| « Back to article | Print this article |

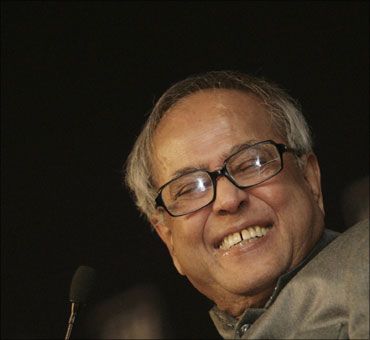

No White Paper on black money, says Pranab

The government on Tuesday told Parliament that it does not propose to bring out a White Paper on black money.

"There is no proposal to publish any White Paper on black money," Finance Minister Pranab Mukherjee told the Rajya Sabha in a written reply.

White Papers, which are issued by the government, lay out the policy or proposed action on topics of current concern.

The minister, however, said that the government has commissioned a study on black money by three national-level institutions.

Click NEXT to read on . . .

No White Paper on black money, says Pranab

The institutions -- the National Institute of Public Finance and Policy (NIPFP), National Council of Applied Economic Research (NCAER) and National Institute of Financial Management (NIFM)-- were given 18 months to complete the study on black money.

Mukherjee further said the government has constituted a committee headed by the chairman of the Central Board of Direct Taxes to suggest strengthening of laws to "curb generation of black money in India, its illegal transfer abroad and its recovery."

The committee, he added, will examine the existing legal and administrative framework to deal with the menace of generation of black money through illegal means.

Click NEXT to read on . . .

No White Paper on black money, says Pranab

He further said that the committee was given six months' time to submit its report.

It will also examine the feasibility of declaring wealth generated illegally as national assets, enacting laws for confiscation and recovery of such assets and making provisions for exemplary punishment of perpetrators.

In a separate reply to the Rajya Sabha, Minister of State for Finance S S Palanimanickam said the Income Tax Department has seized undisclosed assets to the tune of Rs 2,289 crore (Rs 22.89 billion) during the last three financial years (2008-09, 2009-10 and 2010-11).

Click NEXT to read on . . .

No White Paper on black money, says Pranab

"The Income Tax Department takes several punitive and deterrent steps to unearth unaccounted money and curb tax evasion," Palanimanickam said.

He added that the IT Department conducts scrutiny of tax returns, surveys, search and seizure actions, as well as imposes penalties and launches prosecution in appropriate cases.

The government has already adopted a five-pronged strategy to deal with generation of black money.

Click NEXT to read on . . .

No White Paper on black money, says Pranab

The steps comprised joining the global crusade against black money, creating an appropriate legislative framework and setting up institutions for dealing with illicit funds, developing systems for implementation and imparting skills to the manpower for effective action.

Palanimanickam said that as of March 31, 2011, the amount of tax locked up in litigations amount to Rs 1.03 lakh crore (Rs 1.03 trillion).

"The government has taken several steps to reduce litigation, such as raising of monetary limits for filing appeals, prescribing standard operating procedure and developing alternative dispute redressal channels," he added.