve Bank of India is likely to raise key interest rates by 25-50 basis points at its quarterly monetary policy review on Tuesday.

Although the RBI will have to draw a balance between the competing requirements of containing inflation and promoting growth, bankers expect that the central bank will tighten monetary supply a bit.

The RBI review further said that upside risks of inflation have increased and it could endanger the growth objective and also amplify risks to inclusive growth.

The economy grew by 8.9 per cent in the first half of the current fiscal, but inflation remained at a high level of 8.43 per cent in December, led by high food prices.

. . .

RBI may hike interest rates as govt can't curb prices

Photographs: Reuters

The food inflation for week ended January 15 was 15.52 per cent after touching a high of 18.32 on December 25, 2010.

The central bank raised key short-term lending (repo) and borrowing (reverse repo) rates for six times in 2010 to tame inflation.

The quarterly monetary policy, to be released on Tuesday,is expected to balance the need for containing inflation and promoting growth.

Inflation likely to stay high hurting growth: RBI

The RBI said that the demand-supply mismatch and rising global commodity prices would continue to put pressure on inflation, which could hurt the economic growth.

"Persistent high inflation could endanger the growth objective and also amplify risks to inclusive growth, containing inflation will have to be the predominant objective of monetary policy in the near-term," RBI said in its macroeconomic review released on the eve of the quarterly policy.

It said that the upside risk to inflation have increased and supply side constraints and high global commodity prices could dampen the impact of tight monetary policy.

. . .

RBI may hike interest rates as govt can't curb prices

Photographs: Reuters

"While inflation is likely to soften in coming months it is likely to stay elevated above the earlier anticipated path," it said. The RBI has projected overall inflation to be at 5.5 per cent by March end.

The overall inflation for December shot up to 8.43 per cent on high prices of food items, from 7.48 per cent in November.

The RBI said continued high food inflation is the main cause of overall inflation holding up, adding that return of inflation to a more acceptable level would be gradual.

Ahead of the third quarter monetary policy review, the RBI said demand-supply mismatch in certain food items would keep prices high.

"The upside risks to inflation, particularly from the impact of supply rigidities and hardening commodity prices have increased, which could dampen the expected impact of monetary policy to some extent," it said.

The RBI said that inflation could be contained if the government takes steps to improve supply side bottlenecks and make farm gate products easily available at the retail end.

. . .

RBI may hike interest rates as govt can't curb prices

Photographs: Reuters

The RBI said it expects some moderation in the food inflation, which is currently in double digits, with the advent of rabi crops in the market. The food inflation for the week ended January 8 stood at 15.52 per cent. It had shot up to 18.32 per cent in the end of December on high prices of vegetables, including onion.

"Persistence of food inflation has become a primary impediment to faster moderation of inflation," it said.

The RBI said supply disruptions in many commodities and indications of further quantitative easing by some advanced economies have pushed up prices globally.

"Domestic prices are now significantly impacted by the global commodity price movements, and hence, rising international prices are an important source of upward risk to domestic inflation," the RBI said.

The risks to generalised inflation cannot be overlooked as inflation expectations are currently ruling high. Anchoring inflationary expectations would be necessary to mute the second-round impact of supply-side shocks, it said.

Bankers feel rate hike certain

"Conventional wisdom says that there should be at least a 25 basis points hike in interest rates," according to State Bank of India chairman O P Bhatt.

Despite moderating for two weeks, food inflation was still high at 15.52 per cent for the week ended January 8 on account of rising prices of essential food items like vegetables, particularly onions and tomatoes, besides fruits, milk and eggs.

. . .

RBI may hike interest rates as govt can't curb prices

Photographs: Reuters

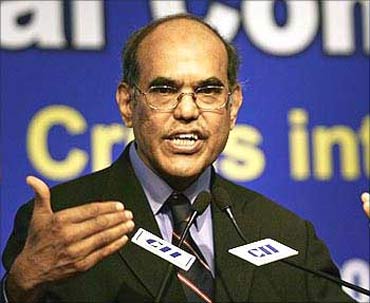

Last week, RBI Governor D Subbarao had expressed concern over food inflation, saying, "Some of the vegetable prices are still high."

Though analysts are not sure whether any further tightening of interest rates can check the price rise, the central bank seems to have no other option.

The RBI could also take steps to ease the liquidity crunch in the system, according to analysts.

It is to be noted that the RBI chose not to tinker with policy rates at its mid-quarter review on December 14, as food inflation had fallen from double-digit levels to a single digit.

However, food inflation subsequently shot up. The stubbornly high food inflation rate may prompt the RBI to now tighten money supply by raising both short-term lending (repo) and borrowing (reverse repo) rates.

Endorsing the widespread view, HDFC Ltd Chairman Deepak Parekh said the RBI is expected to raise key short-term rates by 25-50 basis points.

. . .

RBI may hike interest rates as govt can't curb prices

Photographs: Reuters

"The RBI may be looking at an increase (of short-term rates) of 25-50 basis points... But I personally feel that interest rates are already high and it will impact the growth of retail loans and housing," Parekh said.

Subbarao had said the country was facing surging inflation and the monetary policy needs to be calibrated to manage it, as well as support growth.

In 2010, the RBI raised the repo and reverse repo rates six times to 6.25 per cent and 5.25 per cent, respectively, to normalise the monetary policy, which was loosened to combat a slowdown in economic growth in the wake of the global financial meltdown in late 2008.

Interest rate hike to hamper industrial growth: Sharma

A day prior to the Reserve Bank's third-quarter monetary policy review, Union Commerce and Industry Minister Anand Sharma said any rise in interest rates would hinder industrial growth.

"Inflation is definitely a cause of concern. But it cannot be curbed by increasing interest rates. Instead, for the development of industry and growth of the economy, there is a need to provide easy credit to the industrial sector," Sharma told reporters on the sidelines of an event organised by the CII in New Delhi on Monday.

The RBI is widely expected to raise key short-term rates on Tuesday to rein-in inflation.

There is a need to allow capital inflows and easy credit flow for the growth of economy, he said.

. . .

RBI may hike interest rates as govt can't curb prices

Photographs: Reuters

"For a clear growth of the economy, there is a need for capacity addition. Foreign capital inflows and making credit easily available for the industrial sector by public sector banks will ensure robust industrial production," Sharma said.

Cutting exports would only lead to cutting economic growth and not inflation. "This will result in job loss," he said.

Rate hike to derail growth: Assocham

Industry body Assocham said that any increase in rates will adversely impact the country's growth momentum.

"Higher dose of increased key rates by the Reserve Bank may not be the solution. It is time that the monetary policy instances are also supplemented with bold fiscal as well as administrative steps," the chamber said in a statement.

This would also help in improving supply chain bottlenecks and lead to wider participation of farmers and consumers, it said.

The Indian economy grew by 8.9 per cent in the first half of the current fiscal, but inflation remained at a high level of 8.43 per cent in December, led by high food prices.

The food inflation for week ended January 15 was 15.52 per cent after touching a high of 18.32 on December 25, 2010.

article