| « Back to article | Print this article |

Should you hold on to a controversial company's stock?

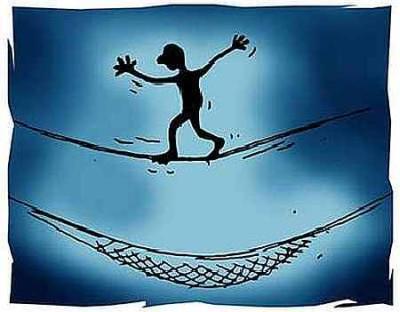

Investing is an act of faith in which we depend on the performance of other entities or assets in order to achieve our financial goals.

While Investing in physical gold or property may only involve due diligence at the time of purchase, investment in equity calls for more ongoing involvement on the part of the investor.

While keeping abreast of the company's operations, results, or any other news are considered 'par for the course', investors may also have to periodically contend with articles and reports of alleged transgressions on the part of the company management, faults in the company's products and so on.

So, how should one react when one encounters a barrage of barbs against one of the companies one has invested in?

While I don't dispute that there is no smoke without fire, I also believe that rather than panicking and selling one's holding, one should ponder about the following:

Who is making the allegation and what is the motive?

If the allegation is being made by a competitor firm, one could take it with a pinch of salt. If it is made by a political party, one could check whether it is made in the interest of the public-at-large or whether there is a hidden political agenda behind the allegation.

For instance, the opposition parties may indulge in muck-raking against a prominent businessman who, incidentally, may be a cabinet minister or may be supporting some other party.

Click NEXT to read more...

Should you hold on to a controversial company's stock?

There may also be some self-proclaimed messiahs who view all businessmen as offenders and will lose no opportunity to pull them down. Such allegations could be broadly ignored, as they are usually not backed by any evidence.

Finally, 'teaser allegations' (threat of releasing evidence about a misdoing in a phased manner) may be made with the intention of extracting financial rewards from the persons or company under the scanner. Investors or investor activists should be wary of such 'greenmail' tactics.

Did I know about this?

This may sound cynical, but let's face it, one often knows what one is getting into. Yet, one chooses to invest in companies with shades of grey.

Sometimes, one has no option as industries involving resource extraction or government largess are traditionally known to be notorious.

And if one wants to invest in them, one has to accept certain unsavoury aspects. Hence, one should not be perturbed if an allegation springs up.

Does the stock price factor it?

Usually, less-than-pristine companies suffer from a promoter or industry discount in valuation. As a result, the surprise factor is limited. And even if the stock price tumbles in reaction, it usually recovers quickly.

Hence, it may not be sensible to indulge in panic-selling just after the allegations have been made.

Click NEXT to read more...

Should you hold on to a controversial company's stock?

How harmful is the allegation for the company?

Sometimes, allegations against the promoter(s) (such as against their flamboyant lifestyles) may not percolate down to the company's performance in the short-term.

However, if investors fear that such behaviour is a sign of a character flaw or a signal that money is being siphoned off from the company, then they may consider exiting.

How is the company reacting?

Usually, any allegation is first met with a denial, which is usually followed by some righteous self-indignation.

This especially happens in the case of exposes regarding faulty products or services.

For instance, when there were reports of a particular car model's brake not functioning or ants inside sealed chocolates, the companies in question tried to bury the matter. And when they failed, they grudgingly admitted that there was a problem.

But once they did, they acted swiftly to contain the damage, by recalling the faulty batches and launching a blitzkrieg of advertisements aimed at bolstering consumer confidence.

Here, investors who behaved in a knee-jerk manner, lost out as the stock prices bounced back with a vengeance.

Two ways in which one can reduce the risk of losses due to such allegations are :

Diversify portfolio: It is unlikely that all the stocks in one's portfolio will be affected at the same time. Therefore, one should not opt for a concentrated portfolio. While this may cap one's gains in good times, it also insulates us during turbulent times.

Choose carefully: A leopard does not change its spots. Similarly, crooked management will not change overnight. Therefore, one must strive to invest in companies where the minority shareholder is not short-changed in any manner. This, applies even when the management is not facing any allegations currently. Allying with a management which lacks integrity is bound to cause us grief in due course.