Photographs: Reuters

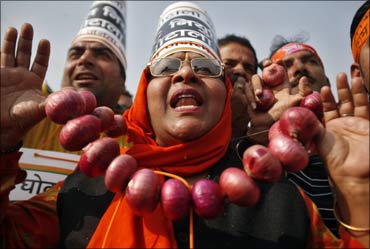

Soaring onion and other vegetable prices led to a sharp rise in inflation at 18.32 per cent for the week ended December 25, a development that may prompt the Reserve Bank of India to tighten monetary policy to check further escalation in commodity costs.

If that happens it will mean more pain for the common man, as the only way the RBI can control runaway inflation is by increasing interest rates and sucking out the liquidity in the system. If interest rates rise, then home loans, car loans, personal and educational loans, etc will become costlier, putting these out of reach of the common man.

Food inflation jumped up by 3.88 percentage points from 14.44 per cent recorded in the previous reporting week, and edged closer to the high level of 19.90 per cent, last witnessed a year ago.

The rise in food inflation has been mainly on account of 58.58 per cent rise in prices of vegetables in the wholesale market.

Among the individual items, onion became dearer by 82.47 per cent on annual basis, while egg, meat and fish became costlier by 20.83 per cent, fruits by 19.99 per cent and milk by 19.59 per cent.

. . .

Prices just keep on rising! Food inflation at 18.32%

Photographs: 06slide-show-2-infla-prices-just-keep-on-rising-food-inflation-at-18-point-32-pc

The data further reveals that onion prices during the one week period ending December 25, rose by 23.01 per cent in the wholesale market.

With food inflation accelerating, RBI may take more measures in its forthcoming quarterly review of the monetary policy on January 25.

The central bank during 2010 had raised short-term key policy rates six times to tame inflation.

Meanwhile, in the non-food category, the prices of fibres and minerals have climbed by 35.53 per cent and 30.58 per cent, respectively. Rising food prices will reflect on the monthly inflation data for December, scheduled for announcement on January 14.

The overall inflation in November had come down to 7.75 per cent from 8.58 per cent a month ago.

. . .

Prices just keep on rising! Food inflation at 18.32%

What is inflation?

"Inflation is the most regressive form of taxation because it hits the poor the most." --Narendra Jadhav, vice chancellor, University of Pune.

Inflation is a rise in the prices of a specific set of goods or services. In either case, it is measured as the percentage rate of change of a price index.

Inflation based on wholesale prices during the period January 1998-January 1999 was 4.6 per cent, one of the lowest in the world.

Today, India's inflation is rising at a fast pace and it is the lawmakers' biggest concern.

There is uproar in Parliament as political parties jostle to grab as much mileage as possible from the government's apparent failure to curb runaway inflation, as they try to sidle up to the aam aadmi who has been worst hit by skyrocketting prices.

. . .

Prices just keep on rising! Food inflation at 18.32%

Inflation in Food and Non-food Commodities during 1994-95 to January 2010

(Based on WPI with base 1993-94) and Growth Rate in Food Output (%)

| Item | 1994-95 to 2004-05 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 January | Average 2006-09 |

| 1. All commodities | 5.90 | 4.74 | 4.82 | 4.82 | 9.12 | 2.01 | 8.54 | 5.19 |

| 2. Non-food commodities | 6.02 | 5.37 | 4.72 | 4.54 | 9.55 | -1.76 | 4.53 | 4.27 |

| 3. Food articles | 5.91 | 3.94 | 6.83 | 7.02 | 6.64 | 12.32 | 17.41 | 8.20 |

| 4. Food products | 5.33 | 1.58 | 2.55 | 3.43 | 9.80 | 13.79 | 22.55 | 7.39 |

| 5. Food commodities (3 and 4) | 5.64 | 2.97 | 5.09 | 5.60 | 7.87 | 12.90 | 19.42 | 7.86 |

