| « Back to article | Print this article |

How Sachin would have made you a richer investor

Just 320 runs. That's what the Indian cricket legend Sachin Tendulkar has scored in his last 10 innings in England.

For someone who has a Test match batting average of 56.25, with 51 centuries, spread over a record 181 Test matches, the recent form must be a cause for worry.

But does this poor form over the past 45 days make Tendulkar a bad player? A majority of us would say, 'No'.

But what about the poor run your stock market investments have seen over the past 45 days? The BSE Sensex has lost 10 per cent during this period.

Is this bad for a market that has risen by 405 per cent over the past 10 years, or on an average 18 per cent every year?

Click NEXT to read on . . .

How Sachin would have made you a richer investor

You would begin to appreciate things when you look at them in perspective, or in relation to something.

Like Tendulkar's current poor form in relation to his class.

Like the stock market's current poor run in relation to what it has earned for investors over the last 10 years.

But just like Tendulkar's form will return sooner than later, you can earn good returns from the stock markets in the long term.

You just need to be patient, and keep your faith.

Click NEXT to read on . . .

How Sachin would have made you a richer investor

Here are some quirky statistics to prove the point.

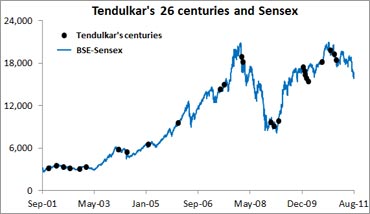

Of the 51 Test match centuries that Tendulkar has hit in his career, 26 have come in the past 10 years.

As a devoted fan, if you had invested Rs 10,000 in an index fund tracking the BSE Sensex one day after Tendulkar hit each of these 26 centuries, what would have been your performance to date?

Our calculations show that your total investment of Rs 260,000 would have turned to Rs 588,524 today.

That's a very good return of 126 per cent on your total investment.

Click NEXT to read on . . .

How Sachin would have made you a richer investor

And mind you, these returns have not come from any conscious thinking or analysis on your part. Nor have they come from following any advice dished out by financial advisors or stock market experts appearing on business channels every day.

You just invested the day after Tendulkar hit his centuries, and that's it.

This way, you not only invested when stocks were cheap in 2001-2003 and then in early 2009, but also when stocks were expensive in 2007-2008 and late 2010. In short, you were not trying to time the market.

See the graphic to the left (Data Source: Cricinfo, Yahoo Finance)

Keep playing the game

Tendulkar has devoted 22 years, or almost 60 per cent of his life, to the game of cricket. During this period, he has seen his form rise and fall.

Click NEXT to read on . . .

How Sachin would have made you a richer investor

But as you know, his class has remained higher than any other cricketer you have seen playing all these years.

This is also true of the stock market. While stocks prices, even of good companies, can be highly volatile in the short term, these track companies' sales, profitability, and competitive advantages over the long run.

So a good business will do well for its investors in the long run, a bad business can make its investors go bankrupt.

Ultimately, it's only the rational player (investor) who can reap the rewards of investing for the long term.

The daily dance of stock prices might be seductive, but it does you no good besides giving you a higher level of anxiety.

Click NEXT to read on . . .

How Sachin would have made you a richer investor

So just keep on playing the game like Tendulkar has done over the past two decades . . . not bothering about short-term declines in form but practicing to be a master in the long term.

There is no sense in making all-or-nothing decisions. Tendulkar must have never said, 'My team has been on a losing streak. So I won't play the next few matches.'

Remember, you miss 100 per cent of the shots you don't take, so getting on the back foot when markets are uncertain is not a profitable plan.

Staying in the game always has been, and always will be, the way to riches.

You may get out for a duck a few times. But this is the only way you'll get better at your game.

This is the best investing lesson you can learn from the God of cricket.