| « Back to article | Print this article |

'FDI will not help when your economy is in trouble'

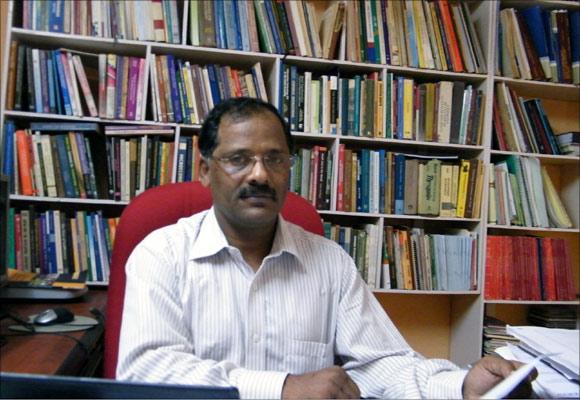

“There is nothing wrong in getting foreign money but depending on FIIs to help you in crisis is not a good idea at all. Foreign investors have their own calculations and they don't go anywhere to do charity," says Dr K. J. Joseph, “Ministry of Commerce Chair” Professor at the Centre for Development Studies (CDS) in Thiruvananthapuram.

A well known economist, Dr Joseph has published over 80 research papers and also authored and co-edited four books. He is the Editor-in-Chief of Innovation and Development, an international journal published by Taylor and Francis.

He was also a Ford Foundation fellow at the Yale University, USA, a Visiting Senior Fellow at Research and Information System for Developing Countries (under the Ministry of External Affairs) and a Professor at Jawaharlal Nehru University.

Dr Joseph discusses the dismal state of the economy and the future prospects for India in this interview with Shobha Warrier.

When recession started globally, Indian economy was growing steadily but now it has slowed down alarmingly. Do you think the global recession is responsible for the current state of the Indian economy?

When the global economy was slowing down, Indian economy could still manage significantly high growth rate of 8- 9 per cent.

The argument was that India was not as globalised as other countries and that the domination of public sector banks in the financial sector also helped. It was said at that time that it was good that India did not open up too much.

Do you agree with the view?

I still hold the view. But I have a slightly different view on the global financial crisis. I will say that the kind of financial expansion the US has done through Ninja loans (low quality subprime loans) has not been done for the first time.

An economy's capability to maintain your high standard of living depends upon what you produce. If your economy has a large number of new products which can bring in profit, your people will get higher income and higher wages.

With new technology, information spreads fast so other countries are catching up like Brazil, China, South Africa, India and South Korea.

So, the period in which you can reap supernormal profit has come down. When others follow, you should be able to come out with new products, which the US has not been able to do in recent times. The ability of the US to retain highly skilled people has also diminished.

As an economist who believes that innovation is the key to development, I feel lack of innovation has slowed the US and the global economy.

When your regulatory system cannot catch up with what is happening in the business sector, this can happen. The 21st century crisis has to be seen from the point of view of innovation.

Click NEXT to read more…

'FDI will not help when your economy is in trouble'

The Finance Minister had said in 2009-2010 that India would never get affected...

The situation is different now. For the last 2 years, Indian economy has been really sliding and this year's projection is 5 per cent growth rate.

The Finance Ministry is now looking at FDI in retail, telecom, airport... everywhere, and expecting the FIIs to bail India out. I am not against FDI.

When you have a trade-GDP ratio of 55 per cent maximum with imports of $500 billion exports of $309 billion, it means, we have to look at the problem internally and not externally.

In a country like Singapore, the trade-GDP ratio is more than 100 per cent.

In 1991, our current account deficit was 3.5 per cent and today, it is 4.8 per cent. Is it a right approach to depend on FIIs to bail you out?

There is nothing wrong in getting foreign money but depending on FIIs to help you in crisis is not a good idea at all.

Foreign Direct Investors have their own calculations and they don't go anywhere to do charity. Unless they get a rate of return that is more than the rate of investment, they will not come.

More importantly, foreign investors take it for granted that developing countries have low wage rates, they get subsidies and interest rate holidays. Today, there is a competition among developing countries to attract FDI.

So, when deciding a location, they check if a place can complement their core competence, whether there is skilled man power and if the country can help them in their global innovation programs.

