| « Back to article | Print this article |

RBI cuts repo rate, CRR by 25 bps

Shedding its 9-month long hawkish monetary policy stance, the Reserve Bank on Tuesday slashed its key interest rates by 0.25 per cent and released Rs 18,000 crore additional liquidity into the system to perk up growth through reduced cost of borrowing.

RBI Governor D Subbarao in the third quarter monetary policy review surprised the market by cutting short-term lending rate called repo by 0.25 per cent to 7.75 per cent and

Cash Reserve Ratio (CRR) by similar margin to 4 per cent, releasing Rs 18,000 crore primary liquidity into the system.

While repo rate cut will reduce the cost of borrowing for individuals and corporates, the reduction in CRR, which is the portion of deposits that banks have to park with RBI, would improve the availability of funds.

"The stance of monetary policy in this review is intended to provide an appropriate interest rate environment to support growth as inflation risks moderate," Subbarao said while unveiling the policy review.

The RBI, however, has reduced the growth projections for the current financial year to 5.5 per cent from its earlier estimate of 5.8 per cent.

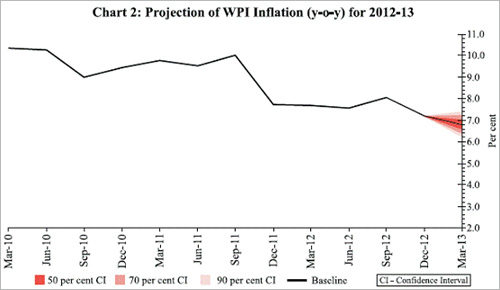

On inflation, it moderated the rate to 6.8 per cent for March-end from earlier projection of 7.5 per cent.

"The moderation in inflation conditions provides the opportunity for monetary policy to act in conjunction with fiscal and other measures to stem growth risks," Subbarao said.

He praised government's recent reform measures including liberalisation of FDI in retail, deferment of GAAR and progressive deregulation of fuel prices saying these actions would "help engender stable macroeconomic conditions and return the economy to its high growth trajectory."

Stock market celebrated the rate cut with a 91 point rally in early trade to take the benchmark Sensex to 20,194.06.

Click NEXT to read more...

RBI keeps key rates unchanged

Planning Commission Deputy Chairman Montek Singh Ahluwalia said the CRR cut will have impact on long term interest rates.

"I think this is the right thing to do at this point of time given that (the decline) in economy is beginning to bottom out," he said.

On the possible impact of the RBI's decision on the interest rates, Bank of India executive director N Seshadari said most of the banks will transfer the rate cut. "Full transmission will happen on both lending and deposit rates. A 0.25 per cent cut is most likely."

Echoing similar views, Canara Bank executive director A K Gupta said the bank would consider interest rate cut in the light of RBI policy action.

The repo rate, which was cut last in April 2012, stands revised at 7.75 per cent with immediate effect, while the liquidity infusing CRR stands at 4 per cent effective February

On Monday, the RBI had left everyone guessing with a hawkish policy stance in the third quarter macroeconomic and monetary development report stating that sticky inflation and widening fiscal and current account deficits limited its scope for a rate cut.

Inflation has been the prime inhibiting factor that has prevented the RBI from cutting repo rate in the last nine months, which have seen a host of liquidity infusing measures like a cut of 1.75 per cent in CRR, government bond buybacks and a one percentage point cut in SLR.

The overnight borrowings, which average Rs 91,000 crore in January, are "above the comfort level", Subbarao said.

Click NEXT to read more...

RBI keeps key rates unchanged

In its guidance for the monetary policy stance, RBI said the likelihood of inflation having peaked gives it a space, though limited, for the policy to give greater emphasis to growth risks.

Subbarao, however, added the caveat stating that the stance will depend on how the government manages the risk from the twin deficits on the fiscal and current account side, and the evolving growth-inflation dynamics.

Stating that the widening current account deficit, which represents the differential between the foreign exchange earned and expended through trade and services, is a big concern, RBI said the number is expected to widen in Q3, beyond the 5.4 percent in the preceding quarter.

"Even though net capital flows have been strong, the sheer size of the external financing requirement imposed by the large CAD has brought to bear downward pressures on the rupee which depreciated in nominal and real terms by January 2013, relative to its level in March 2012," the policy said.

Click NEXT to read more...

RBI cuts repo rate, CRR by 25 bps

Exports have been bad for the past eight months, while RBI today said overall there has been a modest improvement in the global economic prospects since the last quarter of 2012.

Warning that too much dependence on volatile and risky capital inflows to finance CAD is risky, the RBI said such dependence "increases the economy's vulnerability to sudden shifts in risk appetite and liquidity preference potentially threatening macroeconomic and exchange rate stability."

Partly blaming the historically high CAD to fiscal imprudence, the central bank said the inability to reign in the fiscal deficit will "accentuate the CAD risk, further crowd out private investment and stunt growth impulses."

Answering criticism of holding on to high rates for so long, Subbarao today said that apart from the high inflation, RBI was forced to pause because of lack of complementary efforts from the fiscal authorities.

On the reforms process, Subbarao said there is a need for further reforms to raise productivity, improve competitiveness and manage supply constraints to support growth which has been below trend for quite some time.

The RBI will come out with mid-quarter review on March 19 and the annual policy on May 3.