| « Back to article | Print this article |

How to invest profitably in global markets

Wealth managers often recommend international funds and stocks for diversification.

However, most investors have been unwilling to take that risk. Now, things are beginning to change.

"Facebook's initial public offer created quite a buzz and there were many enquiries from high net worth individuals," says a wealth manager.

One of his HNI clients, who invested Rs 1 crore (Rs 10 million) in the US, has made huge profits by investing in a single stock, Apple Inc, in the past year.

Click NEXT to read further. . .

How to invest profitably in global markets

In this period, the stock has given 83 per cent. In the past six months alone, Apple has returned 67 per cent, after Steve Jobs' death in October 2011.

Microsoft Corp has returned 22 per cent in the past year.

Patient investors have got 67 per cent in the past three years from it and a mind-blowing 438 per cent from Apple.

Similarly, Google Inc has given 72 per cent in the past three years and 26 per cent in six months.

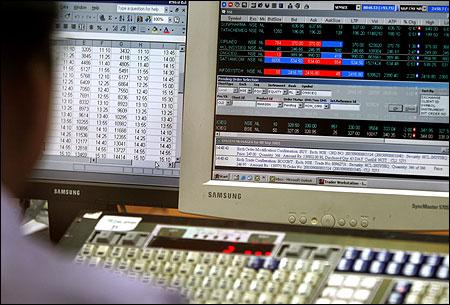

Indians who invest in foreign equities mainly look at US-based companies.

They do not look at other markets, as they don't know much about these and the economies.

Click NEXT to read further. . .

How to invest profitably in global markets

Some of the stocks the client in question has invested are LinkedIn, Apple, Google, Microsoft, AIG, Starbucks and Colgate-Palmolive.

Ask him why and the answer is, "He simply choses companies he has heard of".

This is true in most cases.

Indian investors look for names they are familiar with and whose products they have used.

Indians who've stayed abroad and worked there look at investing in shares of the companies they have worked for.

Click NEXT to read further. . .

How to invest profitably in global markets

"They do not, however, go for companies such as Gillette and Coke, as the share prices of these companies are fully valued and the potential for upside is very limited," says Ashish Kehair, executive vice-president and head, private wealth and international business, ICICI Securities.

Also, they do not bottom-fish, that is, buy cheaper stocks.

"Most have a bias for the home country.

"Then, the process of investing abroad is operationally cumbersome.

Click NEXT to read further. . .

How to invest profitably in global markets

"And, Indian broking firms do not have the research on companies listed abroad; therefore, investors do not get the kind of advice they require," says Prateek Pant, head- wealth solutions at RBS Private Banking.

Largely, ultra HNIs invest in foreign equities for portfolio diversification.

The Reserve Bank of India allows individuals an annual foreign investment limit of $200,000 or Rs 1 crore ($1 =Rs 50).

You need to approach a licenced foreign broker to invest in stocks abroad.

You will also need a bank account in the foreign country for all transactions, as you would have to transfer funds from your domestic account to the foreign one, from where the money would be transferred to your online trading account.

Click NEXT to read further. . .

How to invest profitably in global markets

To comply with the know-your-customer norms, you would have to give documents such as a PAN card, address proof and financial dossiers to establish your net income and so on.

You may also have to provide $5,000 (Rs 2.5 lakh) as a minimum deposit while opening the trading account.

The account opening charges may vary from nil to around $20.

Plus, there will be quarterly account maintenance and brokerage fees.

This entire account(s) opening process can take up to a month.

Any capital gains incurred through trading in foreign securities is taxable in India.

Click NEXT to read further. . .

How to invest profitably in global markets

In case of short-term gains (held for less than a year), you are taxed at slab rates.

For long-term capital gains, the rate would be 20 per cent with indexation.

Experts say the norms on indexation of capital gains on foreign securities are unclear. Still, financial planners discourage retail investors from entering this territory, as you need a lot of understanding to dabble in foreign markets.

"We do see clients who have had a good run in Indian markets showing interest in foreign markets.

"But, we make them understand that it can be very risky and the fund requirement is also higher," said a certified financial planner.