BS Reporters in New Delhi

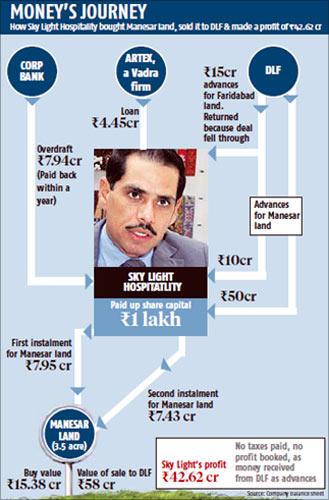

Robert Vadra, who is at the centre of a controversy over his property dealings with realty giant DLF and others, began investing in real estate five years ago, in 2007-08.

He was already a wealthy man by then, not a struggling businessman who could scrape only a few lakh rupees together as capital for his new real estate ventures.

His Artex export firm had the wherewithal to lend Rs 4.45 crore to one of his new firms (Sky Light Hospitality) in 2008-09. The previous year, the company's directors (there were only two, Mr Vadra and his mother Maureen) had lent Rs 1 crore to another of his real estate firms (Sky Light Realty).

Apart from being wealthy, he must also have had excellent relations with Corporation Bank, whose Friends Colony branch (located close to Mr Vadra's companies' offices in the capital) gave an overdraft of Rs 7.94 crore to Sky Light Hospitality.

The newly incorporated company at the time had total resources of Rs 1 lakh, being its paid-up share capital.

...

The inside story of Robert Vadra's realty business

Image: Priyanka Gandhi and her husband Robert Vadra.Photographs: Reuters.

Sky Light Hospitality invested the entire loan amount plus share capital in a piece of land at Manesar.

That was the first instalment, with a second instalment of Rs 7.43 crore paid the following year (2008-09).

It would be unusual for any public sector bank to fund virtually the entire value of a big-ticket land purchase; perhaps the bank already had a business relationship with Mr Vadra, or they knew of his family connections, or both.

Whatever the case, they must have considered him a good risk - which, as it turned out, he was because the money was returned in a year or less.

DLF has disclosed that in March 2008, the Haryana government gave Sky Light Hospitality a letter of intent (LOI) for developing the Manesar land commercially.

...

The inside story of Robert Vadra's realty business

Image: Rahul Gandhi (R) flanked by his brother-in-law Robert Vadra (C) and sister Priyanka Vadra.Photographs: Kamal Kishore/Reuters.

As DLF said in its press release on Saturday, "This (land) was licensable to develop a Commercial Complex and the LOI from Govt of Haryana to develop it for a Commercial Complex had been received in March 2008 itself."

If you are of a suspicious bent of mind, you might wonder whether the fact that Mr Vadra had bought the land influenced the state government when it decided to give the LOI.

But since the land is described as being in Sohna tehsil, just off the National Highway, in the newly developing industrial-commercial area of Manesar (beyond Gurgaon), it is a decision that may be entirely defensible.

The following year (2008-09), Sky Light Hospitality paid the second instalment of Rs 7.43 crore for the Manesar land, making for a total payment of Rs 15.38 crore.

It was the land bought with this money which Mr Vadra promptly offered to DLF, who agreed to pay a handsome Rs 58 crore for the 3.5 acres. DLF says in its press release that it took possession of the land in the same year (2008-09), and paid an advance of Rs 50 crore in instalments.

...

The inside story of Robert Vadra's realty business

Three crucial decisions gave Mr Vadra a flying start in his real estate foray: the generous overdraft from Corporation Bank, the timely approval from the Haryana government for commercial development of Mr Vadra's land, and DLF's decision to buy it at an enhanced value and to advance him most of the purchase price for an extended period.

Sky Light Hospitality's regulatory filings show Rs 10 crore received from DLF as advance in 2008-09, the year in which it paid the second instalment on the Manesar land.

Separately, another Rs 15 crore advance was received from DLF for the Faridabad land deal, which later fell through.

By 2009-10, Rs 50 crore had been received, separate from the Rs 10 crore received earlier and which apparently remained with Sky Light Hospitality till 2010-11.

While Rs 15 crore was returned on account of the abortive Faridabad deal, Sky Light Hospitality was now cash-rich - in less than two years of Mr Vadra having got going in real estate with a single transaction.

...

The inside story of Robert Vadra's realty business

The company would now go on to fund Mr Vadra's other real estate firms, investments in high-end apartments, and other transactions which would follow thick and fast.

DLF says once the required approvals came through, the (Manesar) land was conveyanced in DLF's name. It does not say when.

However, even in 2010-11, Sky Light Hospitality's books show an advance of a little over Rs 58 crore (equivalent to the Manesar sale price), and no booking of profits on the deal (which would have to be done if the land had been conveyanced to DLF). Perhaps this was done in 2011-12, for which the regulatory filings are not yet available.