Click NEXT to read more…

'FDI will not help when your economy is in trouble'

Does India have all those capabilities?

We tell the world that we have skilled man power but it is a wrong notion. The higher education enrolment is 15 per cent in India.

Compare it with China which was 24 per cent three years ago, and it has increased by 8 per cent in these last 3 years.

So, if India wants a double digit growth rate like China, we need at least 24 per cent higher education enrolment. But we are nowhere. We have a severe capacity deficit all over.

Does that mean, if India wants its economy to grow, it has to first do some work domestically?

Yes, though I am not against FDI, what India has to do so that the economy picks up is, look internally. This will take us to agriculture, manufacturing and services.

If we take the agricultural sector, the growth rate had gone up to 3.5 per cent in 2010. Now, it has come down to 2.2 per cent. Let us remember that 60 per cent of the population lives on agriculture.

If you take manufacturing, from double digit growth rate, it has come down to 2 per cent.

What could be the reason for the dismal show of agriculture sector?

Agricultural production has plateaued from 1980 onwards because we have not kept up with modern technological advances.

If your parents have given you something, you have a duty to add something to it. It is as if there was a Green Revolution in the 60s, and we can sleep for another 200 years!

Though we have had a well established agricultural network, it has almost collapsed due to market oriented policies. Private sector could not and will not replace the state.

Click NEXT to read more…

'FDI will not help when your economy is in trouble'

Will you call it the failure of the state?

Yes, it is also the belief that market will take care of everything and the state can withdraw. The state cannot withdraw from agriculture. There has to be a judicious mix of state with the market.

But even among the bureaucrats, the thinking is that you leave everything to the market and it will take care of everything. It will not.

What we need is a mix of Adam Smith and Karl Marx; a Karl Smith model.

Is there any country in the world that has managed this combination?

I would say the Scandinavian countries like Denmark, Sweden, Norway, etc have. In India, only Kerala has a similar kind of approach.

Do you feel China's rise in the area of manufacturing has something to do with India's poor show?

I will give you an example of the electronic industry. A country like South Korea focused on components and forged ahead. For every computer, you need many components and no country can afford to produce every component.

For this kind of an industry, the trade regime has to be helpful in facilitating the free flow of input and output in the economy. Lack of this hindered the growth of the electronic industry, and it is true of a whole lot of industries.

Kapil Sibal says that by 2020, our import of electronics will be more than the oil import. That means your import is increasing and export is coming down.

Click NEXT to read more…

'FDI will not help when your economy is in trouble'

The value of the rupee is going down in the process. Where will it lead to?

Look at the current accounts deficit. This is not sustainable.

The import-export balance is going down so much that a few days ago, the Finance Minister told the people not to invest in gold as it is not a safe investment...

Gold has to be looked at from a global perspective. Once we mooted the idea of an Asian Reserve Bank. At that time, China had a foreign exchange reserve of $1300 bn, Korea had $750 bn, Japan had a reserve of $500 bn and India had a reserve of $325 bn. We thought why should we put all the money in America? BRICS is the same idea.

When people found that America is getting weak after the global criss, they started slowly moving towards gold and the demand for gold increased.

If the global demand of gold is around 4000 metric tonnes, our import this year is 1080 metric tonnes. Almost 1/3rd of global import of gold is to India. That accounts for 13 per cent of our trade deficit. Along with oil, this gold import is exerting a major pressure on the economy.

Click NEXT to read more...

'FDI will not help when your economy is in trouble'

But Indians will continue to buy gold. What kind of impact will this have on the economy?

It will affect the current account deficit and that will contribute to inflation.

Also, when you have a weak domestic sector, do not expect outsiders to come and do business here. The FDI which increased from $21 billion to $35 billion last year is back to $22 billion.

At the same time, Indians are investing around $18 billion abroad.

This is where the Finance Minister is going wrong. It is a wrong notion that when you are in trouble, FDI will rescue you. That is why even after giving all the messages, nobody has come to do business in retail.

What do you foresee the prospects for the Indian economy?

I would say the diagnosis is all wrong. I am yet to see a concerted effort towards dynamising the economy.

India being such a large economy, it will not die; it will be in the sick bed for some more time. The good thing is that it is still growing at 5%.