Photographs: Uttam Ghosh/Rediff.com Ashwini Kumar Sharma, Outlook Money

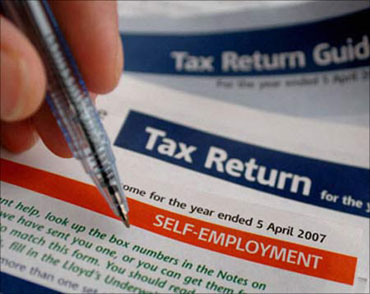

Reclining in your chair in the office or shop, hoping to soak in that rare moment of leisure, you are suddenly struck by the realisation that it's time to file your income-tax return for the financial year 2010-11.

You pick up the phone to call up your chartered accountant to bail you out, once again.

But stop. Think. Why not do it yourself? Believe it or not, it's really not all that tough. All you need to do is to get a bit proactive and collect some important documents, something you would need to do anyway, even if you use the services of a professional.

After everything is in place, all you need to do is follow some easy steps.

Remember, it makes hardly any difference if you are employed abroad at this moment -- if you have earned any taxable income in India during the last financial year, you are bound by law to file your tax return.

. . .

How to file tax returns: A do-it-yourself guide

Photographs: Uttam Ghosh/Rediff.com

Most people shy away from filing their returns themselves because of the complex jargons and apparently tedious steps involved. Add to it the threat of penalty and harassment if you get the calculations wrong and you have all the more reasons to look for an easy way out.

The government, however, has, in the last few years, initiated quite a few measures to make the entire process as simple as possible. ITR forms are much simpler now, online filing facilities have been introduced, there are provisions for taking the services of tax consultants, and so on.

On your part, all you need to do is some amount of homework.

Collect financial documents

Though income-tax authorities don't require you to furnish any document while filing your return, you would need to keep them handy while filling up the form.

You also need to retain your tax-filing documents of up to eight years as you may have to produce them if your case comes up for scrutiny by the taxman.

. . .

How to file tax returns: A do-it-yourself guide

Photographs: Uttam Ghosh/Rediff.com

So, the first step is to collect documentary evidence for all income, expenses and deductions on which you have taken a tax benefit during the fiscal year.

PAN: The most essential document is the PAN (Permanent Account Number) card. You just need to mention the PAN number in the return form and need not attach a copy.

Forms 16 and 12BA: If you are a salaried employee, you would have to collect your Form 16 from your employer. This form carries the details of your income from April 1 to March 31.

Says Ankur Sharma, co-founder and CEO, taxSpanner.com, an online tax-filing service provider: "The last date for issuing Form 16 is May 31 of the assessment year."

If your employer has not issued you the Form 16 so far, immediately send them a registered letter asking for it and send a copy of the letter to your assessing officer.

. . .

How to file tax returns: A do-it-yourself guide

If you have worked with more than one employer during the financial year (FY), you would have to collect the Form 16 from each of them. If no tax has been deducted from your salary at source, get a certificate on the employer's letterhead, mentioning your salary during the financial year.

Also, get Form 12BA from the employer if your pay package includes perks.

Form 16A: This is a certificate that mentions the tax deduction at source (TDS) on income from sources other than salary.

You would need to collect this form from all organisations that have deducted TDS from your income, such as a bank where you have a term deposit.

All bank accounts operated by you during the year with details of deposits, withdrawals and interest earned need to be mentioned.

. . .

How to file tax returns: A do-it-yourself guide

Investment documents: Collect all documents relating to investments, such as Public Provident Fund (PPF), life insurance premium receipts (unit-linked insurance plans and/or traditional plans), equity-linked savings scheme (ELSS), five-year notified bank fixed deposits, five-year post office time deposits, Senior Citizen Savings' Scheme (SCSS), infrastructure bonds and home loan principal repayment, and so on.

You would also need to collect documents related to spending, such as term insurance and medical insurance premiums, interest paid on education loans, donations to charitable trusts, stamp duty and registration charges paid and tuition fees, among others.

If you own one or more property, you must retain municipal tax receipts, rent details and other related papers. Bills, documents and contract notes for assets sold during the year are needed as are the corresponding purchase papers.

If you have bought a house and paid stamp duty and registration fee to get it registered in your name, keep in safe custody the payment details and receipts.

. . .

How to file tax returns: A do-it-yourself guide

If you have bought the house through a home loan, get a certificate of interest and principal paid too.

Details of tax payments made during the year are needed only if you have made or self-assessed advance tax payments.

