| « Back to article | Print this article |

PPF still the best among tax-exempt instruments

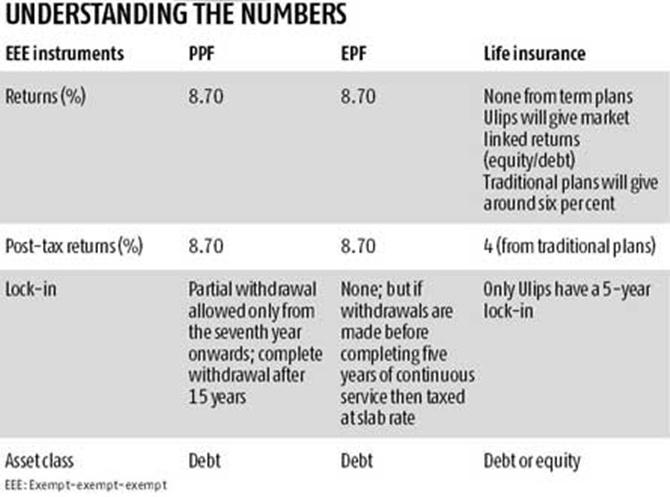

The EEE tax status means the contribution, the accumulation and the withdrawal amounts are all exempt from tax.

Sarita Singhal's relationship manager insisted on meeting her though she did not have any service or related complaints. In no time, the manager came to the main reason for his visit - pitching a new combo-product. His bank had specially designed the product for their 'privilege customers'.

He began by asking how she planned to invest the additional Rs 50,000 worth of deductions allowed under Section 80C from this financial year. Singhal, 40, said she wanted to put the money in the Public Provident Fund (PPF).

"The manager then told me that PPF is not an attractive option. Reason: It is a market-linked product and in times to come, its returns might go down to six per cent levels. Hence, he advised investing in the bank's new product, which gives the edge of equities and insurance," the law professional says.

Many bank relationship managers and brokers are advising individuals to stay away from PPF, for it is market-linked.

In 2011, the Union Finance Ministry announced that the rates for small saving instruments would be benchmarked to those of government securities (G-secs) of similar maturity periods, with a positive mark-up of 25 basis points (bps).

Being market-linked, the rate of return would come down whenever there was a downward revision of interest rates.

Please click NEXT to read more…

PPF still the best among tax-exempt instruments

What works

However, PPF still stands out as one of the best among the instruments giving exempt-exempt-exempt (EEE) benefits, which makes it one of the most popular investment products say financial planners.

The EEE tax status means the contribution, the accumulation and the withdrawal amounts are all exempt from tax.

The other EEE products are Employee Provident Fund (EPF) and life insurance in the basket of instruments that qualify for deductions under Section 80C of the Income Tax Act.

"PPF is one of the best options in the debt universe and among the EEE products. Net of tax, other debt products offer much lower return. For instance, fixed deposits' post-tax returns are in the six per cent range for someone in the highest tax bracket (State Bank of India is offering nine per cent for deposits maturing in one year to less than two years). The product that comes close to offering PPF returns will be tax-free bonds (in the secondary market) with post-tax returns of 7.50-7.90 per cent.

Among the EEE products, only voluntary contribution towards EPF ranks at par with PPF," says Vishal Dhawan of Plan Ahead Wealth Advisors.

In the long term (three to five years), debt funds' returns could be comparable, despite 20 per cent tax with indexation, he adds. According to data from mutual fund rating agency Value Research, medium-term to long-term gilt funds have returned a little over six per cent in the past year.

Additionally, from this financial year, individuals can invest as much as Rs 1.5 lakh as against Rs 1 lakh earlier in PPF. Both PPF and EPF currently earn 8.7 per cent return annually. The PPF rate applicable for each financial year is declared at the beginning of the year.

Please click NEXT to read more…

PPF still the best among tax-exempt instruments

Problem areas

The product does have negatives. PPF has a 15-year tenure, a long period to stay invested without knowing the future interest rate applicable, as it is a market-driven product. The first-year investment can be withdrawn only in the seventh year.

Though the government has always been soft on PPF's return on investment, it is not a given that the rates will stay constant or will go up in a high interest rates scenario.

Since 2013, when the rates were increased from 8.5 per cent to 8.7 per cent, banks were offering close to 9.5-9.75 per cent for up to two to three years of deposits, compounding quarterly, which could take the yield to more than 10 per cent, says Abhinav Angirish, managing director of InvestOnline.in.

Since 2013, when the rates were increased from 8.5 per cent to 8.7 per cent, banks were offering close to 9.5-9.75 per cent for up to two to three years of deposits, compounding quarterly, which could take the yield to more than 10 per cent, says Abhinav Angirish, managing director of InvestOnline.in.

Please click NEXT to read more…

PPF still the best among tax-exempt instruments

Future prospects

Yet, even if the PPF rates drop in the years to come, it could remain among the most attractive debt products to invest in.

Assume PPF returns six per cent tax-free in future; the competing debt products will give less post-tax returns. Then, banks will also returns six to seven per cent annually, which will go down to three to four per cent, post tax.

"But, with five-six per cent returns, PPF will become unattractive compared to products that hold or lock interest rates on investment. For instance, once you invest in a three-year fixed deposit rate of, say, six per cent, it will earn you that much every year for three years. The same goes for tax-free bonds. But, PPF rates will change as per government announcement every year," explains certified financial planner Anil Rego.

Please click NEXT to read more…

PPF still the best among tax-exempt instruments

Recommendations

Investment experts advise parking all of the additional Rs 50,000 under Section 80C in PPF only for those close to retirement, say if one is five to seven years away from hanging up his/her boots.

"And, this too for those who are self-employed. The idea is to keep the retirement corpus untouched from business needs," explains Dhawan.

Salaried individuals should avoid PPF and focus on saving through equity because EPF contribution towards EPF is mandatory for them. And EPF is no different from PPF. "If an investor is willing to stay invested for 15 years, the best mode of investment should be equities.

There is not a single period of 15 years at a stretch where equities would have given below 15 per cent a year.

An equity-linked savings scheme (ELSS) with a three-year lock-is an ideal tool to invest among the Section 80C instruments. However, this is also subject to an investor's risk appetite and asset allocation," explains Angirish.

In the past one year, ELSS has returned 54.23 per cent, shows data from Value Research. In comparison, equity diversified funds have returned 50 per cent in the same time period. Additionally, ELSS gets tax exemption for both the investment amount and returns on it.

Rego suggests sticking to the proportion of PPF one always invested in. Say you invested Rs 25,000 in PPF when the Section 80C limit was Rs 1 lakh. Then, you could maintain the 25 per cent allocation and invest Rs 37,500. The rest of the limit could be diversified among other instruments.