| « Back to article | Print this article |

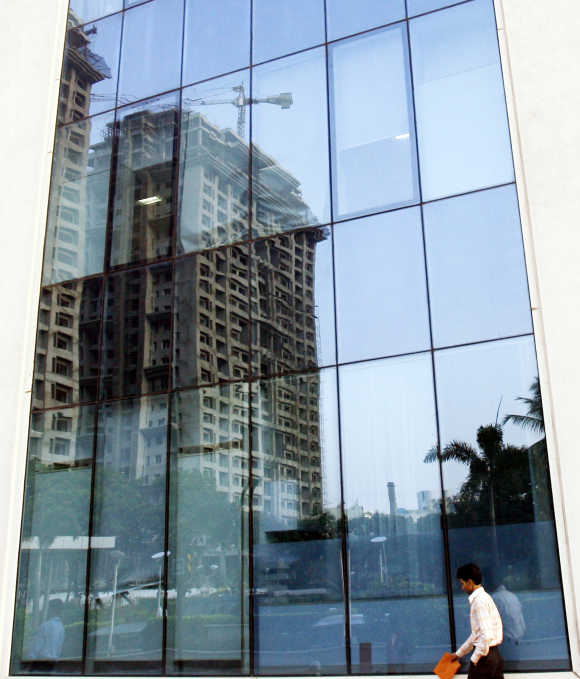

Property prices in Mumbai set to increase 20%

Mumbai home prices could rise by 15 to 20 per cent every year over the next five years due to heavy demand from buyers, shows a new study by a unit of ICICI Home Finance.

The study revealed, though residential transactions had been slow, a pick-up had been noted over the previous financial year and prices in Mumbai might continue to see an upward trend over the one-year period and grow in double digits in the next five years, says the report by ICICI Property Services.

Click NEXT to read more...

Property prices in Mumbai set to increase 20%

"This is mainly due to the hesitant buyer now taking the decision to purchase, as the hope of a correction in real estate prices has faded," the report said.

"More, some builders have offered an attractive 20:80 scheme, which has revived transactions in the market," the report said. In a 20:80 scheme, developers absorb pre-installment charges."

Click NEXT to read more...

Property prices in Mumbai set to increase 20%

Overall, residential real estate prices are likely to remain firm on the back of increasing input costs to developers, coupled with supply slowing due to the slow process of approvals and limited land availability in Mumbai, the report said.

Click NEXT to read more...

Property prices in Mumbai set to increase 20%

Mumbai home prices have already touched Rs 100,000 per sq ft, surpassing those of Manhattan in New York and London. According to the National Housing Bank Residex, which tracks housing prices in major cities, Mumbai saw a nine per cent increase in prices in the last quarter of FY12, compared to the corresponding quarter of FY11.

Click NEXT to read more...

Property prices in Mumbai set to increase 20%

The report says demand is expected to further pick up during the fourth quarter of 2012, amidst the festive season of Ganesh Chaturthi and Diwali.

However, the project completion period has gone up from the earlier two to three years, to four to five years, due to increase in input costs and increase in lending rates, it added.

Click NEXT to read more...

Property prices in Mumbai set to increase 20%

"I do not see any big claim in it," said said Sanjay Dutt, executive managing director, Cushman & Wakefield, a global property consultant, of the report.

"This could have anyway happened due to inflation every year. I think prices have corrected in the last two years due to developers absorbing the increase in input costs and other charges in the wake of inflation."

Click NEXT to read more...

Property prices in Mumbai set to increase 20%

Dutt said since sentiments are neutral for a while, buyers are coming back to the property market, thinking that if jobs are stable and things would pick up later, it makes sense to buy homes now.

Click NEXT to read more...