Katharine Houreld

Pakistan's chaotic financial heart is home to 18 million people, Taliban bombers, contract killers - and one of the world's most successful stock markets.

With 49 per cent returns in 2012, the Karachi Stock Exchange (KSE) was one of the five best performing markets in the world.

Now it is seeking a foreign partner to buy a stake and take over management of a market that has risen three-fold over the past four years.

At least some of that performance came on the back of a government amnesty that allowed people holding undeclared assets or "black money" to invest it freely in the market. And, the relatively illiquid market has also been vulnerable to manipulation.

(Additional reporting by Abhishek Vishnoi in Mumbai, Editing by Bill Tarrant)

...

Why Karachi is among the world's best stock markets

Image: An investor talks on his mobile phone while sitting near an electronic board displaying stock prices at the Karachi Stock Exchange.Photographs: Akhtar Soomro/Reuters.

But government officials say the market's success highlights the economic potential of a country better known for spiralling sectarian violence, the war against al Qaeda and the Taliban, crippling power cuts and entrenched corruption.

The market's benchmark index continues to soar to record highs -- up 10.34 per cent year to date - fuelled in part by expectations May elections will mark Pakistan's first transfer of power from one democratic government to another.

Previous civilian governments were all dismissed by Pakistan's ultimate power: the military.

...

Why Karachi is among the world's best stock markets

Image: Brokers react as they monitor stock prices at the Karachi Stock Exchange.Photographs: Akhtar Soomro/Reuters.

"Pakistan has a lot to offer investors and this is our chance to show it," said Nadeem Naqvi, the KSE chairman. He plans to embark on a series of road shows for potential foreign partners that will take him to London, Frankfurt and Hong Kong in the coming months.

Many of the companies listed on the KSE offer double-digit returns, low stock prices and resilient business models in this frontier market with a population of 180 million. The index still has an attractive price/earnings ratio of $8.50 (٣.5) despite the soaring returns of the past few years.

Pakistan now has a four per cent weighting in the MSCI Frontiers Market Index and has become somewhat of a discovery for foreign investors chasing new markets and yields.

...

Why Karachi is among the world's best stock markets

Photographs: Reuters.

The seamier side

But the KSE's spectacular rise last year can at least be partly attributed to another factor entirely - the cleansing of "black money".

The market took off last year just as a government decree was finalised allowing people to buy stocks with no questions asked about the source of the cash. Average daily volume more than doubled last year to 173 million shares from 79 million in 2011.

Authorities say the measure will bring undocumented funds into the tax net in a country where few pay taxes. But some critics decried it as a gift to corrupt officials and criminals seeking to launder dirty cash.

"Politics and dirty money go hand in hand in Pakistan," said Ikramul Haq, a Supreme Court lawyer and a professor on tax law.

"People want to be outside the regulatory framework and outside the tax net."

...

Why Karachi is among the world's best stock markets

Image: A view of Karachi Stock Exchange.Photographs: Akhtar Soomro/Reuters.

The black money amnesty also drew attention to the seamier side of the Karachi stock market. Interviews with regulators, brokers, market officials and analysts showed insider trading and other manipulations are routine. Regulators have been largely ineffectual in controlling the shady practices.

The Securities and Exchange Commission of Pakistan (SECP) said it found 23 violations of securities laws that merited fines in financial year 2011-12 (April-March). The market regulator sent warning letters in another 19 cases, it said in its annual report.

That's a drop in the bucket, says Ashraf Tiwana, dismissed as head of SECP's legal department after years of clashes with his bosses over fraud in the market. He has petitioned the Supreme Court to replace the SECP chairman and commissioners.

"There's a lot of fraud, a lot of market manipulation...but not enough action has been taken, especially not enough criminal action has been taken," Tiwana told Reuters. "They're just passing small fines and giving out warning letters."

...

Why Karachi is among the world's best stock markets

Photographs: Reuters.

Regulators are too close to the market, Tiwana said. The head of the stock exchange is a former broker and the two top members of the SECP are former employees of Aqeel Karim Dhedhi, founder of one of the country's biggest brokerage houses.

Big Dhedhi

Nicknamed 'Big Dhedhi' for his ability to move markets, Aqeel Karim Dhedhi heads one of Pakistan's largest domestic conglomerates, the AKD Group. Lately, the well-known philanthropist and leading member of Pakistan's business establishment has been trying to fend off arrest over allegations of insider trading.

An SECP investigator accused traders, including Dhedhi's brokerage, of buying shares in a state-run Sui Southern Gas Co before an official announcement allowing the company to raise its prices. In the weeks before Sui Southern's announcement, the stock price jumped from Rs 13.5 to Rs 20, its biggest hike in five years.

...

Why Karachi is among the world's best stock markets

Image: Traders monitor their stocks on computer monitors at the Karachi Stock Exchange.Photographs: Akbar Baloch/Reuters.

The National Accountability Bureau, the state-run anti-corruption agency, called it a case of insider trading. But the SECP said its own confidential investigation showed no evidence of fraud.

The SECP whistleblower in the case has been suspended from her job for disclosing "confidential information".