Identify your income

Once you have collated the documents, the next step is to identify all your sources of income. Even a salaried person may have capital gains as he may have dabbled in shares or mutual funds.

If you have rented out a property, the head, 'income from house property', needs to be accounted for. Apart from that, if you have earned interest from your term deposit or bonds, you need to consider the income under the head, 'income from other sources'.

. . .

How to file tax returns: A do-it-yourself guide

If you think that because tax has been deducted at source from your income, you don't need to file returns, you couldn't be more wrong.

For those whose finances are not subject to an audit, the due date for filing remains July 31. If a minor or a housewife earns any income, it will be assessed as his/her own income. However, if the money is sourced from you, the income(s) will be clubbed with your own.

People who have left the country during the year have to file tax returns too. Income from agricultural activity and dividends from equity mutual funds and stocks are not taken into account for taxation purposes.

Even though it is itself not taxed, agricultural income is still considered to determine your tax rate. Also, long-term capital gains on stock transactions are not taxed if you have paid the securities transaction tax (STT) on sale.

. . .

How to file tax returns: A do-it-yourself guide

But all such income needs to be declared and exemption is availed afterwards.

In the light of the above discussion, identifying the heads of income is an important step.

Calculate gross total income (GTI): There are some exemptions or other available under all the five heads income heads -- income for salary, house property, capital gains, business or profession and other sources.

Add your earnings under the five income heads to arrive at the GTI. Now, take out all your Section 80C and non-80C deductions. While doing so, keep in mind the respective exemption limits.

. . .

How to file tax returns: A do-it-yourself guide

The maximum deduction you can avail under Section 80C is Rs 1 lakh (Rs 100,000), which includes your EPF contribution, along with investments in PPF, ELSS and SCSS, as well as payments for home loan principal, tuition fees, and so on.

An additional Rs 20,000 is allowed for deduction under Section 80CCF for investment in notified long-term infrastructure bonds.

You can avail deduction under Section 80D for payments made towards health insurance policy premiums for yourself and your family dependents, up to Rs 15,000 or Rs 20,000 if you are a senior citizen.

Add another Rs 20,000 or Rs 15,000 if you are paying the premiums for your parents, depending on whether at least one of them is a senior citizen. If you are servicing an education loan, the interest paid on the borrowed amount during the year can be claimed for deduction under Section 80E.

. . .

How to file tax returns: A do-it-yourself guide

Any donation made to a charitable trust can also be claimed for tax deduction within the prescribed limit. Remember that only the payment actually made during the financial year is taken into account for deduction; no accrued payment is allowed for deduction.

Calculate net taxable income (NTI): The NTI is arrived at by deducting the total deduction from GTI. It's on NTI that you will be taxed.

Filing of income tax return is mandatory only for those persons whose total income during the previous year exceeds the maximum amount which is not chargeable to income tax under the provisions of I-T Act, 1961.

However, from the current financial year, salaried individuals with taxable income of less than Rs 5 lakh (Rs 500,000) will not have to file returns in the current financial year, provided the entire income is accrued from a single employer and there is no interest income of more than Rs 10,000 from your savings accounts.

. . .

How to file tax returns: A do-it-yourself guide

Your tax liability will vary depending on whether you are a man or a woman. Senior citizens, too, have different tax slabs. Let's illustrate this with an example.

Suppose you are a 35-year-old woman and your net taxable income during 2010-11 was Rs 7 lakh (Rs 700,000), arrived at after allowing for different tax deductions, then your total tax liability would be:

Up to Rs 1.9 lakh: Nil;

Rs 1.9 lakh to Rs 5 lakh: Rs 31,000 (10 per cent of Rs 3.1 lakh);

Rs 5 lakh to Rs 7 lakh: Rs 40,000 (20 per cent of income above Rs 5 lakh, i.e Rs 2 lakh)

Total tax payable will be Rs 71,000 (31,000 + 40,000) + Rs 2,130 (3 per cent of Rs 71,000 as education cess).

So, net tax will be Rs 73,130.

Filing your return

Computing and filing your I-T return could be a slightly tedious affair, but help is at hand, both offline and online.

. . .

How to file tax returns: A do-it-yourself guide

Offline: You could either hire a chartered accountant who will do the entire groundwork as well as compute your tax liability, or you can do it yourself.

In the former case, all you need to do is just sign on the relevant ITR form. The CA would also take care of the task of submitting the form to the income tax office concerned and provide you the acknowledgement.

But then nothing comes for free. The CA may typically charge you anywhere between Rs 200 and Rs 3,000, depending on how varied your sources of income are and other factors.