| Foodgrains | 5.54 | 3.83 | 9.71 | 6.27 | 6.37 | 14.14 | 17.89 | 9.12 |

| Cereals | 5.57 | 3.68 | 6.63 | 6.97 | 7.20 | 12.96 | 13.69 | 8.44 |

| Pulses | 5.46 | 5.04 | 32.05 | 2.14 | 1.30 | 21.81 | 45.62 | 14.33 |

| Rice | 5.00 | 4.01 | 2.13 | 6.05 | 8.97 | 15.96 | 12.02 | 8.28 |

| Wheat | 5.93 | 1.08 | 12.99 | 6.77 | 5.06 | 6.83 | 14.86 | 7.91 |

| Oilseeds | 5.89 | -6.11 | -3.96 | 26.58 | 17.46 | 0.92 | 10.05 | 10.25 |

| Fruits and vegetables | 7.47 | 7.51 | 2.24 | 6.49 | 5.94 | 11.77 | 8.33 | 6.61 |

| Dairy products | 5.20 | 0.11 | 4.20 | 6.08 | 8.38 | 6.12 | 12.87 | 6.19 |

| Milk group | 5.57 | 0.73 | 4.48 | 8.17 | 7.87 | 8.93 | 13.99 | 7.36 |

| Egg, fish and meat | 6.46 | 9.46 | 6.72 | 6.38 | 3.75 | 14.44 | 30.71 | 7.82 |

| Edible oils | 4.85 | -7.19 | 1.23 | 13.11 | 12.52 | -6.59 | -1.17 | 5.07 |

| Sugar | 4.06 | 15.09 | 4.83 | -14.69 | 5.62 | 36.34 | 58.94 | 8.02 |

| Growth in food output (%/a year) | 2.39 | 0.55 | 5.87 | 4.10 | 5.39 | 1.60 | -02 AE | 4.24 |

(1) AE stands for Advance Estimate provided by CSO. (2) Growth rates in last row refer to financial year ending with, like 2005 stands for 2004-05.

Sources: (1) Office of Economic Adviser, Ministry of Commerce and Industry, GOI, New Delhi. (2) National Accounts Statistics, CSO. (3) Department of Agriculture and Cooperation, Ministry of Agriculture, GOI, New Delhi.

Source: Ramesh Chand, "Understanding the Nature and Causes of Food Inflation", EPW, February 27, 2010

. . .

Prices just keep on rising! Food inflation at 18.32%

Why inflation hurts us badly

'Inflation is bringing us true democracy. For the first time in history, luxuries and necessities are selling at the same price.' -- Robert Orben.

Inflation hits us badly as prices rise. We end up spending more money for things that we could buy for less earlier.

What we could buy for Rs 100, a few years ago, would now cost us nearly double.

As a result, your savings will come down. As prices rise, the purchasing power of money goes down too. So to fight inflation, we must always invest money wisely.

When we invest money, we must be careful about the return on our investment.

The return on our investment must always be higher than the rate of inflation.

We may have got a good pay hike, but if inflation is high, we end up spending more money so in effect the hike makes little sense.

A high inflation rate negates the salary hike we have received.

Inflation reduces the purchasing power of our money.

It hits retired folk and people with fixed incomes very badly.

Inflation destablises the economy as consumers and investors change their spending habits.

People tend to spend less when prices are up as a result production slows down resulting in job losses as well. Inflation also affects the distribution of income.

Lenders and borrowers are also hit.

Experts, however, say a little inflation is good for the economy. It keeps the economy active as the prices of goods keep changing. In the short term, it encourages spending and borrowing and also encourages long term investments.

. . .

Prices just keep on rising! Food inflation at 18.32%

'RBI action may be needed'

According to a recent Business Standard report, the Reserve Bank of India might further tighten its monetary policy if inflation did not come down significantly by the end of this month, Prime Minister's Economic Advisory Council chairman C Rangarajan said on Thursday.

The central bank is slated to review its credit policy on January 25.

Rangarajan said RBI's action (likely quantum of rise in policy rates) would depend on price behaviour, especially of food items, between December and January. He said if food inflation persisted, it would feed into general inflation.

"We still have three weeks to go (for January-end). If the inflation rate comes down significantly, then there may not be any need for action.

"But on the other hand, if inflation remains sticky, then action will be required," Rangarajan told reporters on the sidelines of the Skoch summit in New Delhi [ Images ].

He also said inflation was likely to come down to 7 per cent by the end of December and decline further to 6-6.5 per cent by the end of March.

article