Photographs: Reuters

Jet Airways and Etihad on Wednesday announced closure of a Rs 2,069-crore (Rs 20.69 billion) deal for the Abu Dhabi-based carrier to pick up 24 per cent equity in the Indian airline, marking the first foreign direct investment infusion by an airline in the Indian aviation sector.

Maintaining that all requisite regulatory approvals from Indian authorities have been obtained on November 12, the two airlines said Jet has ‘issued and allotted 27,263,372 equity shares of a face value of Rs 10 each at a price of Rs 754.7361607 per equity share on a preferential basis to Etihad Airways.’

Following the allotment of equity shares on preferential basis to Etihad Airways, Etihad Airways holds 24 per cent of the post-issue paid up share capital of Jet Airways "on a fully diluted basis".

. . .

Rs 2,069 crore Jet-Etihad deal finally takes off

Image: Jet Airways Chairman Naresh Goyal (L) and James Hogan (R) of United Arab Emirates Etihad Airways shake hands.Photographs: Punit Paranjpe/Reuters

As per legal requirements, 51 per cent stake would be held by Jet and its Chairman and promoter Naresh Goyal.

In a statement, the two carriers also announced that Etihad President and CEO James Hogan and its Chief Financial Officer have been appointed as additional directors on the board of directors of Jet from Wednesday.

The announcement came shortly after a Jet Board meeting in Mumbai on Wednesday.

Goyal and Hogan said "the collaboration between the airlines would commence immediately with a view to delivering network and service benefits to customers as soon as possible.

“Specific details will be released progressively."

The Jet stake sale deal is the first of its kind in an Indian airline.

. . .

Rs 2,069 crore Jet-Etihad deal finally takes off

Image: An Etihad flight attendant helps a visitor sit in a mock cabin lounge seat.Photographs: Reuters

The announcements by Malaysian carrier AirAsia to set up AirAsia India and by Singapore Airlines to set up a joint venture airline with Tata Sons, are yet to fructify.

"Consequent to the above allotment, the paid up share capital of Jet Airways stands increased to 11,35,97,383 equity shares of Rs 10 each," the statement said.

Goyal said the FDI infusion would "result in economies of scale, grow traffic at our airports and create job opportunities.

“I am confident that this investment will greatly benefit all our stakeholders whilst significantly benefitting our customers who will now have access to a more expanded global network."

. . .

Rs 2,069 crore Jet-Etihad deal finally takes off

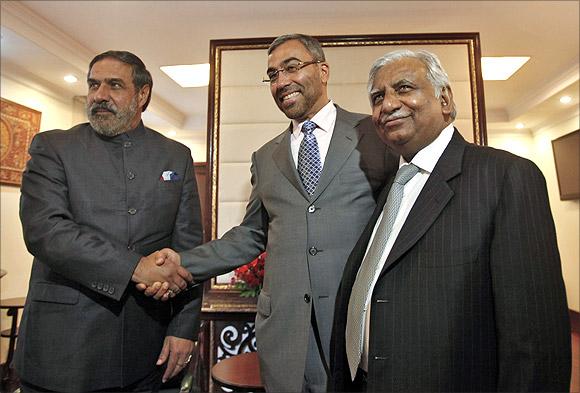

Image: Trade Minister Anand Sharma shakes hands with Ahmed Ali-al-Sayegh, a board member of Abu Dhabi's Etihad Airways, as Jet Airways Chairman Naresh Goyal (L-R) looks on.Photographs: Mansi Thapliyal/Reuters

He also said that together with Etihad Airways, Jet Airways would ‘enhance connectivity for tourists, business travellers, Indian families and the wider travelling public.’

Describing India as one of the largest and fastest-growing markets in the world and ‘a key part of the Etihad Airways growth strategy’, Hogan said ‘through this association, Etihad Airways and Jet Airways will both be strengthened, as will the economies of India and the United Arab Emirates.

‘By linking our two networks and adding new flights, new routes and more code-share options, travel to, from and within India will become much easier."

. . .

Rs 2,069 crore Jet-Etihad deal finally takes off

Image: A newly acquired Jet Airways Boeing 777-300ER aircraft sits on the tarmac at Mumbai airport.Photographs: Punit Paranjpe/Reuters

The finalisation of the deal came over a week after fair trade regulator Competition Commission of India approved the acquisition of stake in Jet by Etihad, which was the last hurdle.

Though all the regulatory approvals are in, the courts are hearing two petitions against the deal.

The deal also includes $150 million soft loan from Etihad, another $100 million investment by Etihad in Jet's frequent flyer programme JPMiles and sale of two Jet slots at the Heathrow airport to Etihad for $70 million.

article