Abhay Rao in Mumbai

Value deals are available at Rs 2-10 lakh, giving investors an opportunity to make some good buys.

Over the past few years, art has become an important alternative asset for many high net worth individuals (HNIs).

A recent world wealth survey by Merrill Lynch and Capgemini said such assets as a part of HNI portfolios were up from six per cent in 2009 to nine per cent in 2010.

For those art investors who like adding works to their collection and portfolio rather than invest in art funds, current market conditions offer many opportunities.

...

Looking for new investment options? Consider Art

Photographs: Courtesy, Artflute

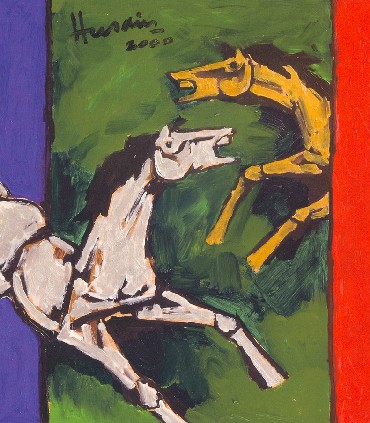

"For an investor, quality matters. The small format works of modern artists like Raza and Hussain, or good works by mid-level modern artists like Arpita Singh and Jogen Chowdhury who have shown in the past that their works do appreciate in value, are good areas to look into", says Dinesh Vazirani, CEO and co-founder, Saffronart.

The Indian market has quite a few serious art collectors. Good works by the top modernists are going for astronomical prices. On the other hand, non-Indian buyers are favouring top contemporary artists.

This leaves a decent gap for investors, who can look to add pieces of good modernists. These artists may not be in the top rung, but are reputed.

...

Looking for new investment options? Consider Art

Collector-Driven

The current market is very focused on specific works and collections, as it is driven by collectors who are willing to pay top billing for the works they want. This has kept the art market in India alive despite the slowdown blues.

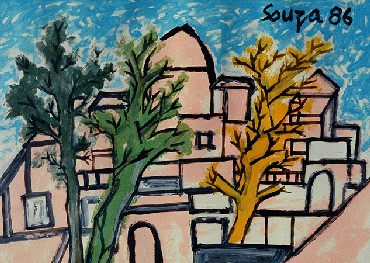

Last year was a major comeback for Indian art, with modern masters such as Raza, Hussain and Souza notching sales worth $45 million.

While works by Hussain and Raza sold at an average price twice as high as the 2005 levels, the demand for Souza remained strong, maintaining average prices of almost $115,000.

Tyeb Mehta and Ram Kapoor have not yet soared to the same highs they had previously. However, this too might turn around, with Mehta's Untitled (Kali) fetching Rs 5.72 crore in the recently concluded Saffronart auction.

...

Looking for new investment options? Consider Art

Also, modern artist Akbar Padamsee set a new record for himself only last month, by selling a painting for $1.43 million at the Sotheby's New York sale, reaffirming the sense of investing in Indian modern artists.

With the focus high on the top three Indian modernists, and with the recent passing of M F Hussain, the collectors are going after good pieces by these artists more aggressively.

This leaves an array of other modern artists for one to look at, as well as the contemporary artists establishing themselves in the many forms of art, mixed media and statues.

The resale value of most Indian artists has been high and they have over the past five years constantly surpassed expectations.

...

Looking for new investment options? Consider Art

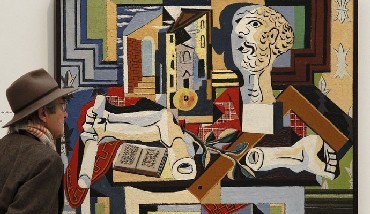

Photographs: Stefan Wermuth/Reuters

The main reason behind the dynamic thrust on the masters is because contemporary valuations have been too high.

"For an investor, a value proposition needs to be seen. At current levels, contemporary artists like Jitesh Kallat for Rs 30-40 lakhs, Subodh Gupta for Rs 90 lakh-1 crore or a Bharti Kher for Rs 40-50 lakh makes sense. Also, Jyoti Swaroop and other lesser known masters are good investments," says Ajay Seth, chief mentor, Copal Art. There are good deals available in the range of Rs 2-10 lakh as well (see chart).

Some financial planners, on the other hand, are still sceptical about alternative assets as such, and the Osian fund debacle didn't help matters.

"Some investors have been inquiring about alternative asset investment options. However, apart from real estate as an alternative asset, we are by and large advising people against investing in higher risk areas, especially in unregulated sectors," says Gaurav Mashruwala, certified financial planner.

article