| « Back to article | Print this article |

No let up in economic reforms: Pranab

Finance Minister Pranab Mukherjee on Monday strongly refuted observations by US think-tanks, the government and industry that India has gone slow on economic reforms and insisted that a series of reforms are in the process, which will lead to the next round of growth.

However, Mukherjee observed that reforms in India require political consensus, which is being worked upon by the government led by Prime Minister Manmohan Singh.

Reform is a continuous process and the United Progressive Alliance government is committed to it.

Click NEXT to read further. . .

No let up in economic reforms: Pranab

"The more you reform, there is the need for additional reform," he argued addressing a meeting of India and American corporate leaders, policy makers and think-tank members at a conference on the 'US-India Economic and Financial Partnership' jointly organised by the Confederation of Indian Industry and Brookings Institute, a Washington-based think-tank.

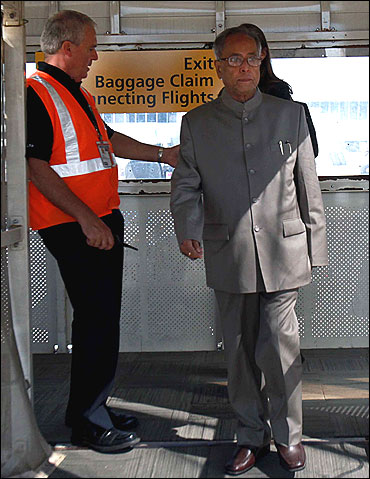

"We have taken certain steps, as I was talking of structural reforms," said Mukherjee, who arrived in Washington on Monday leading a high-powered Indian delegation for the second India-US Economic and Financial Partnership discussions being held in Washington.

"We have recently finalised the guidelines of the debt bonds. We have also decided that. . . foreign direct investment to be more user-friendly (and) all prior regulation and guidelines have been consolidated into one comprehensive document which is reviewed every six months.

Click NEXT to read further. . .

No let up in economic reforms: Pranab

"This has been done with the specific intent of enhancing clarity and predictability of our FDI policy to foreign investors," he said.

"Ownership and control is now central to the foreign direct investment policy and the methodology in this regard has been clearly defined.

Discussions are currently underway to build consensus on further liberalisation of the FDI policy," he said.

Certain important legislations for reform of banking regulations, enhancement of FDI in the insurance sector and pension fund regulation were introduced in the last session of Parliament, he said, hoping that it would be possible to get these legislations cleared expeditiously by Parliament.

Click NEXT to read further. . .

No let up in economic reforms: Pranab

"But I was mentioning to Secretary Geithner that in our system, we ought to have the consensus from the other parties, because we do not have the simple majority to get the laws passed in our Parliament.

"The talks to develop a consensus are going on and I do hope it will be possible. With the help of the parties concerned, we would be able to get these legislations passed," Mukherjee said.

In the areas of taxations, New Delhi, he said, has undertaken two major reforms.

"In direct taxes, it is under the scrutiny of the parliamentary standing committee and I do hope that from the next financial year, we will be able to operationalise it," he noted.

Click NEXT to read further. . .

No let up in economic reforms: Pranab

"With respect of another reform, goods and services tax, (on) which we are trying to evolve a consensus, because of our constitutional practice, these are areas of taxation which the constitution has authorised the federal and provincial governments to enforce taxes on certain items.

"Unless the states agree and a constitutional amendment is introduced and passed, this is not possible to make it effective," he said.

And for that constitutional amendment, the central government requires a special majority and concurrence of 50 per cent of the provincial government.

"Therefore, the consensus among the major political parties is absolutely necessary. It would be a very important reform if we are able to get this legislation passed.

"We are working on that and if we are in a position to get this legislation passed, to my mind it will be a major reform," he said.

Click NEXT to read further. . .

No let up in economic reforms: Pranab

"Another important reform we have decided to introduce is the mutual funds to directly attract investment from foreign investors who meet the KYC guidelines, know-your-plans guidelines with a view to facilitate investment opportunity in India.

"Earlier, these windows were available only to foreign institutional investors," he said.

"Along with these in two stages, the ceiling for investment by foreign institutional investors into corporate bonds has been increased from the existing $15 billion to $40 billion.

The finance minister said during the next five years, the infrastructure requirement would be up to the tune of $1 trillion, 50 per cent of which would come from the private sector.

"Naturally, we do expect that (given) these various measures including the PPP project and the recent guidelines which we have issued for the debt funds, it would be possible for the private sectors to come and make investment.

"In order to make PPP projects successful, we are providing support through a viability funding mechanism, which is quite attractive," he said.