| « Back to article | Print this article |

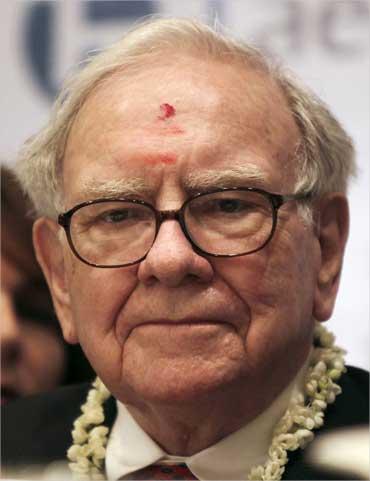

5 great investing lessons from Warren Buffett

In no chairman's annual statement to his shareholders will you find attached a letter from the chairman's grandfather to his uncles. This is what makes Warren Buffett's letter so unique.

Every value investor eagerly waits for this annual letter from Buffett, the chairman of Berkshire Hathaway, a group with a market cap of $208 billion. It holds companies in industries as diverse as insurance, airlines and candies.

We picked up Buffett's most recent letter to his shareholders and highlight just five lessons from this letter, though every line of it has something to teach.

Click NEXT to read on . . .

5 great investing lessons from Warren Buffett

Lesson 1

The market value and intrinsic value will converge, though it could take years. Stick to the rule of picking stocks below their intrinsic value.

Margin of safety: The doomsayers have suggested that in a 'new normal world,' future stock returns would not replicate past averages. But Buffett emphasises: "Market price and intrinsic value often follow very different paths -- sometimes for extended periods -- but eventually they meet."

Many academic research papers say the same thing, but coming from a practitioner who himself has made billions of dollars from stocks, it should instil your faith in equities.

Click NEXT to read on . . .

5 great investing lessons from Warren Buffett

However, note that deciding factor of stock returns is 'intrinsic value.' Buffett's philosophy in picking stocks is he buys 'a dollar bill at 40 cents'.

Here, 'a dollar' is the intrinsic value, and if you buy a stock worth a dollar at 40 cents, you can hope to make profits. The huge discount at which you are buying the stock is called 'margin of safety.'

But how do you find the intrinsic value of a stock? Buffett measures the performance of his company's stock using 'book value' (we guess he must be using similar tools to measure the performance of many of his other investments too).

Combine the two things and it suggests that you could make profits if you are able to pick a stock trading below its book value.

However, you should use book value selectively. In some cases, book value is not a good proxy to the company's value, for instance, in IT companies whose main resources are humans.

Click NEXT to read on . . .

5 great investing lessons from Warren Buffett

Lesson 2

Derivatives are not all that bad. But they can be 'weapons of mass destruction', if not understood properly.

"Derivatives are weapons of mass destruction." Buffett has been quoted saying so in the aftermath of the credit-led financial crisis of 2008. Some of his critics believe this is misleading, as Buffett's company Berkshire Hathaway itself has forged many derivative contracts.

The latest financial statement of the company reports 203 of them. But there is something very unique to them.

His company has 39 'equity puts' on global indices such as S&P 500 and FTSE 100. This means he has sold insurance to investors who fear against the fall in these indices.

Obviously, looking at the present uncertainties, the odds of these indices falling is significant. But the duration of these contracts is as long as 10-15 years, highlighting Buffett's belief that equity delivers in the long term.

Click NEXT to read on . . .

5 great investing lessons from Warren Buffett

Assume a slack period for equities through this new decade and that the S&P 500 and FTSE 100, after 10 years, remain at the level where they are today.

Buffett would lose absolutely nothing. In fact, Berkshire would make a huge profit. The company raked in a premium of $4.2 billion from selling these puts.

If the indices remain at the same level, Berkshire would lose $3.8 billion, which is the settlement value of the contract. The net gain is, therefore, $400 million!

Berkshire also designed the contracts to its advantage, in such a way that it does not have to pay any collateral for these contracts.

Can you do the same? First, let's admit that very few of us properly understand the risk when we enter into derivatives contracts. It's true for companies too.

Hexaware Technologies and Ranbaxy Laboratories suffered huge losses due to these complex instruments.

Also, you can't take such a long view in India. Contracts are of shorter duration, and you can only roll it over, further complicating the matter. Also, in derivative contracts, you pay margin, which can ruin your wealth if the value of underlying asset moves in an unexpected direction.

Click NEXT to read on . . .

5 great investing lessons from Warren Buffett

Lesson 3

Management matters. It decides how the company will use retained earnings. If a company's stock can't deliver return higher than the index, you are better off holding the index.

Management is important

Buffett benchmarks the performance of his company to S&P 500. If stocks of Berkshire are not able to deliver a return higher than S&P 500 consistently over the long term, the shareholders would be better off investing in an index fund.

Buffett says managements "should establish performance goals at the onset of their stewardship. Lacking such standards, managements are tempted to shoot the arrow of performance and then paint the bull's-eye around wherever it lands."

You carefully go through press releases of Indian companies and transcripts of analyst conferences after every quarterly result, and quite often you would observe this phenomenon.

But firms with good management, like Infosys Technologies, give some guidance on their future performance, even though it's for the short term.

Click NEXT to read on . . .

5 great investing lessons from Warren Buffett

Lesson 4

Avoid companies with large debt. Debt woes can bring a company to its knees.

"Life and debt." Debt can magnify losses as much as it can magnify gains. Buffett has another reason to worry about. He cautions: "Leverage is addictive."

It's worth mentioning that the analogy Buffett draws: "And as we all learned in third grade -- and some relearned in 2008 -- any series of positive numbers, however impressive the numbers may be, evaporates when multiplied by a single zero. History tells us that leverage all too often produces zeroes, even when it is employed by very smart people."

Click NEXT to read on . . .

5 great investing lessons from Warren Buffett

Lesson 5

Maintain liquidity. It cushions you in bad times and gives you chance to buy aggressively when others are down.

The simple message in Buffett's grandfather's letter to his sons was to save cash. Every year, he added some money to a corpus till it amounted to $1,000, which his children could use when they needed it quickly.

Buffett and his company follow this message religiously. He either keeps cash or buys US Treasury Bills. This helped his firm after Lehman Brothers collapsed.

It also gave him the chance to buy when others were down.