Dhedhi strongly denied any wrongdoing and said he purchased his gas stocks years before the announcement.

"There is nothing there. The (SECP) report totally cleared us," said Dhedhi, a burly man wearing a traditional long cotton shirt and baggy pants. "I'm proud to say that in more than 40 years of operating, we've never paid a penny in fines."

...

Why Karachi is among the world's best stock markets

Image: An elderly man is reflected on a marble table as he monitors share prices on a screen during a trading session at the Karachi Stock Exchange.Photographs: Akhtar Soomro/Reuters.

Dhedhi says he often offers advice to government officials on financial policy. His business empire includes two equity funds that were among the best performing in Asia in 2012.

"The SECP has really started listening to the market," Dhedhi said, a suited executive acting as translator.

REVOLVING DOOR

Dhedhi remains under investigation. But even if regulators were to find him guilty of insider trading, past practice shows he would likely get a slap on the wrist. The SECP's fines are almost always a fraction above the amount of money made in the stock manipulation, and sometimes even less.

In December, a broker was fined half the amount he made from trades that manipulated the share price of tobacco giant Philip Morris. In February, the SECP fined Pakistani brokerage BMA Capital $500,000 - after it made $460,000 by misleading a foreign client. BMA Capital has appealed.

...

Why Karachi is among the world's best stock markets

Image: A stockbroker at the Karachi Stock Exchange.Photographs: Reuters.

Imtiaz Haider, the SECP commissioner in charge of market regulation, acknowledged fines were largely symbolic. If they were too high, he said, brokers might not be willing to pay them. Contesting fines in the congested court system could take years.

"The purpose is more to name and shame," Haider said in an interview. "It causes them reputational damage."

Like KSE Chairman Nadeem Naqvi, Haider is a former employee of Dhedhi's. Both men denied any conflict of interest.

"It's important to have people in charge who know the way markets work," Haider said. "I've had lots of other jobs than just working for Dhedhi."

The SECP can revoke licenses, impose hefty fines, or open criminal cases against offenders. But it almost never does. It has launched only 10 criminal cases in the past five years - all still held up in the judicial backlog. It has issued dozens of small fines.

...

Why Karachi is among the world's best stock markets

Image: A stockbroker at the Karachi Stock Exchange.Photographs: Reuters.

"We have great laws and regulations but they are not properly enforced," said Khalid Mirza, a former SECP chief. "The SECP is just catching the small fish as far as I can see."

Naqvi, the KSE head, acknowledged his priority has been to boost the market, not to crack down on it.

"My management style isn't confrontational because I want to build confidence in the market," he said.

Separating the commercial and the regulatory functions of the market is one of the main reasons the KSE is looking for a foreign partner. It has appointed Deutsche Bank as its advisor on its quest to demutualise - a process that will separate those two functions.

...

Why Karachi is among the world's best stock markets

Image: A Pakistani monitors stock prices at the Karachi Stock Exchange.Photographs: Akhtar Soomro/Reuters.

"Demutualisation is another step on the road to reform," Naqvi said. "Right now we have a fairly robust system. But I'm not saying its foolproof."

BLACK TO WHITE

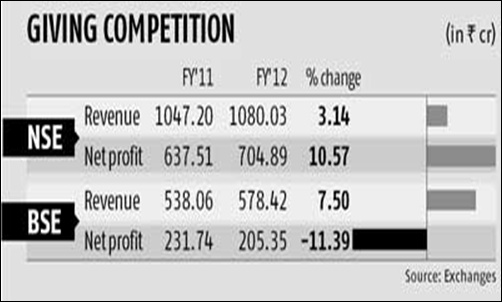

The Karachi market's small size and lack of liquidity make it vulnerable to manipulation. Market capitalization is only $41.5 billion - the Bombay stock market's capitalisation is more than 10 times higher at $578 billion.

Only a quarter of the shares are freely floated - about 30 percent of that is held by foreign funds and investors, including Franklin Templeton, Invesco Ltd, Goldman Sachs Asset Management and Mackenzie Financial Corporation.

...

Why Karachi is among the world's best stock markets

Image: Stockbrokers on the floor of the Karachi Stock Exchange.Photographs: Reuters.

Since only 60 of KSE's 600 listed companies trade regularly, small trades can rapidly make a big difference in a company's share price.

Boosting volumes on the exchange was one of the intentions behind Pakistani President Asif Ali Zardari's decree last April turning black money into white.

It said no questions could be asked by the Federal Board of Revenue about the source of funds invested in stocks till July 2014. The investments become legally legitimate.

The pool of such funds is potentially huge. A report by the United Nations Office on Drug and Crime projected the size of Pakistan's informal or "black" economy at $34 billion in 2010-11, one-fifth of the formal economy.

...

Why Karachi is among the world's best stock markets

Photographs: Reuters.

The Paris-based Financial Action Task Force, which monitors money laundering, said the decree did not contravene Pakistan's existing anti-money laundering legislation.

But anecdotal evidence suggests controls are lax.

In one case shown to Reuters by a lawyer, a man invested $10 million buying stocks in a single transaction. His address: a Karachi slum notorious for Taliban infiltration.

article