| « Back to article | Print this article |

All about EMI and loan repayment

To meet some of your goals like buying a car or building a home might require additional financial help in the form of a loan.

In the current scenario of rising interest rates, it is vital that you understand important elements in the loan-taking process.

What is an EMI?

An equated monthly installment is the amount of money that is paid back to the lender on a monthly basis.

It is essentially made up of two parts, the principal amount and the interest on the principal amount.

The EMI is always paid up to the bank or lender on a fixed date each month until the total amount due is paid up during the tenure.

You might assume that the equal parts of the principal and interest are repaid to the financial institution every month.

However, this not the case.

Click NEXT to read further. . .

All about EMI and loan repayment

During the initial years, the interest component is higher and during the latter years of repayment, the principal component is higher.

Therefore, if you think you have paid half of the amount borrowed from the bank in five years in a 10-year loan tenure, that would not be the case.

You would probably have reduced the total interest component considerably and would have only repaid the interest component for the most part.

Here is a simple example that explains how the repayment of your EMI reduces your loan amount during the repayment period leading up to the end of the loan tenure.

Click NEXT to read further. . .

All about EMI and loan repayment

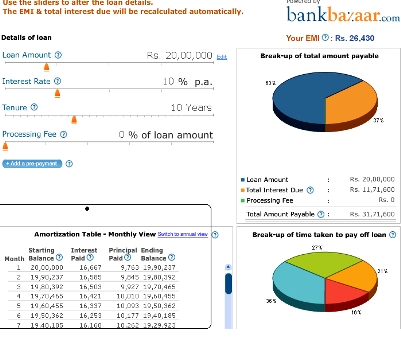

Here the loan amount is 20 lakhs (Rs 2 million), which is lent at an interest rate of say 10 per cent with loan tenure of 10 years.

The monthly EMI is calculated at the annualised rate of 10 per cent and amounts to Rs. 26,430 per month.

You will notice that the interest repaid decreases with each passing month and the principal repaid increases with each passing month.

In the case of large loan amounts with long tenures, the interest component will constiture the greater portion of the EMI, while the reverse is true for the principal component.

Remember to request your bank for an amortisation table, which will indicate at any point in time, what exactly your outstanding loan amount is!

Click NEXT to read further. . .

All about EMI and loan repayment

EMI and your income

Did you ever wonder why your EMI is generally restricted to 30 per cent or 40 per cent of your monthly income?

Here is why.

Salary details, qualifications, employer/business, years of experience, growth prospects, alternate employment prospects and sources of other income, if any, are all aspects that determine the amount of loan you are eligible for.

Generally, the repayment schedule is worked out in a manner that allows only around 40-50 per cent of your monthly take home income to be repaid as EMI.

It is thus restricted keeping the following factors in mind:

About 10 per cent of your income is spent on other loans, if you have any or if you avail one in the future.

Click NEXT to read further. . .

All about EMI and loan repayment

About 20- 25 per cent of your income could be deducted by way of statutory deductions and for investment purposes.

About 20-25 per cent of your income is generally spent to meet your monthly expenses.

This leaves back around 40-50 per cent, which is taken as your repayment capacity for your loan.

For self-employed applicants, profit is the benchmark that determines loan value.

The longer the time frame for repaying the loan the lower the EMI and this also means you can opt for a larger loan amount.

The loan amount you are eligible for is also dependent on other factors like the company you are employed with, city of residence and your credit history.

Click NEXT to read further. . .

All about EMI and loan repayment

A long term loan like a home loan is a debt that is part of your budget every month.

If you invest too much into it, there might not be adequate funds to manage a huge list of other expenses that will tend to accumulate with time.

For example, you need to make allowances for future expenses like education expenses for children, emergency funds for a job loss or the loss of one income in a situation where two people have taken a joint loan.

There might be spikes in interest rates.

In such a scenario, banks usually will increase the loan tenure in order to not put the loan taker in a tight spot by increasing his EMI.

However, in such a case if you have adequate funds in hand or when your income increases with time you could prepay at regular intervals, allowing scope for closing your loan early and reducing your total interest outgo.

It is best not to commit to a higher EMI that might cause a strain in your finances; rather it should be the other way around.

Powered by

BankBazaar.com is an online marketplace where you can instantly get loan rate quotes, compare and apply online for your personal loan, home loan and credit card needs from India's leading banks and NBFCs.

Copyright 2025 www.BankBazaar.com. All rights reserved.