SI Reporter in Mumbai

Markets ended in the red, after recovering marginally from the day's low on weak cues from global peers.

The Sensex opened weak, following selling pressure in the Asian markets.

The Sensex touched a high of 16,256 and a low of 16,056.

The index finally ended at 16,151 - down 302 points. Nifty lost 94 points to end at 4,850.

Asian bourses were down on Monday, extending Friday's fall on concerns about the world economy and the lack of a credible solution to Europe's debt crisis.

The Hang Seng shed 4.3% to 16,822. Jakarta Composite dropped 5.6% and Nikkei shed 1.7% to 8,545.

Back home, investors opted to play it safe and remained on the sidelines ahead of the quarterly results of India Inc.

The corporate numbers for the july-September quarter will start trickling in with Infosys on October 12.

Data showed that India's exports maintained their growth momentum in August, 2011, rising by 44.2% year-on-year to $24.3 billion despite the economic woes in traditional Western markets.

Imports, too, grew by 41.8% to $38.4 billion in August, translating into a trade deficit of $14 billion, or 3.1% of the GDP during the month.

Nomura, in its latest report suggests that it expects the current account deficit to remain substantial.

"We expect both merchandise and services export growth to moderate against the uncertain global backdrop, even though imports growth should also slow reflecting the recent correction in commodity prices," the report states.

In other news, monsoon rains at the end of the June-September season were 1% above normal, raising hopes of improved crop supplies.

All the sectoral indices ended in the red today with BSE realty, metal and bankex dropping 3-4.5% each.

Auto shares recovered from the day's lows on strong sales numbers from most of the companies.

Click on NEXT for more...

Markets end lower on global cues

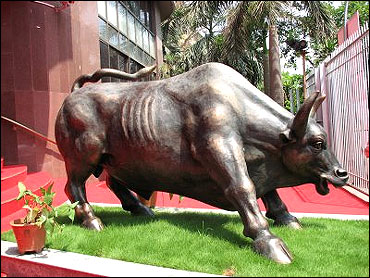

Image: The bull in front of the BSE building.Among specific stocks, Dainik Bhaskar picked up a 2.7% stake in IT training services provider, Edserv Softsystems for Rs 15 crore (Rs 150 million).

Edserv slipped to a 52-week low of Rs 90.

Reliance Power is likely to earn Rs 2,000 crore (Rs 20 billion) by trading carbon credits from its Tilaiya ultra mega power project during the first 10 years of its operations. The stock was up 1.3% at Rs 78.

Other Reliance ADAG group stocks were in the green after witnessing a steep fall in the previous session on reports that the Central Bureau of Investigation has given a clean chit to a group chairman Anil Ambani, in the structuring of different firms and transfer of funds relating to Swan Telecom, in 2G scam.

Reliance Infrastructure, Reliance Capital and Reliance Communications jumped 1-2% each.

Mahindra & Mahindra added naerly 1% to Rs 809 on a 25% rise in total sales to a record 44,137 units. Bajaj Auto and TVS Motors from the two-wheeler pack also moved up.

Maruti Suzuki pared early gains and was down marginally at Rs 1,080.

The company's 30-day standoff between management and labour at the Manesar plant has come to an end.Meanwhile, DLF remained the biggets Sensex loser, down 8% at Rs 201.

Metal names, Jindal Steel, Hindalco and Tata Steel dropped 4-6% each. Tata Power, Jaiprakash Associates and Sterlite declined over 3% in trades.Heavyweights, ICICI Bank, Reliance and Infosys accounted for a loss of 128 points on the Sensex.

The BSE market breadth was negative.

Out of 2,894 stocks traded, 1,906 stocks declined while 876 stocks advanced.

article