The second option before you is doing it yourself. If you take this route, you would need to download the relevant ITR Form from www.incometaxindia.gov.in.

. . .

How to file tax returns: A do-it-yourself guide

Fill up the required details in the form, submit it at the ward concerned at the income-tax office and collect the acknowledgement.

Online: Like with most other things these days, the online facility is available for filing I-T returns as well. To do so, you could choose from any of the designated websites.

E-filing websites are designed to reduce the labyrinth of difficult tax jargon and hold the taxpayer's hand while he files the returns on his own. Some popular websites offering the e-filing facility include www.taxspanner.com, www.taxshax.com, www.taxsmile.com and www.taxsum.com.

The government, too, has a site designated for this purpose, the services for which are free -- www.incometaxindiaefiling.gov.in/portal/index.jsp.

. . .

How to file tax returns: A do-it-yourself guide

The non-government sites mentioned above, too, are secure and easy to navigate. They differ from each other on two counts, the number of income sources they cover and the process involved. They also have different packages, offers and discounts.

So, get clarity on the cost and features offered before making a choice. The cheapest package would normally cover only the salary income.

You may require an advanced version if you have income under other heads, such as business and profession, capital gains, house property and other sources.

Says Ankur Sharma of taxSpanner.com: "Before zeroing in on a service provider, look at the quality of the content on its website and whether they are authorised for tax filing by the income tax office."

. . .

How to file tax returns: A do-it-yourself guide

Note that when you file your returns online, you are sharing important personal financial details, such as your income, savings and investments, bank account details, and so on.

So, as Sharma says, "it's crucial that you check the 'confidentiality and privacy policy' of the service provider". Decide on the service provider after you are assured that your information will not be shared with others.

How to E-file your return

Having zeroed in on the service provider, all you need to do is to follow some easy steps to finish the process. Considering how simple and quick online filing of return is, more and more people are now using this option.

Last year, more than 100,000 tax-payers filed their returns with TaxSpanner alone. Says Sharma: "This year, we expect to quadruple last year's figures."

. . .

How to file tax returns: A do-it-yourself guide

Using the government website: Filing your returns through the government website is slightly different from a designated private service provider.

If you are using the government website, you first need to download a 'return preparation software' for the particular form from the website and save it on your desktop.

Fill up the return offline using the software and generate an XML file and save it. Then, register and create a user id/password by providing your PAN. Once you have created an account, log in and . . .

How to file tax returns: A do-it-yourself guide

Using a service provider: Most service providers have in-built, self-designed, user-friendly software on their website, which need not be downloaded. This, itself, reduces the time involved.

You just need to follow instructions and fill up the form. Some service providers, to make the process even simpler, have the procedure in a question-and-answer format.

Still others require you to just send across the soft copy of your Form 16 so that they can do the groundwork and send you the filled-up ITR form for further processing.

Whether it's the government website or a service provider, once you have filled up the ITR form, you have to submit it online only.

. . .

How to file tax returns: A do-it-yourself guide

Things to watch out for

It's very important that you mention your PAN correctly. If you have lost your PAN card and don't remember the number either, apply for a fresh card.

If you don't have one in the first place, then too, immediately apply for it so that you don't miss the tax-filing deadline. If you switched jobs last year, remember to report the income(s) from the previous job(s) or submit the Form 16 details of the previous employer(s) as well.

Including interest earned on your savings bank account is essential too. Disclose any share transactions, however small they may be.

If you have filed your return without a digital signature, then, while taking a printout of ITR-V, ensure that it is printed only in black ink. Sign it, in original, in blue ink before mailing it to CPC.

. . .

How to file tax returns: A do-it-yourself guide

What if you miss the deadline? If you miss the July 31 deadline, you are left with two options. If there is no pending tax to be paid, you may file your return without paying any penalty by March 31, 2012.

But if you still have a tax liability, you will have to pay a monthly penal interest on the tax due if you file your return by March 31, 2012. If you miss that deadline too, you will have to pay a penalty of Rs 5,000, along with the monthly penal interest on the tax due.

If you are entitled to a refund, interest on it will be given to you only from the date of filing the return. On the other hand, if you are on time, you can revise your form to correct any mistake or deletions, by March 31, 2012.

You can't avail this facility if you haven't filed the return on time. If you have incurred losses on shares during the year, you will be able to carry forward the losses for future tax set-off only if you file the return within the deadline.

Now that you know what to do, begin the process immediately as time is on your side. A little bit of exertion now and you can rest easy till the next year.

article