| « Back to article | Print this article |

4 infra stocks that have become darlings of D-street

Taking a plunge into low-quality or fundamentally weaker infrastructure stocks, they are up more on hopes and increased traders’ interest, could cost investors dearly.

That’s because many infra companies continue to face serious issues in terms of both earnings and balance sheet.

The CNX Infra index is up almost 12 per cent in a month but individual stocks are up as much as 40 per cent, on hope that the sector could revive in the coming months, led by a stable government after the elections.

While the optimism is not without reason, safety of capital at this point in time is more important, given the unpredictability of an election outcome, and the fact that interest rates will remain elevated till the end of 2014.

Investors, thus, will do better while sticking to safety now and adding risk (weaker names) after clarity emerges after the elections in May.

Click NEXT to read more....

4 infra stocks that have become darlings of D-street

Companies such as GMR, GVK, IVRCL, NCC and JP Associates, among the leading ones in their businesses, face issues on the debt front. This, low cash generation and the burden of interest has led to pressure for many of these.

In fact, interest costs take away a large part of the operating profits for some of these. IVRCL, for instance, reported a PBIDT (profit before interest, depreciation and taxes) of Rs 139 crore (Rs 1.39 billion) during the nine months ending December 2013, while interest outgo was Rs 441 crore (Rs 4.41 crore), a net loss of Rs 389 crore (Rs 3.89 core).

Thus, the fortunes of many of these largely depend on ability to lower debt and monetise assets in a timely manner, beside a pick-up in economic activity and fall in interest rates.

On the other hand, there are companies -- IVRCL, Lanco, Reliance Infrastructure, HCC-- which also face regulatory hurdles. Many of the concerns might not get resolved soon, believe analysts.

Click NEXT to read more....

4 infra stocks that have become darlings of D-street

Amit Srivastava, who tracks the infra sector at Nirmal Bang Equities says, “The market is hoping for a stable government after the elections. The focus of the new government will be on power and infrastructure because that has the ability to revive the growth. Though there are reasons to be optimistis, not all the companies deserve re-rating, as many have balance sheet issues which could take a longer time to resolve.”

Click NEXT to read more...

4 infra stocks that have become darlings of D-street

Here are four stocks, which stand apart in this segment:

Engineers India

Due to its exposure to the hydrocarbon sector, particularly in public sector projects, Engineers India was able to maintain a high sales growth of 27 per cent annually and on an average, generated cash of about Rs 400 crore (Rs 4 billion) from operations over each of the five years ending FY13.

Although revenue growth has been under pressure in FY14 so far, it continues to generate positive cash flow. For the nine months ended December 2013, while it posted revenue of Rs 1,329 crore or Rs 13.29 billion (down 33 per cent), net profit was Rs 376 crore or Rs 3.76 billion (down 16 per cent year-on-year).

Given the expected investments in the hydrocarbon segment, the long-term prospects remain healthy.

Click NEXT to read more.....

4 infra stocks that have become darlings of D-street

Importantly, its business does not require much capex, due to which the company is almost debt-free and generates a strong return on equity of about 30 per cent.

As result it has also been rewarding its shareholders with generous dividends.

Currently, the stock is offering close to four per cent dividend yield and is trading at a price to earnings multiple (PE) of 11 times, which is reasonable.

In terms of growth, the company is well placed to take advantage of future capex in the hydrocarbon sector.

The order book, at Rs 3,800 crore ( Rs 38 billion) or 1.5 times its FY13 sales, provides good revenue and earnings visibility in the medium term.

Click NEXT to read more...

