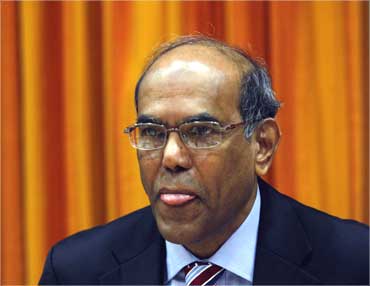

Photographs: Danish Siddiqui/Reuters Manojit Saha in Mumbai

Reserve Bank of India Governor Duvvuri Subbarao says that while the common citizen will benefit from the central bank's action, the policy stance is consistent with sustaining high growth in the medium term. Excerpts:

This is the first time since the present rate increase cycle started that RBI has raised the operating rate by 50 basis points (bps). Was the March inflation number the decisive factor?

That was certainly one of the variables, but we were not entirely driven by the March number.

We analysed the trajectory of inflation and drivers of inflation last year, divided that into three sub-periods of four months each and showed how inflation drivers were different in each period. Actually, the deviation from forecasts started from December 2010.

You would see that there were some concerns about inflation going up even in our March 16 document.

So, as much as the March number, which came out on April 14, was important, I would not say that was the only variable or the crucial variable.

...

RBI on why rate hike is 'good' for India

Image: A staff of a food superstore arranges price tags.Photographs: Amit Dave/Reuters

Earlier, RBI used to look at various parameters to take a view on inflation. Has the stance shifted to only the wholesale price index?

We do look at all the numbers. For the purpose of communication, there has to be a number. So, we use WPI because that's used by everyone.

But internally, we look at a number of other indicators, the consumer price index (CPI), credit growth, money supply growth, deposit growth, etc.

We wrote one paragraph on the CPI movement (in the policy document). That should be credible evidence that we look at a number of other indicators also.

How much of an interest rate increase have you factored in?

That I cannot say really. I cannot give more guidance than what we have said in the document. It is for you to interpret. We have said that the trajectory of inflation will be around the March level for the next six months.

We have factored that in our policy action today. In other words, we wanted our interlocutors to know that higher inflation over the next six months would not surprise us.

...

RBI on why rate hike is 'good' for India

Image: A labourer works inside a sugar-candies manufacturing industry in Ahmedabad.Photographs: Amit Dave/Reuters

How does the common man benefit from the RBI action?

Today's RBI action, I believe, is good for the economy and good for the common people. Because when inflation is running at 9 per cent, it is very difficult to plan.

And inflation is a very regressive tax, especially for the poor, because it hurts them the most.

Certainly we need to bring it down. Also, today's policy action is consistent with sustaining high growth in the medium term in order to provide investors a more predictable and stable environment.

Why did you increase the savings bank rate by only 50 bps?

We cannot destabilise the system at once. We have to keep in mind the asset-liability mismatch of banks. This time we have corrected it by 50 bps because it has not been corrected for the last eight years.

This rate will continue until we take a decision on whether to deregulate the savings bank rate or not.

...

RBI on why rate hike is 'good' for India

Image: Vendors sell vegetables at an open air fruit and vegetable market.Photographs: Amit Dave/Reuters

In the last one year, inflation was higher than RBI's comfort zone. A lot of economists and experts have argued for steeper rate increases. What are the lessons of the last one year?

It is difficult to draw a lesson on what could have been done. But certainly, we should manage inflation expectations regardless of what inflation drivers are. And, RBI has improved its communication and continues to improve it.

How realistic is the possibility of banks resorting to the marginal standing facility (MSF)?

It is too early to say. But it is meant to be an exceptional facility. In fact, originally we said EMSF (exceptional marginal standing facility) to signal that it is meant to be exceptional.

It is presumably a penal rate, 1 per cent above the repo rate. The expectation is banks will first go into CBLO (collateralized borrowing and lending obligation) and the market repo before accessing this facility.

...

RBI on why rate hike is 'good' for India

Image: A RBI employee counts currency notes before placing them into new machines.Photographs: Roy Madhur/Reuters

In the discussion paper on reviewing the operating procedure of monetary policy, the bank rate was proposed to be re-activated. But that has not happened.

Yes, we de-linked the bank rate from revision of the operating procedure because of two reasons. One, a number of other interest rates are linked to the bank rate.

So, if we change the interest rate suddenly, they will get affected. Second, there are some legal and operational issues we need to resolve before we take a view on the bank rate.

RBI recently rolled back the provisioning coverage ratio (PCR) for banks. When PCR was introduced, it was argued that banks needed a counter-cyclical buffer in good times for use in bad times. Do you think the banking sector is under stress as far as NPAs (non-performing asets) are concerned?

Not really. Certainly there was a lot of restructuring after the crisis. The asset quality will slightly deteriorate and NPAs may slightly go up.

But I don't see them going up so much as to cause a concern because we have put in sufficient checks and balances.

We introduced 70 per cent PCR because immediately after the crisis banks were doing reasonably well. We have built countercyclical buffers. Now, we have asked that provision to be shifted to countercyclical buffers.

However, to compensate for withdrawing this, we have introduced additional provisioning for sub-standard and doubtful assets. It is consistent with the current credit scenario and the health of the banking system.

...

RBI on why rate hike is 'good' for India

Image: A man talks on his mobile phone as he walks past the logo of the Reserve Bank of India.Photographs: Rupak De Chowdhuri/Reuters

Do you have a time frame on when RBI will issue new banking licences?

No, I have no time frame in mind because there are uncertainties that are beyond my control. First, we need to discuss the draft guidelines with the government to know where we agree and where we disagree.

Second, the amendments to the Banking Regulation Act have to go through. That is at the standing committee stage and will take time.

In January, RBI expressed concern over banks using LAF (liquidity adjustment facility) funds to support credit growth. Has that concern abated?

Well, it is difficult to monitor the end use of funds. As long as it makes business sense, banks will continue to do that.

But we hope that with today's rate action, it will be more difficult for banks to use short-term money for the long term.

article