The obvious question is how land that was valued in 2007-08 at Rs 15.38 crore came to be worth Rs 58 crore the next year (assuming that DLF paid the correct market price, and nothing more).

...

The inside story of Robert Vadra's realty business

Image: Corporation Bank.The likely explanation would be that the permission to commercially exploit the land had overnight multiplied its value, in which case Mr Vadra played the role of a clever land developer. Meanwhile, since Rs 58 crore stayed as an advance, no profits were booked and no taxes paid on the Rs 42.62 crore profit from the deal.

Already, by 2008-09, Mr Vadra was busy deploying the large dollops of money that had come to Sky Light Hospitality: Rs 25 crore from DLF as advance on two separate deals, Rs 4.45 crore from Artex, and Rs 1.55 crore from a company called Carnival International Estates.

He wiped out the overdraft with Corporation Bank, paid the second instalment on the Manesar land, and lent Rs 5.5 crore to two other companies of his - Sky Light Realty got Rs 3.5 crore and Blue Breeze Trading got Rs 2 crore. A further Rs 10 crore lay in the bank.

...

The inside story of Robert Vadra's realty business

Photographs: Reuters.

Sky Light Realty, meanwhile, had taken the Rs 1 crore lent to it by its directors in 2007-08, and in its very first transaction, promptly deposited it with DLF, perhaps for booking flats (which DLF says was done in September 2008).

The following year, armed with Rs 3.5 crore received from Sky Light Hospitality, another Rs 1.5 crore from Carnival, and Rs 15 lakh from Artex, Sky Light Realty went shopping.

It bought land in Hayyatpur for Rs 1 crore, more land in Palwal (both places in Haryana) for Rs 42 lakh, and paid DLF another Rs 2 crore for multiple flat bookings. Some Rs 78 lakh stayed in bank accounts.

...

The inside story of Robert Vadra's realty business

Photographs: Adnan Abidi/Reuters.

By the next year (2009-10), Artex had got back its original loan to Sky Light Hospitality, and it now increased its loan to Sky Light Realty to Rs 2.84 crore.

Sky Light Realty shows the apartment in Aralias as a joint venture with Mr Vadra, valued in Sky Light Realty's books at Rs 89 lakh, while furniture and fixtures in the flat are valued at Rs 94 lakh.

Another seven flats get booked in the neighbouring Magnolias apartment complex, the payment for these being shown as Rs 5.23 crore, while Rs 5.07 crore has been put into DLF's Capital Green project in Delhi.

Some of these numbers were mentioned by Mr Arvind Kejriwal when he raked up the whole issue of Mr Vadra's dealings, last week.

...

The inside story of Robert Vadra's realty business

Photographs: Rupak de Chowdhuri/Reuters.

What Kejriwal missed, though, is the balance sheet for the following year (2010-11), in which Sky Light Realty paid a further Rs 8.57 crore for the Aralias flat, making for total payment of Rs 10.4 crore.

In its press release, DLF puts the total price of the Aralias flat at Rs 11.9 crore, while the rough cost of the seven Magnolias flats would be in excess of Rs 40 crore (all of which might not have been paid as yet, since the flats are not ready).

Sky Light Hospitality, meanwhile, increased its loan to Sky Light Realty from Rs 3.5 crore to Rs 6.61 crore in 2009-10, the money being shown as being for a joint venture (presumably, the DLF flats).

It also gave Rs 2.05 crore to Blue Breeze, and Rs 2 crore to yet another Mr Vadra firm, Real Earth Estates. The company's biggest investment, though, was in Saket Courtyard Hospitality, its value after booking losses being Rs 31.7 crore.

...

The inside story of Robert Vadra's realty business

Photographs: Reuters.

While Sky Light Hospitality has accumulated losses (but only because the profits on the Manesar land were yet to be booked till 2010-11), Sky Light Realty has prospered; it had Rs 6.65 crore sloshing around in bank current accounts, its income from realty in 2010-11 was Rs 16.5 crore, accumulated reserves were Rs 12 crore, and it paid Rs 1.8 crore as tax on profits.

All that would be small beer compared to the current market value of the properties acquired.

The Aralias and Magnolias flats together would fetch Rs 130 crore or thereabouts, and by DLF's calculation Mr Vadra's share in the hotel project would be in excess of Rs 50 crore.

His total asset base from the two Sky Light companies - all made by rolling over transactions with DLF, and helped by real estate value appreciation - would be in the vicinity of Rs 200 crore, made in five years with initial capital deployed of about Rs 6 crore.

Not a bad business to be in, you might say. As the Beatles sang long ago, "I get by with a little help from my friends".

If Mr Vadra had to count his friends in the real estate business, they would be Corporation Bank, the Haryana government and DLF.

article