4 infra stocks that have become darlings of D-street

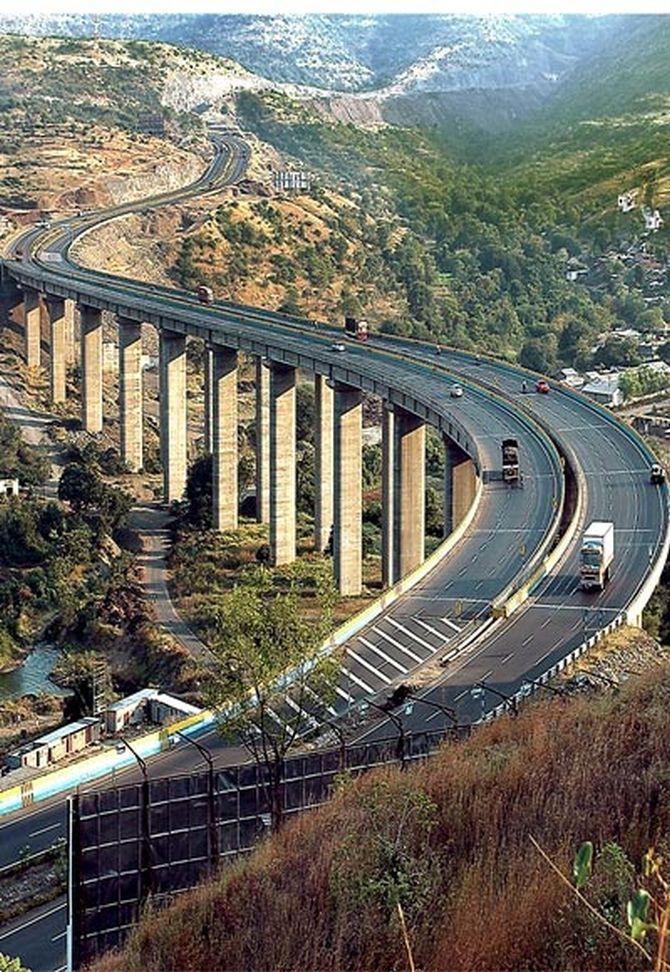

IRB Infrastructure Developers

There are doubts over revival of the road sector in the near term, plus concerns over pick-up in execution.

But, whenever the sector revives, companies like IRB Infrastructure are well placed to take advantage, considering their capabilities and balance sheet strength. IRB does not have any major balance sheet issues, with as FY13 debt-equity ratio of 1.13 times and interest coverage ratio of over two times.

That apart, it is sitting on huge operational BOT (build-operate-transfer) road assets which generate enough cash flow and profits, enabling the company to face any sector downturn. At Rs 100, the stock is currently trading at seven times earnings and offers a reasonably attractive dividend yield of almost five per cent.

Click NEXT to read more....

4 infra stocks that have become darlings of D-street

Larsen & Toubro

Larsen & Toubro’s leadership in the sector, balance sheet strength, diversification in terms of geographies and segments, and strong order book (2.2 times FY13 consolidated revenues) provide comfort.

Analysts believe FY15 should see better growth, given the expected revival in earnings and order book.

Additionally, the company is expected to do well with the restructuring of some of its businesses and subsidiaries, marginal gains on the margin front and possible monetisation of stake in L&T Infrastructure Development Projects and DhamraPort.

“Post a 50 per cent stock up-move, we believe there is still a lot of steam left and we remain ‘Buy’ on the stock. L&T looks set to grow sales by 15 per cent (yearly) over FY14-16, with stable margins.

Also, domestic capex should rebound in early FY16 and we believe L&T will emerge stronger from recent Indian economic deceleration and outperform peers when the economy accelerates,” said Venkatesh Balasubramaniam, who tracks the company at Citi Research.

The bullishness also stems from the fact that if a domestic economic rebound takes time, L&T has the ability to pick up international orders, which it is already doing.

Click NEXT to read more....

4 infra stocks that have become darlings of D-street

VA Tech Wabag

Within the infrastructure space, VA Tech Wabag is a promising water technology solution provider.

Its presence in the water and waste water industry helps it remain relatively insulated from any slowdown.

Additionally, its exposure to international markets (particularly the developing world), wherein orders for water treatment and sanitation projects funded by international funding agencies continue to flow, provides confidence.

That apart, the dependence on debt is low, as it continues to generate good operating cash flow, while the requirement for capex to sustain growth is low.

Thankfully, business prospects have been improving. In the first nine months ending December 2013, the company bagged orders worth Rs 3,048 crore (Rs 20.48 billion) versus its earlier expectation of about Rs 2,700 crore (Rs 27 billion) for the full financial year.

On its annual revenue of Rs 1,618 crore (Rs 16.18 billion), the order book is almost Rs 6,000 crore (Rs 60 billion) or 3.7 times, which is good enough and provides revenue visibility for the next three years.