Photographs: Reuters BS Reporter in New Delhi

Amid investors pinning hopes on a Narendra Modi-led government at the Centre, leading equity research firm Credit Suisse on Thursday said an election verdict in favour of the Bharatiya Janata Party wouldn’t help kick-start investments, as only a quarter of the stalled projects required clearance from the Centre.

In its report Elections: Much Ado About Nothing, Credit Suisse said many projects were stuck due to factors that involved state governments, demand-supply issues or other project-specific constraints.

. . .

Modi-led govt may not boost economy, says Credit Suisse

Image: Supporters of Gujarat's chief minister Narendra Modi wear masks of Modi during a rally in Chennai.Photographs: Babu/Reuters

It is probably the first time a global firm has discounted Modi’s impact on the economy; earlier, brokerages such as Goldman Sachs and Nomura were upbeat on the BJP coming to power after the Lok Sabha elections.

“We disagree with the consensus view elections can revive the investment cycle.

“Only a fourth of projects are stuck with the central government, and two-thirds of these are in power and steel, both wracked with massive overcapacity; thermal power utilisation is at two-decade low.

“Only state governments can revive power demand. Even elsewhere, solutions will take years,” Credit Suisse said.

According to the agency’s estimates, of projects worth Rs 83 lakh crore (Rs 83 trillion) under implementation, 437 projects, involving an investment of Rs 21 lakh crore (Rs 21 trillion), were before the Cabinet Committee on Investment.

. . .

Modi-led govt may not boost economy, says Credit Suisse

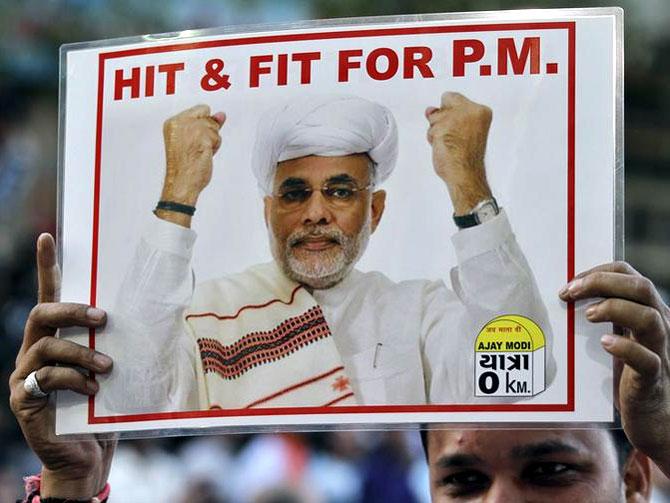

Image: Narendra Modi is the overwhelming favourite with a whopping 77 per cent of the 25 corporate leaders surveyed opting for him.Photographs: Reuters

In the 15 months since CCI was set up, it has cleared projects worth Rs 5 lakh crore (Rs 5 trillion), while projects involving an investment of Rs 16 lakh crore (Rs 16 trillion), primarily in the power, steel and coal sectors, await approval.

Credit Suisse said for the government, fiscal stress would continue, as receipts from income tax and corporation tax were volatile, while expenditure was mostly non-discretionary.

It, however, added capital inflows would continue, as India was better placed than other emerging economies, in terms of earnings, growth and falling inflation.

Capital inflows could drive mild gains in the rupee and a drop in wholesale funding costs, though these might not aid damaged balance sheets, it said.

. . .

Modi-led govt may not boost economy, says Credit Suisse

Image: Narendra Modi.Photographs: Reuters

The agency said there could be four scenarios -- the BJP and its allies securing more than 220 seats; 200-220 seats, 180-200 seats, less than 180 seats in the Lok Sabha.

On three phases -- the run-up to the election results (from January), three months after the elections (up to August) and the period till the year-end (up to December) --, it said, “The unjustified rally in financials and industrials is likely to continue in the first phase and unwind in the third. . . The uncertainty is on the second phase, which will depend on the electoral verdict.

Opinion polls project the most positive of these: a greater-than-220-seat verdict for the BJP+.

Such a verdict (less likely than market consensus, in our view) will fuel a continuation of the rally in cyclicals.

A less-than-180-seat verdict for the BJP+ (low probability) is likely to lead to a major market correction.”

article