| « Back to article | Print this article |

12 nations that are BURSTING with opportunity!

Consumers' spending urge is fast emerging to be a new area of interest for surveyors across the world.

According to a report by global management consulting firm A T Kearney, 12 countries at the moment are bursting with opportunity.

The firm reviewed 30 emerging markets, their risk profiles, and potential for consumer growth.The rankings have changed significantly over last year because of global recession.

Though Asia led the recovery, Latin America saw the largest overall increase in the index.

Click NEXT to know more about 12 nations where people are set to go on a shopping spree. . .

12 nations that are BURSTING with opportunity!

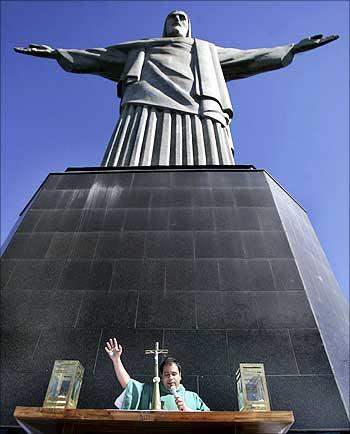

Rank 1: Brazil

The Brazilian economy is the world's eighth largest economy by nominal gross domestic product and the eighth largest by purchasing power parity.

Brazil is one of the world's fastest growing major economies.

The upcoming Olympics and World Cup are expected to see up to $50 billion in investment.

Large real estate investment have also helped the retail sector.

The biggest challenges for international retailers are high import taxes and seasonal differences.

With a 79.4 rating, Brazil has lower risk than other BRIC countries -- Russia, India, China nations India and China.

Click NEXT to read further. . .12 nations that are BURSTING with opportunity!

Rank 2: Uruguay

Uruguay was the only country in the Americas which did not go into recession (two consecutive quarters of retraction) as a result of the late-2000s financial crisis.

Uruguay is reimbursed by the United Nations for the majority of its military spending, because the majority of its military is deployed as UN Peacekeepers.

Uruguay's economic success has been tied to Brazil and Argentina and with rapid economic growth in recent years, and an urban population the retail sector looks positive.

The country has a 73.8 risk rating and investors need to be wary of the fact that the market for large and international retailed is largely focused in Montevideo.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 3: Chile

Chile is now considered to be one of Latin America's most competitive markets.

It is one of South America's most stable and prosperous nations and a recognised middle power.

It leads Latin American nations in human development, competitiveness, income per capita, globalization, economic freedom, low perception of corruption and state of peace.

A young, urban population and rising middle-class purchasing power is expected to boost retail sector growth by 10 per cent in 2011 alone.

Chile's risk rating is 100.

Its political environment is fairly stable.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 4: India

India's burgeoning middle class has boosted consumer spending in the country.

India's risk rating of 59.9 reflects the country's tight foreign direct investment regulations.

The Indian economy is the world's 10th largest by nominal gross domestic product and fourth largest economy by purchasing power parity.

Organised retail which only accounts for 7 per cent of the market is expected to jump to 20 per cent by 2020.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 5: Kuwait

The country has the world's fifth largest oil reserves and petroleum products now account for nearly 95 per cent of export revenues, and 80 per cent of government income.

The country has a 80.6 risk rating.

Kuwait is the 11th richest country in the world per capita.

The demographic trends have seen its retail sector grow 8 per cent every year over the last five years.

Moreover, high salaries for government jobs, low utility costs and welfare provisions have kept disposable income high.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 6: China

China has $2.1-trillion retail market

The biggest challenge in Chinese market is achieving profitability.

China's risk rating stands at 76.5.

Consumers remain optimistic about personal income levels though rising inflation and key rate hikes by the central bank remain the daunting challenges.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 7: Saudi Arabia

Saudi Arabia has an oil-based economy with strong government control over major economic activities.

Saudi Arabia possesses 25 per cent of the world's proven petroleum reserves, ranks as the largest exporter of petroleum and plays a leading role in Organization of Petroleum Exporting Countries.

Consumer confidence is high in Saudi Arabia.

The country has a risk rating of 80.7.

The country has a young population with high discretionary income.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 8: Peru

Peru is a developing country with a market-oriented economy.

According to 2010 data, 31.3% of its total population is poor, including 9.8% that is extremely poor.

It has a high Human Development Index score of 0.723 based on 2010 data.

Historically, the country's economic performance has been tied to exports, which provide hard currency to finance imports and external debt payments.

Although they have provided substantial revenue, self-sustained growth and a more egalitarian distribution of income have proven elusive.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 9: United Arab Emirates

The United Arab Emirates has recovered well from the global recession and tourism.

The UAE is a founding member of the Cooperation Council for the Arab States of the Gulf, and a member state of the Arab League.

It is also a member of the United Nations, the Organisation of the Islamic Conference, the OPEC, and the World Trade Organisation.

Consumer spending was up 9 per cent in 2010 but is lower than pre-crisis levels.

UAE is the preferred entry point for the region but the market is heavily saturated. With a risk rating of 88.9, the country has low political and business risks.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 10: Turkey

With a 65.5 risk rating, Turkey is an attractive market for retailers.

Although Turkey has made a good start at addressing its energy problems; some analysts feel that more attention needs to be paid to conservation and pricing policies to limit the growth of demand.

In Turkey, industry is the major consumer of energy, and industrial consumption is expected to grow rapidly if left unchecked.

Turkey jumped eight spots to 10th place in this year's rankings, thanks to rapid economic recovery.

The demand for convenience shopping is surging but the market already has aggressive domestic and international competition.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 11: Lebanon

The country has a 43 risk rating.

With its recent investment in new malls, 7 per cent compound annual growth rate and liberal consumers, Lebanon has emerged as an attractive market.

The country is known for its commercial networks throughout the world.

As a result, remittances from Lebanese abroad to family members within the country total $8.2 billion and account for one fifth of the country's economy.

Lebanon has a high proportion of skilled labour comparable to most European nations and the highest among Arabic speaking countries.

Click NEXT to read further. . .

12 nations that are BURSTING with opportunity!

Rank 12: Egypt

Egypt's retail market is expected to grow 10 per cent over five years with more than 80.4 million people gaining in purchasing power.

Egypt's 49.5 risk rating represents high business and political risk.

The economy of Egypt is one of the most diversified in the Middle East, with sectors such as tourism, agriculture, industry and service at almost equal production levels.

In early 2011, Egypt underwent a revolution, which resulted in the ousting of President Hosni Mubarak after nearly 30 years in power.